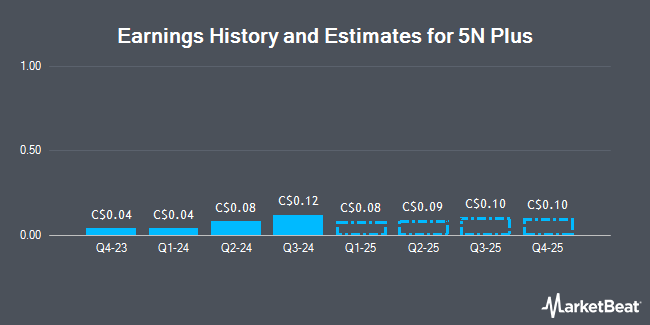

5N Plus Inc. (TSE:VNP - Free Report) - Stock analysts at Desjardins lifted their FY2024 earnings per share (EPS) estimates for shares of 5N Plus in a research report issued to clients and investors on Tuesday, November 5th. Desjardins analyst F. Tremblay now forecasts that the company will post earnings of $0.29 per share for the year, up from their previous forecast of $0.28. Desjardins has a "Buy" rating and a $8.50 price target on the stock. The consensus estimate for 5N Plus' current full-year earnings is $0.37 per share. Desjardins also issued estimates for 5N Plus' Q4 2024 earnings at $0.06 EPS.

5N Plus (TSE:VNP - Get Free Report) last announced its earnings results on Monday, August 5th. The company reported C$0.08 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of C$0.06 by C$0.02. 5N Plus had a net margin of 4.15% and a return on equity of 8.56%. The company had revenue of C$102.04 million during the quarter, compared to analysts' expectations of C$91.45 million.

Several other brokerages have also recently commented on VNP. Raymond James raised their target price on shares of 5N Plus from C$7.50 to C$8.50 in a report on Friday, September 6th. National Bankshares increased their price target on 5N Plus from C$8.00 to C$8.50 in a research report on Tuesday.

View Our Latest Report on 5N Plus

5N Plus Stock Performance

TSE:VNP traded down C$0.08 during mid-day trading on Thursday, reaching C$6.71. 361,700 shares of the company's stock were exchanged, compared to its average volume of 107,915. 5N Plus has a one year low of C$3.05 and a one year high of C$7.61. The company has a debt-to-equity ratio of 110.23, a quick ratio of 1.51 and a current ratio of 3.47. The business's fifty day simple moving average is C$6.93 and its two-hundred day simple moving average is C$6.16. The firm has a market capitalization of C$596.65 million, a PE ratio of 42.44, a price-to-earnings-growth ratio of 6,283.33 and a beta of 1.55.

Insiders Place Their Bets

In other news, Senior Officer Richard Perron bought 75,000 shares of the company's stock in a transaction dated Wednesday, September 11th. The stock was bought at an average cost of C$6.95 per share, for a total transaction of C$521,250.00. Corporate insiders own 4.91% of the company's stock.

About 5N Plus

(

Get Free Report)

5N Plus Inc produces and sells specialty metals and chemicals in North America, Europe, and Asia. It operates through two segments, Specialty Semiconductors and Performance Materials. The company offers semiconductor compounds, semiconductor wafers, metals, epitaxial semiconductor substrates, and solar cells.

See Also

Before you consider 5N Plus, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and 5N Plus wasn't on the list.

While 5N Plus currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.