De Lisle Partners LLP trimmed its stake in shares of Capri Holdings Limited (NYSE:CPRI - Free Report) by 87.0% in the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 7,500 shares of the company's stock after selling 50,000 shares during the quarter. De Lisle Partners LLP's holdings in Capri were worth $318,000 at the end of the most recent reporting period.

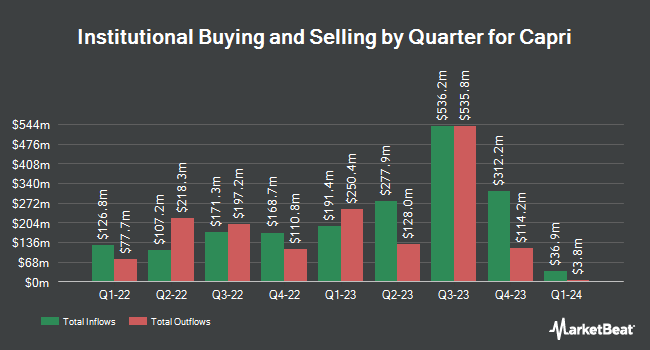

Several other institutional investors and hedge funds have also recently modified their holdings of CPRI. CWM LLC boosted its holdings in shares of Capri by 35.2% during the 2nd quarter. CWM LLC now owns 2,452 shares of the company's stock worth $81,000 after buying an additional 638 shares during the period. Signaturefd LLC boosted its holdings in shares of Capri by 14.7% during the second quarter. Signaturefd LLC now owns 2,734 shares of the company's stock worth $90,000 after acquiring an additional 351 shares during the period. EMC Capital Management grew its position in shares of Capri by 32.7% in the first quarter. EMC Capital Management now owns 2,421 shares of the company's stock valued at $110,000 after purchasing an additional 596 shares during the last quarter. GAMMA Investing LLC increased its stake in shares of Capri by 1,580.1% during the second quarter. GAMMA Investing LLC now owns 3,713 shares of the company's stock worth $123,000 after purchasing an additional 3,492 shares during the period. Finally, KBC Group NV lifted its holdings in Capri by 26.9% during the 3rd quarter. KBC Group NV now owns 3,074 shares of the company's stock worth $130,000 after purchasing an additional 652 shares during the last quarter. 84.34% of the stock is currently owned by institutional investors and hedge funds.

Capri Stock Down 0.5 %

Shares of CPRI traded down $0.11 during trading hours on Friday, hitting $23.41. The stock had a trading volume of 2,201,400 shares, compared to its average volume of 2,157,732. The firm has a 50 day simple moving average of $31.17 and a 200-day simple moving average of $33.17. Capri Holdings Limited has a 1-year low of $18.70 and a 1-year high of $51.23. The company has a debt-to-equity ratio of 0.83, a current ratio of 0.93 and a quick ratio of 0.38. The firm has a market capitalization of $2.76 billion, a P/E ratio of -7.69, a price-to-earnings-growth ratio of 5.01 and a beta of 2.05.

Wall Street Analyst Weigh In

A number of equities research analysts have recently weighed in on CPRI shares. Citigroup downgraded Capri from a "buy" rating to a "neutral" rating and set a $41.00 target price for the company. in a report on Friday, September 13th. Guggenheim raised shares of Capri from a "neutral" rating to a "buy" rating and set a $30.00 price objective for the company in a report on Tuesday. Barclays reaffirmed an "equal weight" rating and set a $21.00 target price on shares of Capri in a report on Wednesday, November 20th. Telsey Advisory Group cut their price target on Capri from $26.00 to $23.00 and set a "market perform" rating for the company in a research note on Friday, November 15th. Finally, StockNews.com lowered Capri from a "hold" rating to a "sell" rating in a research note on Tuesday, August 27th. One analyst has rated the stock with a sell rating, nine have issued a hold rating and one has assigned a buy rating to the company. According to MarketBeat.com, Capri currently has a consensus rating of "Hold" and an average price target of $28.20.

Read Our Latest Analysis on CPRI

About Capri

(

Free Report)

Capri Holdings Limited designs, markets, distributes, and retails branded women's and men's apparel, footwear, and accessories in the United States, Canada, Latin America, Europe, the Middle East, Africa, and Asia. It operates through three segments: Versace, Jimmy Choo, and Michael Kors. The company offers ready-to-wear, accessories, footwear, handbags, scarves and belts, small leather goods, eyewear, watches, jewelry, fragrances, and home furnishings through a distribution network, including boutiques, department, and specialty stores, as well as through e-commerce sites.

Featured Stories

Before you consider Capri, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Capri wasn't on the list.

While Capri currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.