Destination Wealth Management trimmed its stake in Fortive Co. (NYSE:FTV - Free Report) by 31.5% in the third quarter, according to the company in its most recent disclosure with the SEC. The firm owned 326,388 shares of the technology company's stock after selling 150,143 shares during the quarter. Destination Wealth Management owned about 0.09% of Fortive worth $25,762,000 as of its most recent filing with the SEC.

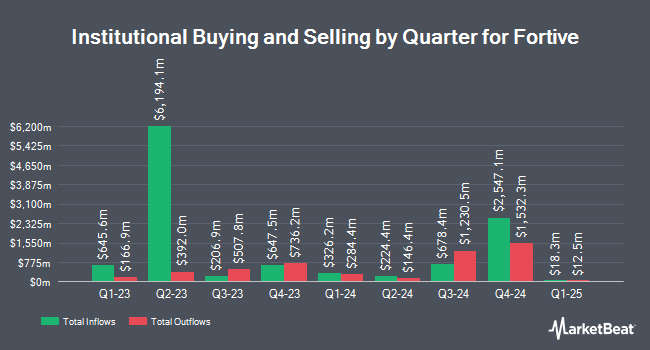

Other institutional investors and hedge funds have also recently bought and sold shares of the company. Raymond James & Associates lifted its stake in shares of Fortive by 15.0% in the 3rd quarter. Raymond James & Associates now owns 395,488 shares of the technology company's stock valued at $31,216,000 after purchasing an additional 51,690 shares in the last quarter. Atomi Financial Group Inc. lifted its position in Fortive by 4.8% during the third quarter. Atomi Financial Group Inc. now owns 4,932 shares of the technology company's stock valued at $389,000 after buying an additional 226 shares in the last quarter. Blue Trust Inc. grew its stake in Fortive by 111.3% during the second quarter. Blue Trust Inc. now owns 541 shares of the technology company's stock worth $40,000 after buying an additional 285 shares during the period. Versor Investments LP acquired a new stake in shares of Fortive in the second quarter worth $749,000. Finally, TD Asset Management Inc raised its stake in shares of Fortive by 3.6% in the 2nd quarter. TD Asset Management Inc now owns 864,924 shares of the technology company's stock valued at $64,091,000 after acquiring an additional 30,234 shares during the period. Institutional investors and hedge funds own 94.94% of the company's stock.

Insider Activity

In related news, CFO Charles E. Mclaughlin sold 6,864 shares of the firm's stock in a transaction that occurred on Friday, September 13th. The shares were sold at an average price of $74.03, for a total value of $508,141.92. Following the completion of the transaction, the chief financial officer now owns 73,391 shares of the company's stock, valued at approximately $5,433,135.73. This trade represents a 8.55 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, SVP Jonathan L. Schwarz sold 14,223 shares of the company's stock in a transaction on Friday, September 13th. The shares were sold at an average price of $73.80, for a total value of $1,049,657.40. Following the transaction, the senior vice president now directly owns 68,161 shares in the company, valued at $5,030,281.80. The trade was a 17.26 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 197,895 shares of company stock worth $14,261,051 over the last three months. Corporate insiders own 1.01% of the company's stock.

Fortive Stock Performance

FTV traded down $1.45 during trading on Thursday, reaching $76.83. 2,221,545 shares of the company were exchanged, compared to its average volume of 2,001,205. The firm has a 50 day moving average of $76.39 and a 200 day moving average of $74.34. The stock has a market cap of $26.66 billion, a P/E ratio of 30.55, a PEG ratio of 2.17 and a beta of 1.14. The company has a current ratio of 1.25, a quick ratio of 0.99 and a debt-to-equity ratio of 0.33. Fortive Co. has a 52 week low of $66.15 and a 52 week high of $87.10.

Fortive (NYSE:FTV - Get Free Report) last posted its earnings results on Wednesday, October 30th. The technology company reported $0.97 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.93 by $0.04. The firm had revenue of $1.53 billion during the quarter, compared to analyst estimates of $1.55 billion. Fortive had a net margin of 14.35% and a return on equity of 12.56%. Fortive's revenue was up 2.7% on a year-over-year basis. During the same period in the previous year, the business posted $0.85 EPS. On average, sell-side analysts forecast that Fortive Co. will post 3.85 EPS for the current fiscal year.

Fortive Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Friday, December 27th. Investors of record on Friday, November 29th will be issued a $0.08 dividend. This represents a $0.32 annualized dividend and a yield of 0.42%. The ex-dividend date of this dividend is Friday, November 29th. Fortive's payout ratio is currently 12.75%.

Analyst Upgrades and Downgrades

Several analysts recently issued reports on FTV shares. JPMorgan Chase & Co. upgraded Fortive from a "neutral" rating to an "overweight" rating and increased their price target for the company from $90.00 to $92.00 in a report on Thursday, October 10th. Morgan Stanley initiated coverage on Fortive in a report on Friday, September 6th. They set an "overweight" rating and a $89.00 target price on the stock. Citigroup cut Fortive from a "buy" rating to a "neutral" rating and decreased their price target for the stock from $92.00 to $86.00 in a report on Monday. Wolfe Research lowered shares of Fortive from an "outperform" rating to a "peer perform" rating in a research note on Friday, September 6th. Finally, Barclays decreased their target price on shares of Fortive from $98.00 to $95.00 and set an "overweight" rating for the company in a research note on Thursday, October 31st. Seven investment analysts have rated the stock with a hold rating and eight have given a buy rating to the company. Based on data from MarketBeat, the company currently has an average rating of "Moderate Buy" and an average target price of $86.73.

Get Our Latest Stock Report on Fortive

About Fortive

(

Free Report)

Fortive Corporation designs, develops, manufactures, and services professional and engineered products, software, and services in the United States, China, and internationally. It operates in three segments: Intelligent Operating Solutions, Precision Technologies, and Advanced Healthcare Solutions. The Intelligent Operating Solutions segment provides advanced instrumentation, software, and services, including electrical test and measurement, facility and asset lifecycle software applications, and connected worker safety and compliance solutions for manufacturing, process industries, healthcare, utilities and power, communications and electronics, and other industries.

See Also

Before you consider Fortive, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fortive wasn't on the list.

While Fortive currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.