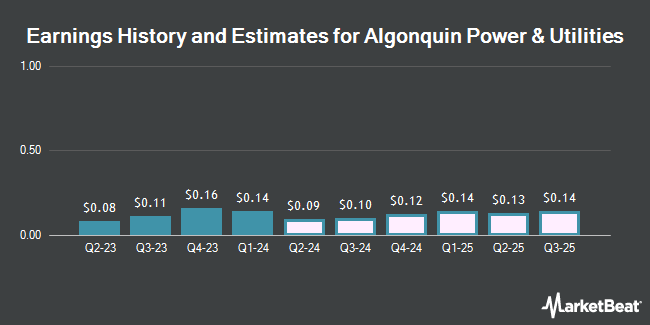

Algonquin Power & Utilities Corp. (NYSE:AQN - Free Report) - Equities researchers at Desjardins cut their Q3 2024 EPS estimates for shares of Algonquin Power & Utilities in a research note issued to investors on Tuesday, November 5th. Desjardins analyst B. Stadler now forecasts that the utilities provider will post earnings of $0.06 per share for the quarter, down from their prior forecast of $0.07. Desjardins currently has a "Hold" rating and a $5.25 price target on the stock. The consensus estimate for Algonquin Power & Utilities' current full-year earnings is $0.43 per share. Desjardins also issued estimates for Algonquin Power & Utilities' Q4 2024 earnings at $0.05 EPS, FY2025 earnings at $0.28 EPS and FY2026 earnings at $0.34 EPS.

A number of other analysts have also commented on AQN. Raymond James lowered shares of Algonquin Power & Utilities from an "outperform" rating to a "market perform" rating and decreased their price target for the company from $7.75 to $7.00 in a research note on Monday, August 12th. Janney Montgomery Scott started coverage on shares of Algonquin Power & Utilities in a report on Thursday, September 5th. They issued a "neutral" rating and a $6.00 target price on the stock. CIBC cut their price target on Algonquin Power & Utilities from $5.75 to $5.50 and set a "neutral" rating for the company in a research note on Tuesday, October 22nd. Wells Fargo & Company lowered their price objective on Algonquin Power & Utilities from $6.00 to $5.50 and set an "equal weight" rating for the company in a research note on Wednesday, October 16th. Finally, Scotiabank cut their target price on Algonquin Power & Utilities from $6.50 to $5.75 and set a "sector perform" rating on the stock in a research report on Tuesday, August 13th. One equities research analyst has rated the stock with a sell rating, nine have issued a hold rating, one has issued a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat.com, the company has an average rating of "Hold" and an average target price of $6.23.

View Our Latest Analysis on AQN

Algonquin Power & Utilities Stock Up 0.2 %

Shares of NYSE AQN traded up $0.01 during midday trading on Thursday, hitting $4.81. 8,644,958 shares of the stock traded hands, compared to its average volume of 5,647,511. The company has a debt-to-equity ratio of 1.08, a quick ratio of 0.78 and a current ratio of 0.97. Algonquin Power & Utilities has a one year low of $4.67 and a one year high of $6.79. The business has a 50 day moving average price of $5.21 and a two-hundred day moving average price of $5.76. The company has a market cap of $3.69 billion, a PE ratio of 29.94 and a beta of 0.68.

Algonquin Power & Utilities (NYSE:AQN - Get Free Report) last released its quarterly earnings data on Friday, August 9th. The utilities provider reported $0.09 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.08 by $0.01. The company had revenue of $598.60 million for the quarter, compared to analysts' expectations of $635.95 million. Algonquin Power & Utilities had a net margin of 4.70% and a return on equity of 5.36%. The business's revenue was down 4.7% on a year-over-year basis. During the same quarter in the prior year, the firm earned $0.08 EPS.

Algonquin Power & Utilities Cuts Dividend

The business also recently declared a quarterly dividend, which was paid on Tuesday, October 15th. Investors of record on Monday, September 30th were issued a $0.065 dividend. This represents a $0.26 dividend on an annualized basis and a dividend yield of 5.41%. The ex-dividend date of this dividend was Monday, September 30th. Algonquin Power & Utilities's dividend payout ratio (DPR) is currently 162.50%.

Institutional Trading of Algonquin Power & Utilities

A number of large investors have recently added to or reduced their stakes in AQN. The Manufacturers Life Insurance Company raised its stake in shares of Algonquin Power & Utilities by 320.6% in the second quarter. The Manufacturers Life Insurance Company now owns 7,273,228 shares of the utilities provider's stock valued at $42,633,000 after buying an additional 5,544,063 shares during the period. BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp raised its stake in Algonquin Power & Utilities by 156.0% in the 2nd quarter. BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp now owns 8,905,059 shares of the utilities provider's stock valued at $52,341,000 after acquiring an additional 5,426,523 shares during the period. Jane Street Group LLC lifted its holdings in Algonquin Power & Utilities by 851.0% during the first quarter. Jane Street Group LLC now owns 3,765,026 shares of the utilities provider's stock valued at $23,797,000 after purchasing an additional 3,369,124 shares during the last quarter. Private Management Group Inc. purchased a new stake in Algonquin Power & Utilities during the third quarter valued at about $12,361,000. Finally, Davidson Kempner Capital Management LP boosted its position in Algonquin Power & Utilities by 79.8% during the second quarter. Davidson Kempner Capital Management LP now owns 4,634,250 shares of the utilities provider's stock worth $27,157,000 after purchasing an additional 2,056,534 shares during the period. Hedge funds and other institutional investors own 62.28% of the company's stock.

About Algonquin Power & Utilities

(

Get Free Report)

Algonquin Power & Utilities Corp. operates in the power and utility industries in the United States, Canada, and other regions. The company operates in two segments, Regulated Services Group and Renewable Energy Group. The company primarily owns and operates a regulated electric, water distribution and wastewater collection, and natural gas utility systems and transmission operations.

Read More

Before you consider Algonquin Power & Utilities, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Algonquin Power & Utilities wasn't on the list.

While Algonquin Power & Utilities currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.