Dean Investment Associates LLC cut its stake in Omnicom Group Inc. (NYSE:OMC - Free Report) by 49.8% in the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 34,330 shares of the business services provider's stock after selling 34,044 shares during the quarter. Dean Investment Associates LLC's holdings in Omnicom Group were worth $3,549,000 at the end of the most recent quarter.

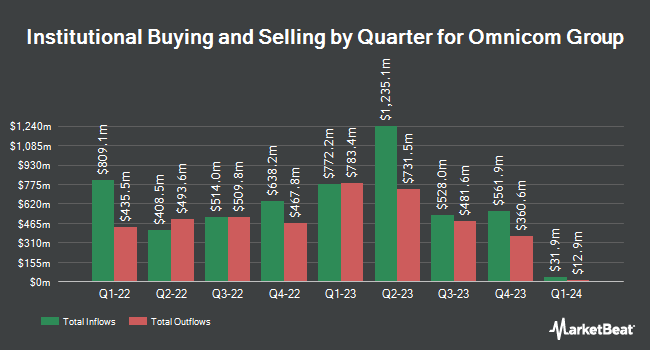

Several other institutional investors and hedge funds have also recently modified their holdings of OMC. Bank of New York Mellon Corp lifted its position in Omnicom Group by 37.0% during the second quarter. Bank of New York Mellon Corp now owns 3,307,882 shares of the business services provider's stock valued at $296,717,000 after buying an additional 892,494 shares during the period. State Street Corp lifted its position in Omnicom Group by 5.7% during the 3rd quarter. State Street Corp now owns 14,118,529 shares of the business services provider's stock valued at $1,468,615,000 after acquiring an additional 759,980 shares during the period. Los Angeles Capital Management LLC bought a new stake in Omnicom Group during the second quarter worth about $56,177,000. World Investment Advisors LLC boosted its stake in Omnicom Group by 4,413.3% during the third quarter. World Investment Advisors LLC now owns 383,448 shares of the business services provider's stock worth $39,645,000 after acquiring an additional 374,952 shares in the last quarter. Finally, Dimensional Fund Advisors LP grew its holdings in Omnicom Group by 18.9% in the second quarter. Dimensional Fund Advisors LP now owns 2,293,095 shares of the business services provider's stock worth $205,682,000 after purchasing an additional 364,665 shares during the period. 91.97% of the stock is owned by hedge funds and other institutional investors.

Insiders Place Their Bets

In other news, CAO Andrew Castellaneta sold 4,000 shares of the business's stock in a transaction on Friday, October 18th. The shares were sold at an average price of $105.29, for a total transaction of $421,160.00. Following the completion of the sale, the chief accounting officer now owns 23,545 shares of the company's stock, valued at $2,479,053.05. The trade was a 14.52 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available at this link. Insiders own 1.30% of the company's stock.

Omnicom Group Stock Performance

Shares of NYSE OMC traded up $0.28 during trading on Friday, reaching $103.42. 1,115,249 shares of the company traded hands, compared to its average volume of 1,701,565. The company has a quick ratio of 0.86, a current ratio of 0.98 and a debt-to-equity ratio of 1.37. The firm has a 50 day simple moving average of $102.64 and a 200-day simple moving average of $97.35. Omnicom Group Inc. has a 52-week low of $81.41 and a 52-week high of $107.00. The stock has a market capitalization of $20.18 billion, a PE ratio of 14.13, a P/E/G ratio of 2.32 and a beta of 0.94.

Omnicom Group (NYSE:OMC - Get Free Report) last posted its earnings results on Tuesday, October 15th. The business services provider reported $2.03 EPS for the quarter, topping analysts' consensus estimates of $2.02 by $0.01. The business had revenue of $3.88 billion during the quarter, compared to the consensus estimate of $3.79 billion. Omnicom Group had a net margin of 9.45% and a return on equity of 36.59%. During the same quarter in the previous year, the firm posted $1.86 EPS. Equities research analysts anticipate that Omnicom Group Inc. will post 7.94 earnings per share for the current year.

Omnicom Group Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Friday, January 10th. Shareholders of record on Friday, December 20th will be issued a $0.70 dividend. This represents a $2.80 dividend on an annualized basis and a yield of 2.71%. The ex-dividend date is Friday, December 20th. Omnicom Group's dividend payout ratio is 38.25%.

Analysts Set New Price Targets

Several research firms have recently issued reports on OMC. Barclays lifted their target price on shares of Omnicom Group from $110.00 to $121.00 and gave the company an "overweight" rating in a report on Thursday, October 17th. UBS Group boosted their target price on Omnicom Group from $120.00 to $124.00 and gave the stock a "buy" rating in a report on Wednesday, October 16th. Wells Fargo & Company downgraded Omnicom Group from an "overweight" rating to an "equal weight" rating and raised their price target for the company from $106.00 to $110.00 in a report on Wednesday, October 16th. JPMorgan Chase & Co. upped their price target on shares of Omnicom Group from $118.00 to $119.00 and gave the stock an "overweight" rating in a research note on Wednesday, October 16th. Finally, Macquarie raised their price objective on shares of Omnicom Group from $110.00 to $120.00 and gave the company an "outperform" rating in a research note on Wednesday, October 16th. One research analyst has rated the stock with a sell rating, two have issued a hold rating and seven have given a buy rating to the company. Based on data from MarketBeat, the company currently has an average rating of "Moderate Buy" and an average price target of $110.11.

Read Our Latest Stock Report on OMC

About Omnicom Group

(

Free Report)

Omnicom Group Inc, together with its subsidiaries, offers advertising, marketing, and corporate communications services. It provides a range of services in the areas of advertising and media, precision marketing, commerce and branding, experiential, execution and support, public relations, and healthcare.

Read More

Before you consider Omnicom Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Omnicom Group wasn't on the list.

While Omnicom Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.