AGF Management (TSE:AGF.B - Get Free Report) had its target price increased by research analysts at Desjardins from C$13.00 to C$13.50 in a note issued to investors on Thursday,BayStreet.CA reports. The brokerage currently has a "buy" rating on the stock. Desjardins' price target suggests a potential upside of 33.27% from the company's previous close.

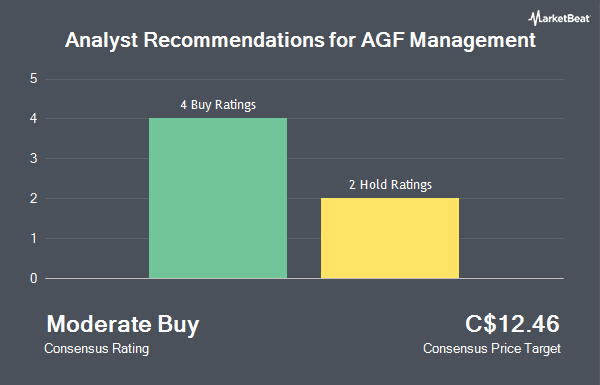

Other equities research analysts also recently issued reports about the stock. Jefferies Financial Group raised their target price on shares of AGF Management from C$11.00 to C$12.00 and gave the company a "buy" rating in a research note on Wednesday, January 8th. TD Securities increased their price target on AGF Management from C$12.00 to C$13.00 and gave the company a "buy" rating in a research note on Thursday, January 30th. Finally, BMO Capital Markets raised their price target on AGF Management from C$10.00 to C$11.00 in a report on Wednesday, January 8th. Two analysts have rated the stock with a hold rating and four have issued a buy rating to the company. Based on data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of C$12.54.

Check Out Our Latest Stock Report on AGF.B

AGF Management Stock Up 1.6 %

AGF.B stock traded up C$0.16 during trading on Thursday, reaching C$10.13. 66,691 shares of the company traded hands, compared to its average volume of 71,092. The business has a 50 day simple moving average of C$10.79 and a 200 day simple moving average of C$10.50. AGF Management has a 12 month low of C$7.37 and a 12 month high of C$11.95. The company has a debt-to-equity ratio of 11.27, a quick ratio of 1.75 and a current ratio of 1.19. The company has a market capitalization of C$646.90 million, a price-to-earnings ratio of 7.91, a price-to-earnings-growth ratio of 1.18 and a beta of 1.73.

Insider Activity

In other AGF Management news, insider AGF EMPLOYEE BENEFIT PLAN TRUST purchased 21,100 shares of the business's stock in a transaction that occurred on Thursday, February 20th. The stock was purchased at an average price of C$11.57 per share, for a total transaction of C$244,127.00. Insiders purchased a total of 89,700 shares of company stock valued at $1,033,992 in the last quarter. 18.70% of the stock is currently owned by company insiders.

About AGF Management

(

Get Free Report)

AGF Management Limited is one of Canada's premier investment management companies with offices across Canada and subsidiaries around the world. 2007 marks AGF's 50th anniversary ofproviding Canadians with innovative investment solutions across the wealth continuum. AGF's products and services include a diversified family of more than 50 mutual funds, the evolutionary AGF Elements portfolios, the Harmony asset management program, AGF Private Investment Management, Institutional Account Services and AGF Trust GICs, loans and mortgages.

Recommended Stories

Before you consider AGF Management, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AGF Management wasn't on the list.

While AGF Management currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.