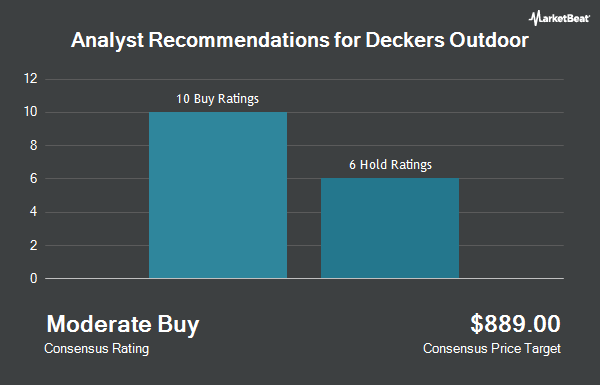

Shares of Deckers Outdoor Co. (NYSE:DECK - Get Free Report) have been assigned a consensus recommendation of "Moderate Buy" from the nineteen research firms that are currently covering the firm, Marketbeat Ratings reports. Eight analysts have rated the stock with a hold rating and eleven have assigned a buy rating to the company. The average 1-year price target among brokers that have updated their coverage on the stock in the last year is $153.53.

DECK has been the topic of a number of analyst reports. Bank of America upped their target price on Deckers Outdoor from $170.00 to $182.00 and gave the company a "neutral" rating in a research note on Friday, October 25th. UBS Group lifted their target price on Deckers Outdoor from $226.00 to $232.00 and gave the stock a "buy" rating in a research report on Friday, October 25th. Barclays raised their price target on shares of Deckers Outdoor from $180.00 to $190.00 and gave the stock an "overweight" rating in a research note on Friday, October 25th. Robert W. Baird upped their target price on shares of Deckers Outdoor from $180.00 to $195.00 and gave the stock an "outperform" rating in a research note on Friday, October 25th. Finally, Evercore ISI raised their target price on shares of Deckers Outdoor from $185.00 to $195.00 and gave the stock an "outperform" rating in a research report on Friday, October 25th.

View Our Latest Stock Report on Deckers Outdoor

Deckers Outdoor Price Performance

Shares of Deckers Outdoor stock traded up $4.34 on Monday, reaching $196.49. The company had a trading volume of 3,910,657 shares, compared to its average volume of 2,245,259. The firm's 50-day moving average price is $163.85 and its two-hundred day moving average price is $74.68. Deckers Outdoor has a 1 year low of $105.83 and a 1 year high of $198.08. The firm has a market cap of $29.85 billion, a price-to-earnings ratio of 34.04, a P/E/G ratio of 2.70 and a beta of 1.05.

Deckers Outdoor (NYSE:DECK - Get Free Report) last announced its earnings results on Thursday, October 24th. The textile maker reported $1.59 earnings per share for the quarter, beating the consensus estimate of $1.24 by $0.35. Deckers Outdoor had a net margin of 18.95% and a return on equity of 41.48%. The business had revenue of $1.31 billion for the quarter, compared to the consensus estimate of $1.20 billion. During the same quarter in the prior year, the firm posted $1.14 earnings per share. The business's revenue for the quarter was up 20.1% on a year-over-year basis. As a group, analysts anticipate that Deckers Outdoor will post 5.48 EPS for the current year.

Insider Transactions at Deckers Outdoor

In related news, Director David Powers sold 140,832 shares of Deckers Outdoor stock in a transaction that occurred on Friday, September 6th. The shares were sold at an average price of $23.97, for a total value of $3,376,368.96. Following the completion of the sale, the director now directly owns 2,450,808 shares in the company, valued at $58,756,760.24. This trade represents a 5.43 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, insider Thomas Garcia sold 18,000 shares of the company's stock in a transaction that occurred on Tuesday, November 19th. The shares were sold at an average price of $175.28, for a total transaction of $3,155,040.00. Following the transaction, the insider now owns 63,642 shares in the company, valued at $11,155,169.76. The trade was a 22.05 % decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders have sold 210,492 shares of company stock valued at $15,590,797. Corporate insiders own 0.40% of the company's stock.

Institutional Inflows and Outflows

Several institutional investors have recently modified their holdings of the company. American Trust purchased a new position in Deckers Outdoor during the 1st quarter worth approximately $405,000. Railway Pension Investments Ltd raised its holdings in shares of Deckers Outdoor by 17.0% during the first quarter. Railway Pension Investments Ltd now owns 13,100 shares of the textile maker's stock worth $12,331,000 after purchasing an additional 1,900 shares during the last quarter. Tidal Investments LLC lifted its position in Deckers Outdoor by 51.1% during the first quarter. Tidal Investments LLC now owns 2,855 shares of the textile maker's stock valued at $2,687,000 after purchasing an additional 966 shares during the period. Plato Investment Management Ltd acquired a new stake in Deckers Outdoor during the 1st quarter worth about $135,000. Finally, SVB Wealth LLC acquired a new stake in Deckers Outdoor during the 1st quarter worth about $228,000. 97.79% of the stock is currently owned by hedge funds and other institutional investors.

About Deckers Outdoor

(

Get Free ReportDeckers Outdoor Corporation, together with its subsidiaries, designs, markets, and distributes footwear, apparel, and accessories for casual lifestyle use and high-performance activities in the United States and internationally. The company offers premium footwear, apparel, and accessories under the UGG brand name; footwear, apparel, and accessories for ultra-runners and athletes under the HOKA brand name; and sandals, shoes, and boots under the Teva brand name.

Featured Articles

Before you consider Deckers Outdoor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Deckers Outdoor wasn't on the list.

While Deckers Outdoor currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.