Daymark Wealth Partners LLC reduced its stake in shares of NVIDIA Co. (NASDAQ:NVDA - Free Report) by 1.4% during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 1,100,577 shares of the computer hardware maker's stock after selling 15,878 shares during the quarter. NVIDIA accounts for approximately 4.4% of Daymark Wealth Partners LLC's portfolio, making the stock its 3rd largest holding. Daymark Wealth Partners LLC's holdings in NVIDIA were worth $133,654,000 at the end of the most recent reporting period.

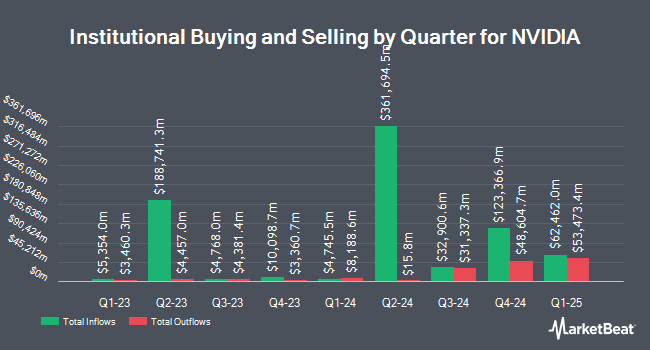

A number of other hedge funds also recently added to or reduced their stakes in the stock. Objectivity Squared LLC increased its position in NVIDIA by 17.3% during the third quarter. Objectivity Squared LLC now owns 9,514 shares of the computer hardware maker's stock worth $1,215,000 after buying an additional 1,401 shares in the last quarter. Tilia Fiduciary Partners Inc. increased its position in shares of NVIDIA by 5.1% in the third quarter. Tilia Fiduciary Partners Inc. now owns 5,532 shares of the computer hardware maker's stock worth $672,000 after acquiring an additional 266 shares in the last quarter. First National Corp MA ADV grew its stake in shares of NVIDIA by 3.1% in the third quarter. First National Corp MA ADV now owns 12,863 shares of the computer hardware maker's stock valued at $1,562,000 after buying an additional 389 shares in the last quarter. Eagle Wealth Strategies LLC boosted its holdings in NVIDIA by 10.4% in the 3rd quarter. Eagle Wealth Strategies LLC now owns 9,334 shares of the computer hardware maker's stock worth $1,133,000 after acquiring an additional 883 shares during the period. Finally, Barlow Wealth Partners Inc. grew its position in NVIDIA by 79.9% in the third quarter. Barlow Wealth Partners Inc. now owns 126,397 shares of the computer hardware maker's stock valued at $16,143,000 after acquiring an additional 56,147 shares in the last quarter. 65.27% of the stock is owned by hedge funds and other institutional investors.

NVIDIA Price Performance

Shares of NVDA stock traded down $2.37 during trading on Monday, hitting $145.26. The company had a trading volume of 180,326,633 shares, compared to its average volume of 403,076,219. The stock has a market capitalization of $3.56 trillion, a price-to-earnings ratio of 68.40, a price-to-earnings-growth ratio of 1.56 and a beta of 1.66. The stock's 50-day moving average is $127.27 and its two-hundred day moving average is $118.46. The company has a quick ratio of 3.79, a current ratio of 4.27 and a debt-to-equity ratio of 0.15. NVIDIA Co. has a 52 week low of $45.01 and a 52 week high of $149.77.

NVIDIA (NASDAQ:NVDA - Get Free Report) last announced its quarterly earnings results on Wednesday, August 28th. The computer hardware maker reported $0.68 EPS for the quarter, topping analysts' consensus estimates of $0.64 by $0.04. NVIDIA had a return on equity of 113.50% and a net margin of 55.04%. The business had revenue of $30.04 billion for the quarter, compared to analysts' expectations of $28.74 billion. During the same period in the previous year, the firm earned $0.25 EPS. The business's quarterly revenue was up 122.4% on a year-over-year basis. As a group, analysts predict that NVIDIA Co. will post 2.66 EPS for the current fiscal year.

NVIDIA declared that its board has initiated a share buyback program on Wednesday, August 28th that permits the company to repurchase $50.00 billion in outstanding shares. This repurchase authorization permits the computer hardware maker to purchase up to 1.6% of its stock through open market purchases. Stock repurchase programs are often an indication that the company's board of directors believes its stock is undervalued.

NVIDIA Cuts Dividend

The company also recently announced a quarterly dividend, which was paid on Thursday, October 3rd. Stockholders of record on Thursday, September 12th were issued a dividend of $0.01 per share. The ex-dividend date was Thursday, September 12th. This represents a $0.04 dividend on an annualized basis and a dividend yield of 0.03%. NVIDIA's dividend payout ratio is currently 1.88%.

Insider Buying and Selling

In other NVIDIA news, Director Mark A. Stevens sold 155,000 shares of the stock in a transaction that occurred on Wednesday, October 9th. The stock was sold at an average price of $132.27, for a total value of $20,501,850.00. Following the completion of the sale, the director now owns 8,100,117 shares in the company, valued at approximately $1,071,402,475.59. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the SEC, which can be accessed through the SEC website. In other news, CFO Colette Kress sold 66,670 shares of the firm's stock in a transaction that occurred on Friday, September 20th. The stock was sold at an average price of $116.59, for a total value of $7,773,055.30. Following the completion of the transaction, the chief financial officer now owns 4,954,214 shares in the company, valued at $577,611,810.26. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, Director Mark A. Stevens sold 155,000 shares of the stock in a transaction on Wednesday, October 9th. The stock was sold at an average price of $132.27, for a total value of $20,501,850.00. Following the completion of the transaction, the director now owns 8,100,117 shares of the company's stock, valued at approximately $1,071,402,475.59. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 2,156,270 shares of company stock valued at $254,784,327 over the last ninety days. 4.23% of the stock is owned by insiders.

Analyst Ratings Changes

Several research firms recently issued reports on NVDA. Evercore ISI lifted their price target on shares of NVIDIA from $145.00 to $150.00 and gave the stock an "outperform" rating in a research note on Friday, August 23rd. The Goldman Sachs Group increased their price target on NVIDIA from $135.00 to $150.00 and gave the company a "buy" rating in a report on Friday, October 11th. Raymond James lifted their price objective on NVIDIA from $120.00 to $140.00 and gave the stock a "strong-buy" rating in a report on Thursday, August 29th. DA Davidson restated a "neutral" rating and issued a $90.00 price target on shares of NVIDIA in a research note on Thursday, August 29th. Finally, Truist Financial raised their price objective on shares of NVIDIA from $140.00 to $145.00 and gave the stock a "buy" rating in a report on Tuesday, August 27th. Five investment analysts have rated the stock with a hold rating, thirty-seven have issued a buy rating and two have given a strong buy rating to the company's stock. Based on data from MarketBeat, the company presently has an average rating of "Moderate Buy" and a consensus price target of $145.63.

Get Our Latest Stock Report on NVDA

About NVIDIA

(

Free Report)

NVIDIA Corporation provides graphics and compute and networking solutions in the United States, Taiwan, China, Hong Kong, and internationally. The Graphics segment offers GeForce GPUs for gaming and PCs, the GeForce NOW game streaming service and related infrastructure, and solutions for gaming platforms; Quadro/NVIDIA RTX GPUs for enterprise workstation graphics; virtual GPU or vGPU software for cloud-based visual and virtual computing; automotive platforms for infotainment systems; and Omniverse software for building and operating metaverse and 3D internet applications.

Further Reading

Before you consider NVIDIA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NVIDIA wasn't on the list.

While NVIDIA currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report