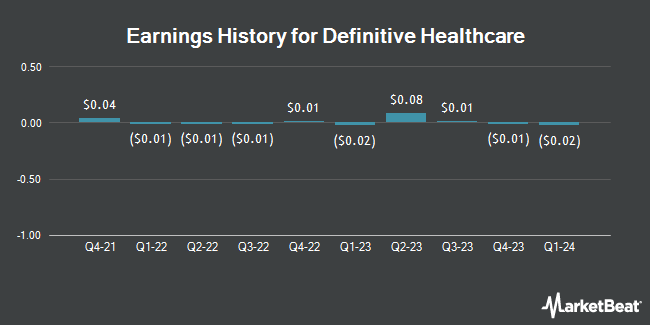

Definitive Healthcare (NASDAQ:DH - Get Free Report) is anticipated to release its earnings data after the market closes on Thursday, February 27th. Analysts expect Definitive Healthcare to post earnings of $0.07 per share and revenue of $60.60 million for the quarter. Persons that wish to listen to the company's earnings conference call can do so using this link.

Definitive Healthcare Stock Performance

DH stock traded down $0.27 during trading on Friday, hitting $4.92. The company had a trading volume of 443,783 shares, compared to its average volume of 776,608. The firm has a 50-day moving average price of $4.59 and a 200-day moving average price of $4.43. The company has a quick ratio of 2.49, a current ratio of 2.49 and a debt-to-equity ratio of 0.33. The firm has a market cap of $568.36 million, a PE ratio of -1.59, a price-to-earnings-growth ratio of 4.10 and a beta of 1.45. Definitive Healthcare has a 1-year low of $3.19 and a 1-year high of $10.62.

Insiders Place Their Bets

In other news, insider William Moschella sold 45,000 shares of Definitive Healthcare stock in a transaction that occurred on Tuesday, December 3rd. The shares were sold at an average price of $4.70, for a total transaction of $211,500.00. Following the completion of the sale, the insider now directly owns 433,830 shares in the company, valued at approximately $2,039,001. This trade represents a 9.40 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Insiders own 14.84% of the company's stock.

Analyst Ratings Changes

A number of research analysts have recently issued reports on the company. Needham & Company LLC reissued a "hold" rating on shares of Definitive Healthcare in a report on Thursday, January 16th. Stephens initiated coverage on shares of Definitive Healthcare in a research note on Friday, December 20th. They issued an "equal weight" rating and a $5.00 price objective on the stock. Finally, Barclays restated an "underweight" rating and set a $4.00 price objective on shares of Definitive Healthcare in a research report on Monday, January 13th. Two investment analysts have rated the stock with a sell rating, six have issued a hold rating and three have given a buy rating to the stock. According to data from MarketBeat.com, the stock has an average rating of "Hold" and an average price target of $5.72.

View Our Latest Stock Report on DH

About Definitive Healthcare

(

Get Free Report)

Definitive Healthcare Corp., together with its subsidiaries, provides software as a service (SaaS) healthcare commercial intelligence platform in the United States and internationally. Its SaaS platform provides information on healthcare providers and their activities to help its customers from product development to go-to-market planning, and sales and marketing execution.

Featured Stories

Before you consider Definitive Healthcare, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Definitive Healthcare wasn't on the list.

While Definitive Healthcare currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.