Cenovus Energy (TSE:CVE - Get Free Report) NYSE: CVE had its price objective dropped by Desjardins from C$24.50 to C$22.50 in a report issued on Tuesday,BayStreet.CA reports. The brokerage presently has a "buy" rating on the stock. Desjardins' target price would suggest a potential upside of 34.33% from the stock's previous close.

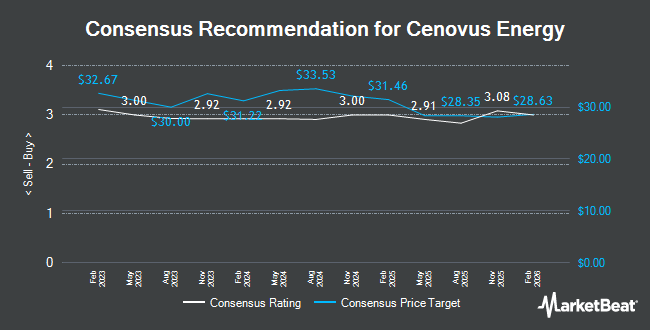

A number of other analysts also recently issued reports on the company. Jefferies Financial Group decreased their price target on Cenovus Energy from C$32.00 to C$30.00 in a report on Thursday, January 30th. JPMorgan Chase & Co. reduced their price target on shares of Cenovus Energy from C$34.00 to C$32.00 and set an "overweight" rating for the company in a research report on Friday, April 11th. Scotiabank upgraded shares of Cenovus Energy to a "strong-buy" rating in a research note on Wednesday, March 19th. National Bank Financial downgraded Cenovus Energy from a "strong-buy" rating to a "hold" rating in a report on Thursday, February 20th. Finally, CIBC dropped their price target on Cenovus Energy from C$32.00 to C$28.00 in a research note on Thursday, April 10th. Two analysts have rated the stock with a hold rating, eight have given a buy rating and one has given a strong buy rating to the company's stock. According to MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of C$28.35.

View Our Latest Stock Analysis on CVE

Cenovus Energy Trading Up 3.7 %

TSE CVE traded up C$0.59 during trading on Tuesday, hitting C$16.75. The stock had a trading volume of 8,123,353 shares, compared to its average volume of 6,160,118. The company has a quick ratio of 1.00, a current ratio of 1.59 and a debt-to-equity ratio of 33.59. The company has a market capitalization of C$30.51 billion, a PE ratio of 8.26, a PEG ratio of 0.09 and a beta of 2.63. The firm has a 50 day moving average price of C$18.92 and a 200 day moving average price of C$21.04. Cenovus Energy has a twelve month low of C$14.48 and a twelve month high of C$29.46.

Insiders Place Their Bets

In other Cenovus Energy news, Senior Officer Jeffery George Lawson purchased 10,000 shares of the firm's stock in a transaction that occurred on Friday, February 21st. The shares were purchased at an average cost of C$21.39 per share, for a total transaction of C$213,900.00. Also, Senior Officer Karamjit Singh Sandhar acquired 5,000 shares of the business's stock in a transaction on Wednesday, February 26th. The stock was acquired at an average price of C$20.05 per share, with a total value of C$100,250.00. In the last quarter, insiders bought 31,934 shares of company stock worth $619,586. 32.03% of the stock is owned by insiders.

Cenovus Energy Company Profile

(

Get Free Report)

Cenovus Energy is an integrated oil company, focused on creating value through the development of its oil sands assets. The company also engages in production of conventional crude oil, natural gas liquids, and natural gas in Alberta, Canada, with refining operations in the U.S. Net upstream production averaged 472 thousand barrels of oil equivalent per day in 2020, and the company estimates that it holds 6.7 billion boe of proven and probable reserves.

Recommended Stories

Before you consider Cenovus Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cenovus Energy wasn't on the list.

While Cenovus Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.