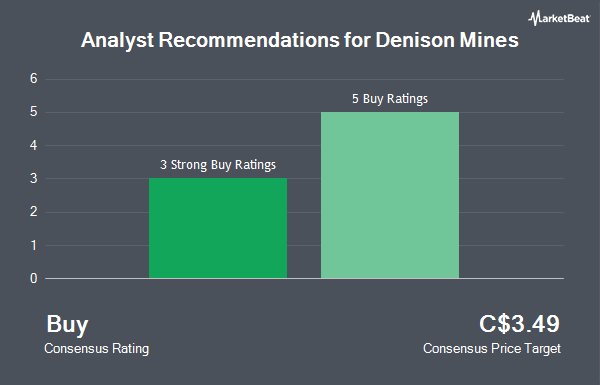

Denison Mines Corp. (TSE:DML - Get Free Report) NYSE: DNN has been given an average recommendation of "Buy" by the eight brokerages that are covering the stock, Marketbeat.com reports. Five analysts have rated the stock with a buy rating and three have assigned a strong buy rating to the company. The average 1-year price target among brokerages that have covered the stock in the last year is C$3.57.

A number of equities analysts have weighed in on the stock. National Bankshares lifted their price target on shares of Denison Mines from C$3.50 to C$4.15 and gave the company an "outperform" rating in a report on Thursday, October 24th. CIBC set a C$3.25 price objective on Denison Mines and gave the stock an "outperform" rating in a report on Thursday, September 26th. National Bank Financial raised shares of Denison Mines to a "strong-buy" rating in a research report on Tuesday, September 3rd. Cibc World Mkts raised shares of Denison Mines to a "strong-buy" rating in a research report on Thursday, September 26th. Finally, BMO Capital Markets raised Denison Mines from a "market perform" rating to an "outperform" rating and set a C$3.00 price objective on the stock in a research report on Wednesday, September 25th.

Get Our Latest Stock Report on DML

Insider Buying and Selling at Denison Mines

In related news, Senior Officer Andrew Alan Yackulic sold 45,500 shares of the firm's stock in a transaction on Monday, November 11th. The stock was sold at an average price of C$2.84, for a total transaction of C$129,124.45. 0.31% of the stock is owned by insiders.

Denison Mines Trading Up 7.8 %

DML traded up C$0.23 during midday trading on Monday, hitting C$3.16. The company's stock had a trading volume of 4,709,369 shares, compared to its average volume of 1,967,969. Denison Mines has a 52-week low of C$1.91 and a 52-week high of C$3.37. The firm has a 50-day moving average price of C$2.66 and a two-hundred day moving average price of C$2.67. The company has a current ratio of 6.94, a quick ratio of 3.12 and a debt-to-equity ratio of 0.07. The firm has a market cap of C$2.82 billion, a P/E ratio of 52.50, a PEG ratio of 1.42 and a beta of 1.89.

Denison Mines Company Profile

(

Get Free ReportDenison Mines Corp. engages in the acquisition, exploration, and development of uranium bearing properties in Canada. Its flagship project is the Wheeler River uranium project covering an area of approximately 300,000 hectares located in the Athabasca Basin region in northern Saskatchewan. The company was formerly known as International Uranium Corporation and changed its name to Denison Mines Corp.

Featured Articles

Before you consider Denison Mines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Denison Mines wasn't on the list.

While Denison Mines currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.