Dearborn Partners LLC decreased its position in Pool Co. (NASDAQ:POOL - Free Report) by 5.6% in the third quarter, according to its most recent 13F filing with the SEC. The firm owned 63,586 shares of the specialty retailer's stock after selling 3,753 shares during the period. Dearborn Partners LLC owned about 0.17% of Pool worth $23,959,000 at the end of the most recent reporting period.

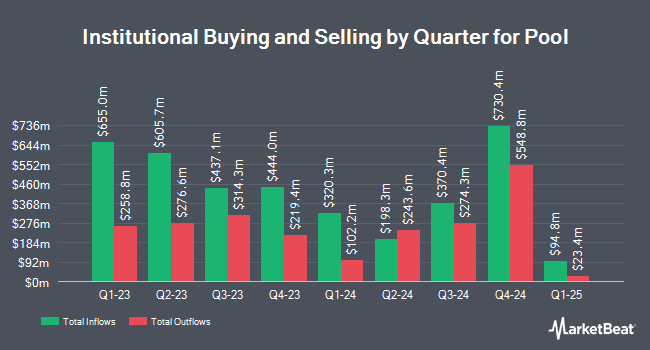

A number of other hedge funds and other institutional investors also recently added to or reduced their stakes in POOL. Swedbank AB bought a new stake in shares of Pool in the 1st quarter worth approximately $96,528,000. International Assets Investment Management LLC raised its holdings in Pool by 37,863.6% during the third quarter. International Assets Investment Management LLC now owns 137,808 shares of the specialty retailer's stock worth $51,926,000 after acquiring an additional 137,445 shares in the last quarter. Caledonia Investments PLC acquired a new stake in Pool in the 2nd quarter valued at about $37,390,000. Bank of New York Mellon Corp boosted its holdings in shares of Pool by 26.6% during the 2nd quarter. Bank of New York Mellon Corp now owns 433,166 shares of the specialty retailer's stock worth $133,125,000 after buying an additional 90,951 shares during the period. Finally, Epoch Investment Partners Inc. increased its position in Pool by 58.6% during the 1st quarter. Epoch Investment Partners Inc. now owns 195,741 shares of the specialty retailer's stock worth $78,981,000 after buying an additional 72,322 shares during the period. Hedge funds and other institutional investors own 98.99% of the company's stock.

Pool Trading Up 0.8 %

Shares of POOL traded up $2.70 during midday trading on Friday, hitting $360.19. 393,737 shares of the stock were exchanged, compared to its average volume of 347,499. The stock has a fifty day simple moving average of $363.76 and a 200 day simple moving average of $352.48. The firm has a market cap of $13.71 billion, a P/E ratio of 30.77, a P/E/G ratio of 2.13 and a beta of 1.01. The company has a debt-to-equity ratio of 0.61, a quick ratio of 0.77 and a current ratio of 2.39. Pool Co. has a 52-week low of $293.51 and a 52-week high of $422.73.

Pool (NASDAQ:POOL - Get Free Report) last issued its earnings results on Thursday, October 24th. The specialty retailer reported $3.26 earnings per share for the quarter, topping the consensus estimate of $3.15 by $0.11. The company had revenue of $1.43 billion for the quarter, compared to analyst estimates of $1.40 billion. Pool had a net margin of 8.42% and a return on equity of 31.89%. The firm's revenue for the quarter was down 2.8% compared to the same quarter last year. During the same period in the prior year, the business posted $3.50 earnings per share. On average, research analysts anticipate that Pool Co. will post 11 EPS for the current fiscal year.

Pool Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Wednesday, November 27th. Stockholders of record on Wednesday, November 13th will be given a $1.20 dividend. This represents a $4.80 dividend on an annualized basis and a dividend yield of 1.33%. The ex-dividend date of this dividend is Wednesday, November 13th. Pool's dividend payout ratio (DPR) is 41.31%.

Wall Street Analyst Weigh In

Several brokerages have commented on POOL. Oppenheimer boosted their target price on Pool from $380.00 to $386.00 and gave the stock an "outperform" rating in a research note on Monday, October 28th. Stifel Nicolaus upped their price objective on shares of Pool from $335.00 to $340.00 and gave the stock a "hold" rating in a research report on Monday, October 28th. Wells Fargo & Company boosted their price objective on Pool from $330.00 to $370.00 and gave the company an "equal weight" rating in a research note on Monday, October 7th. StockNews.com upgraded Pool from a "sell" rating to a "hold" rating in a research report on Saturday, November 2nd. Finally, The Goldman Sachs Group upped their price objective on shares of Pool from $365.00 to $415.00 and gave the company a "buy" rating in a research note on Friday, July 26th. One research analyst has rated the stock with a sell rating, six have given a hold rating and three have assigned a buy rating to the company's stock. According to data from MarketBeat, the company currently has an average rating of "Hold" and an average price target of $369.11.

Get Our Latest Research Report on POOL

Pool Company Profile

(

Free Report)

Pool Corporation distributes swimming pool supplies, equipment, and related leisure products in the United States and internationally. The company offers maintenance products, including chemicals, supplies, and pool accessories; repair and replacement parts for pool equipment, such as cleaners, filters, heaters, pumps, and lights; and building materials, such as concrete, plumbing and electrical components, functional and decorative pool surfaces, decking materials, tiles, hardscapes, and natural stones for pool installations and remodeling.

Featured Stories

Before you consider Pool, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pool wasn't on the list.

While Pool currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.