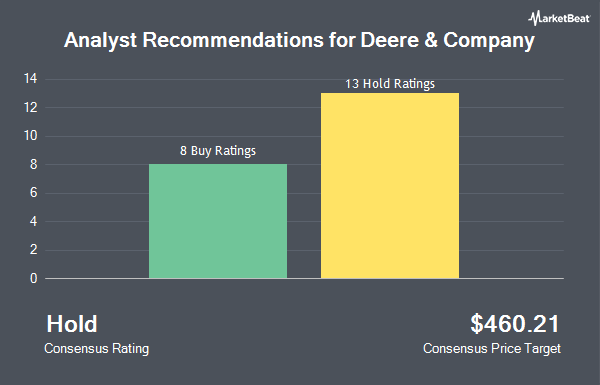

Shares of Deere & Company (NYSE:DE - Get Free Report) have been assigned an average recommendation of "Hold" from the twenty-two research firms that are presently covering the company, Marketbeat Ratings reports. Thirteen equities research analysts have rated the stock with a hold recommendation and nine have given a buy recommendation to the company. The average 12 month price target among analysts that have covered the stock in the last year is $443.94.

Several equities analysts have recently commented on the stock. Jefferies Financial Group downgraded shares of Deere & Company from a "buy" rating to a "hold" rating and set a $510.00 target price on the stock. in a report on Friday, December 6th. Barclays boosted their price objective on shares of Deere & Company from $400.00 to $475.00 and gave the company an "overweight" rating in a research report on Friday, November 22nd. Citigroup lifted their price objective on Deere & Company from $460.00 to $470.00 and gave the company a "neutral" rating in a report on Monday, December 9th. Morgan Stanley upped their target price on Deere & Company from $401.00 to $450.00 and gave the stock an "overweight" rating in a report on Monday, November 25th. Finally, Oppenheimer raised their price target on shares of Deere & Company from $448.00 to $477.00 and gave the company an "outperform" rating in a report on Friday, November 22nd.

Read Our Latest Analysis on DE

Deere & Company Stock Performance

Deere & Company stock traded up $5.86 during mid-day trading on Friday, reaching $432.49. 2,438,001 shares of the stock traded hands, compared to its average volume of 1,442,307. Deere & Company has a 12-month low of $340.20 and a 12-month high of $469.39. The business's 50-day moving average is $423.38 and its 200-day moving average is $394.74. The company has a debt-to-equity ratio of 1.89, a current ratio of 2.09 and a quick ratio of 1.90. The stock has a market capitalization of $117.45 billion, a PE ratio of 16.89, a price-to-earnings-growth ratio of 1.91 and a beta of 0.96.

Deere & Company (NYSE:DE - Get Free Report) last announced its earnings results on Thursday, November 21st. The industrial products company reported $4.55 EPS for the quarter, beating analysts' consensus estimates of $3.89 by $0.66. The business had revenue of $9.28 billion during the quarter, compared to analysts' expectations of $9.20 billion. Deere & Company had a net margin of 13.73% and a return on equity of 31.32%. The firm's revenue was down 32.8% on a year-over-year basis. During the same period in the prior year, the company earned $8.26 earnings per share. As a group, sell-side analysts predict that Deere & Company will post 19.52 EPS for the current fiscal year.

Deere & Company Increases Dividend

The firm also recently announced a quarterly dividend, which will be paid on Monday, February 10th. Stockholders of record on Tuesday, December 31st will be issued a $1.62 dividend. This represents a $6.48 dividend on an annualized basis and a dividend yield of 1.50%. This is a boost from Deere & Company's previous quarterly dividend of $1.47. The ex-dividend date of this dividend is Tuesday, December 31st. Deere & Company's payout ratio is presently 25.31%.

Hedge Funds Weigh In On Deere & Company

A number of large investors have recently bought and sold shares of the company. Wellington Management Group LLP increased its holdings in Deere & Company by 32.0% in the third quarter. Wellington Management Group LLP now owns 7,352,465 shares of the industrial products company's stock valued at $3,068,404,000 after buying an additional 1,782,984 shares in the last quarter. Geode Capital Management LLC increased its holdings in Deere & Company by 0.6% during the 3rd quarter. Geode Capital Management LLC now owns 5,208,368 shares of the industrial products company's stock valued at $2,168,737,000 after acquiring an additional 31,459 shares in the last quarter. FMR LLC raised its position in Deere & Company by 27.8% during the third quarter. FMR LLC now owns 4,542,013 shares of the industrial products company's stock worth $1,895,518,000 after acquiring an additional 988,380 shares during the last quarter. Legal & General Group Plc lifted its holdings in shares of Deere & Company by 2.7% in the second quarter. Legal & General Group Plc now owns 2,254,266 shares of the industrial products company's stock valued at $842,259,000 after purchasing an additional 60,255 shares in the last quarter. Finally, Dimensional Fund Advisors LP increased its stake in shares of Deere & Company by 15.0% during the 2nd quarter. Dimensional Fund Advisors LP now owns 2,146,441 shares of the industrial products company's stock worth $802,037,000 after purchasing an additional 279,627 shares in the last quarter. Hedge funds and other institutional investors own 68.58% of the company's stock.

Deere & Company Company Profile

(

Get Free ReportDeere & Company engages in the manufacture and distribution of various equipment worldwide. The company operates through four segments: Production and Precision Agriculture, Small Agriculture and Turf, Construction and Forestry, and Financial Services. The Production and Precision Agriculture segment provides large and medium tractors, combines, cotton pickers and strippers, sugarcane harvesters and loaders, harvesting front-end equipment, pull-behind scrapers, and tillage and seeding equipment, as well as application equipment, including sprayers and nutrient management, and soil preparation machinery for grain growers.

See Also

Before you consider Deere & Company, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Deere & Company wasn't on the list.

While Deere & Company currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.