DAVENPORT & Co LLC grew its stake in Verra Mobility Co. (NASDAQ:VRRM - Free Report) by 17.9% during the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 1,603,342 shares of the company's stock after acquiring an additional 243,723 shares during the quarter. DAVENPORT & Co LLC owned 0.97% of Verra Mobility worth $38,641,000 at the end of the most recent quarter.

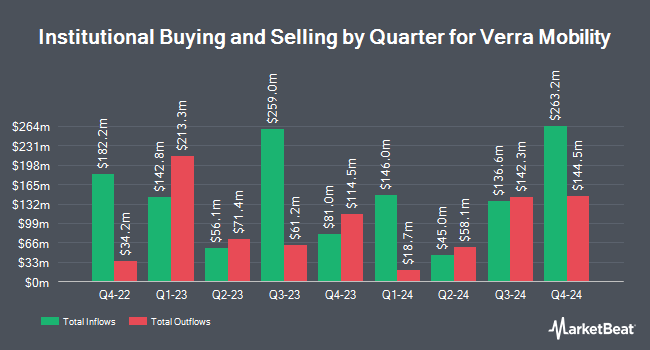

A number of other hedge funds and other institutional investors have also recently modified their holdings of the business. Signaturefd LLC boosted its holdings in shares of Verra Mobility by 112.4% during the 3rd quarter. Signaturefd LLC now owns 1,060 shares of the company's stock valued at $29,000 after purchasing an additional 561 shares during the last quarter. First Horizon Advisors Inc. lifted its position in shares of Verra Mobility by 192.0% during the third quarter. First Horizon Advisors Inc. now owns 1,133 shares of the company's stock worth $32,000 after purchasing an additional 745 shares during the last quarter. Avanza Fonder AB purchased a new position in shares of Verra Mobility during the fourth quarter valued at $74,000. Blue Trust Inc. increased its stake in shares of Verra Mobility by 27.5% during the third quarter. Blue Trust Inc. now owns 3,219 shares of the company's stock valued at $88,000 after buying an additional 694 shares during the period. Finally, US Bancorp DE increased its stake in shares of Verra Mobility by 10.3% during the third quarter. US Bancorp DE now owns 4,478 shares of the company's stock valued at $125,000 after buying an additional 418 shares during the period.

Verra Mobility Price Performance

Shares of VRRM stock traded up $0.18 during trading hours on Wednesday, hitting $26.08. 295,269 shares of the company's stock were exchanged, compared to its average volume of 839,461. The company has a quick ratio of 2.52, a current ratio of 2.61 and a debt-to-equity ratio of 2.13. The firm has a market cap of $4.30 billion, a P/E ratio of 43.41, a P/E/G ratio of 2.21 and a beta of 1.24. The firm has a 50 day moving average of $24.64 and a two-hundred day moving average of $26.02. Verra Mobility Co. has a fifty-two week low of $20.26 and a fifty-two week high of $31.03.

Wall Street Analyst Weigh In

Several equities analysts have issued reports on VRRM shares. Morgan Stanley cut their target price on Verra Mobility from $26.00 to $25.00 and set an "equal weight" rating on the stock in a research note on Wednesday, October 30th. Deutsche Bank Aktiengesellschaft dropped their price target on Verra Mobility from $31.00 to $29.00 and set a "buy" rating on the stock in a research note on Friday, November 1st. Finally, Robert W. Baird dropped their price target on Verra Mobility from $29.00 to $28.00 and set a "neutral" rating on the stock in a research note on Friday, November 1st.

Get Our Latest Analysis on VRRM

Verra Mobility Company Profile

(

Free Report)

Verra Mobility Corporation provides smart mobility technology solutions and services in the United States, Australia, Canada, and Europe. It operates through three segments: Commercial Services, Government Solutions, and Parking Solutions. The Commercial Services segment provides automated toll and violations management, and title and registration services to rental car companies, fleet management companies, and other large fleet owners.

Featured Articles

Before you consider Verra Mobility, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Verra Mobility wasn't on the list.

While Verra Mobility currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.