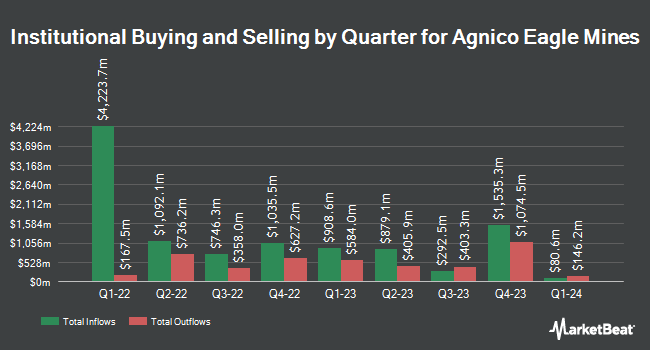

De Lisle Partners LLP increased its position in Agnico Eagle Mines Limited (NYSE:AEM - Free Report) TSE: AEM by 56.6% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 40,123 shares of the mining company's stock after acquiring an additional 14,500 shares during the period. De Lisle Partners LLP's holdings in Agnico Eagle Mines were worth $3,233,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Healthcare of Ontario Pension Plan Trust Fund lifted its stake in Agnico Eagle Mines by 18.0% during the 3rd quarter. Healthcare of Ontario Pension Plan Trust Fund now owns 127,842 shares of the mining company's stock valued at $10,298,000 after acquiring an additional 19,542 shares during the period. Blueshift Asset Management LLC raised its holdings in shares of Agnico Eagle Mines by 94.5% during the third quarter. Blueshift Asset Management LLC now owns 6,390 shares of the mining company's stock worth $515,000 after purchasing an additional 3,105 shares during the last quarter. RiverGlades Family Offices LLC purchased a new position in shares of Agnico Eagle Mines during the third quarter worth $242,000. Bridgewater Associates LP lifted its position in Agnico Eagle Mines by 123.2% during the third quarter. Bridgewater Associates LP now owns 204,168 shares of the mining company's stock valued at $16,448,000 after purchasing an additional 112,712 shares during the period. Finally, Freedom Investment Management Inc. purchased a new stake in Agnico Eagle Mines in the third quarter valued at $574,000. Institutional investors and hedge funds own 68.34% of the company's stock.

Agnico Eagle Mines Trading Down 0.7 %

Shares of NYSE AEM traded down $0.56 during trading on Thursday, hitting $83.55. 1,682,864 shares of the company were exchanged, compared to its average volume of 2,646,990. The company has a debt-to-equity ratio of 0.06, a quick ratio of 0.83 and a current ratio of 1.75. The company has a fifty day moving average price of $82.74 and a 200-day moving average price of $76.35. Agnico Eagle Mines Limited has a 12-month low of $44.37 and a 12-month high of $89.00. The firm has a market capitalization of $41.95 billion, a PE ratio of 41.78, a P/E/G ratio of 0.70 and a beta of 1.09.

Analyst Upgrades and Downgrades

Several equities analysts have recently issued reports on the company. Jefferies Financial Group boosted their price objective on Agnico Eagle Mines from $68.00 to $85.00 and gave the company a "hold" rating in a report on Friday, October 4th. Scotiabank increased their price target on Agnico Eagle Mines from $81.00 to $94.00 and gave the stock a "sector outperform" rating in a research report on Monday, August 19th. TD Securities raised their target price on Agnico Eagle Mines from $90.00 to $91.00 and gave the company a "buy" rating in a research report on Friday, August 2nd. UBS Group began coverage on Agnico Eagle Mines in a research report on Tuesday, September 17th. They set a "buy" rating and a $95.00 price target for the company. Finally, Royal Bank of Canada raised their price objective on Agnico Eagle Mines from $80.00 to $87.00 and gave the company an "outperform" rating in a report on Tuesday, September 10th. One equities research analyst has rated the stock with a hold rating and eight have issued a buy rating to the company's stock. According to data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $86.78.

Get Our Latest Stock Report on AEM

Agnico Eagle Mines Company Profile

(

Free Report)

Agnico Eagle Mines Limited, a gold mining company, exploration, development, and production of precious metals. It explores for gold. The company's mines are located in Canada, Australia, Finland and Mexico, with exploration and development activities in Canada, Australia, Europe, Latin America, and the United States.

Further Reading

Before you consider Agnico Eagle Mines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Agnico Eagle Mines wasn't on the list.

While Agnico Eagle Mines currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.