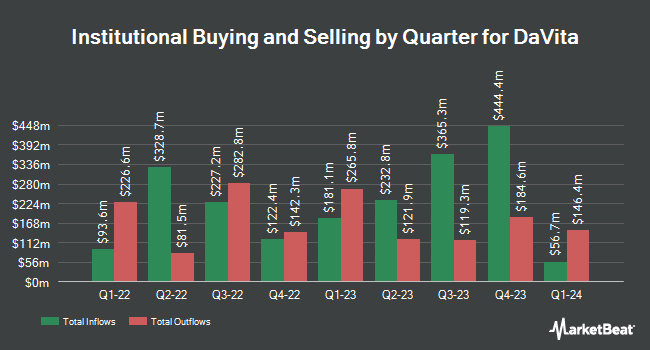

Ontario Teachers Pension Plan Board lifted its position in DaVita Inc. (NYSE:DVA - Free Report) by 98.7% in the fourth quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 17,372 shares of the company's stock after purchasing an additional 8,628 shares during the period. Ontario Teachers Pension Plan Board's holdings in DaVita were worth $2,598,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Several other institutional investors and hedge funds have also recently modified their holdings of the company. Wellington Management Group LLP increased its stake in DaVita by 9.1% in the 4th quarter. Wellington Management Group LLP now owns 2,711 shares of the company's stock worth $405,000 after buying an additional 227 shares in the last quarter. Franklin Resources Inc. boosted its stake in shares of DaVita by 134.6% in the third quarter. Franklin Resources Inc. now owns 54,901 shares of the company's stock worth $8,885,000 after acquiring an additional 31,502 shares during the period. Assenagon Asset Management S.A. grew its position in shares of DaVita by 201.7% during the fourth quarter. Assenagon Asset Management S.A. now owns 74,617 shares of the company's stock worth $11,159,000 after purchasing an additional 49,885 shares in the last quarter. Hussman Strategic Advisors Inc. raised its stake in DaVita by 200.0% during the 4th quarter. Hussman Strategic Advisors Inc. now owns 25,200 shares of the company's stock valued at $3,769,000 after purchasing an additional 16,800 shares during the period. Finally, Nordea Investment Management AB lifted its holdings in DaVita by 4.9% in the 4th quarter. Nordea Investment Management AB now owns 264,535 shares of the company's stock worth $39,712,000 after purchasing an additional 12,339 shares in the last quarter. 90.12% of the stock is currently owned by institutional investors.

Analyst Ratings Changes

DVA has been the subject of a number of research analyst reports. Barclays increased their price objective on shares of DaVita from $164.00 to $169.00 and gave the company an "equal weight" rating in a report on Tuesday, February 18th. StockNews.com upgraded shares of DaVita from a "hold" rating to a "buy" rating in a research note on Thursday, April 10th. Cowen restated a "hold" rating on shares of DaVita in a research report on Tuesday, February 18th. Finally, Sanford C. Bernstein set a $184.00 target price on DaVita in a research report on Friday, February 21st. One analyst has rated the stock with a sell rating, four have issued a hold rating and two have assigned a buy rating to the company. According to MarketBeat.com, DaVita currently has an average rating of "Hold" and an average target price of $166.33.

Get Our Latest Analysis on DVA

DaVita Stock Down 0.9 %

Shares of DVA traded down $1.29 during trading hours on Friday, hitting $140.21. The company had a trading volume of 994,193 shares, compared to its average volume of 834,677. The company has a current ratio of 1.26, a quick ratio of 1.21 and a debt-to-equity ratio of 23.18. The company has a market capitalization of $11.22 billion, a PE ratio of 13.05, a price-to-earnings-growth ratio of 1.07 and a beta of 1.04. DaVita Inc. has a one year low of $128.69 and a one year high of $179.60. The company's fifty day moving average price is $149.13 and its two-hundred day moving average price is $156.00.

DaVita (NYSE:DVA - Get Free Report) last posted its earnings results on Thursday, February 13th. The company reported $2.24 EPS for the quarter, beating analysts' consensus estimates of $2.14 by $0.10. DaVita had a net margin of 7.31% and a return on equity of 115.48%. As a group, equities analysts forecast that DaVita Inc. will post 10.76 earnings per share for the current fiscal year.

DaVita Company Profile

(

Free Report)

DaVita Inc provides kidney dialysis services for patients suffering from chronic kidney failure in the United States. The company operates kidney dialysis centers and provides related lab services in outpatient dialysis centers. It also offers outpatient, hospital inpatient, and home-based hemodialysis services; operates clinical laboratories that provide routine laboratory tests for dialysis and other physician-prescribed laboratory tests for ESRD patients; and management and administrative services to outpatient dialysis centers.

Further Reading

Before you consider DaVita, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DaVita wasn't on the list.

While DaVita currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.