Davis R M Inc. bought a new position in shares of Fiserv, Inc. (NYSE:FI - Free Report) during the 4th quarter, according to the company in its most recent filing with the SEC. The fund bought 2,083 shares of the business services provider's stock, valued at approximately $428,000.

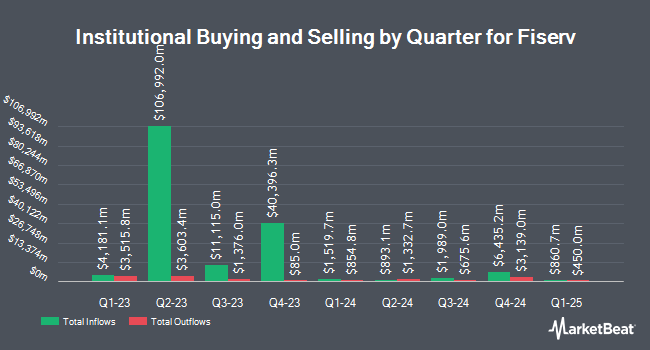

Other large investors have also modified their holdings of the company. Jacobi Capital Management LLC boosted its holdings in Fiserv by 0.4% in the fourth quarter. Jacobi Capital Management LLC now owns 11,104 shares of the business services provider's stock worth $2,281,000 after purchasing an additional 44 shares during the period. Parkside Financial Bank & Trust lifted its position in shares of Fiserv by 1.1% in the 4th quarter. Parkside Financial Bank & Trust now owns 4,109 shares of the business services provider's stock worth $841,000 after buying an additional 45 shares during the last quarter. Catalina Capital Group LLC boosted its holdings in shares of Fiserv by 2.3% in the 4th quarter. Catalina Capital Group LLC now owns 2,160 shares of the business services provider's stock valued at $444,000 after buying an additional 48 shares during the period. Mount Yale Investment Advisors LLC grew its position in shares of Fiserv by 1.2% during the 4th quarter. Mount Yale Investment Advisors LLC now owns 4,126 shares of the business services provider's stock valued at $848,000 after buying an additional 50 shares during the last quarter. Finally, Hemington Wealth Management raised its stake in Fiserv by 6.1% during the fourth quarter. Hemington Wealth Management now owns 864 shares of the business services provider's stock worth $177,000 after acquiring an additional 50 shares during the period. 90.98% of the stock is owned by hedge funds and other institutional investors.

Fiserv Price Performance

Shares of Fiserv stock opened at $213.91 on Wednesday. Fiserv, Inc. has a 52 week low of $145.98 and a 52 week high of $238.59. The company has a current ratio of 1.06, a quick ratio of 1.07 and a debt-to-equity ratio of 0.86. The company's 50-day moving average price is $218.65 and its two-hundred day moving average price is $204.00. The stock has a market cap of $120.06 billion, a PE ratio of 39.69, a price-to-earnings-growth ratio of 1.52 and a beta of 0.93.

Fiserv (NYSE:FI - Get Free Report) last released its earnings results on Wednesday, February 5th. The business services provider reported $2.51 EPS for the quarter, topping analysts' consensus estimates of $2.48 by $0.03. Fiserv had a net margin of 15.31% and a return on equity of 17.93%. As a group, sell-side analysts anticipate that Fiserv, Inc. will post 10.23 EPS for the current fiscal year.

Fiserv declared that its Board of Directors has authorized a share buyback program on Thursday, February 20th that authorizes the company to repurchase 60,000,000 outstanding shares. This repurchase authorization authorizes the business services provider to buy shares of its stock through open market purchases. Shares repurchase programs are generally a sign that the company's management believes its stock is undervalued.

Analyst Ratings Changes

A number of equities analysts have commented on FI shares. The Goldman Sachs Group lifted their target price on Fiserv from $208.00 to $231.00 and gave the company a "neutral" rating in a research note on Tuesday, December 3rd. Compass Point assumed coverage on Fiserv in a research report on Wednesday, November 20th. They set a "buy" rating and a $278.00 price objective for the company. Susquehanna raised their target price on Fiserv from $230.00 to $270.00 and gave the company a "positive" rating in a research note on Monday, February 10th. StockNews.com lowered shares of Fiserv from a "buy" rating to a "hold" rating in a research report on Tuesday, February 25th. Finally, Oppenheimer lifted their price objective on shares of Fiserv from $214.00 to $239.00 and gave the company an "outperform" rating in a research report on Thursday, December 19th. Three equities research analysts have rated the stock with a hold rating, twenty-one have issued a buy rating and two have assigned a strong buy rating to the company's stock. According to MarketBeat.com, Fiserv currently has an average rating of "Moderate Buy" and a consensus target price of $239.83.

View Our Latest Research Report on Fiserv

Insider Activity

In related news, COO Guy Chiarello sold 45,000 shares of Fiserv stock in a transaction on Thursday, February 20th. The stock was sold at an average price of $235.55, for a total value of $10,599,750.00. Following the transaction, the chief operating officer now directly owns 227,711 shares in the company, valued at $53,637,326.05. The trade was a 16.50 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this link. Insiders own 0.75% of the company's stock.

Fiserv Profile

(

Free Report)

Fiserv, Inc, together with its subsidiaries, provides payments and financial services technology services in the United States, Europe, the Middle East and Africa, Latin America, the Asia-Pacific, and internationally. It operates through Merchant Acceptance, Financial Technology, and Payments and Network segments.

Featured Articles

Want to see what other hedge funds are holding FI? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Fiserv, Inc. (NYSE:FI - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Fiserv, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fiserv wasn't on the list.

While Fiserv currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.