Franklin Resources Inc. cut its position in Deutsche Bank Aktiengesellschaft (NYSE:DB - Free Report) by 17.2% during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 4,314,027 shares of the bank's stock after selling 893,621 shares during the quarter. Franklin Resources Inc.'s holdings in Deutsche Bank Aktiengesellschaft were worth $78,482,000 at the end of the most recent reporting period.

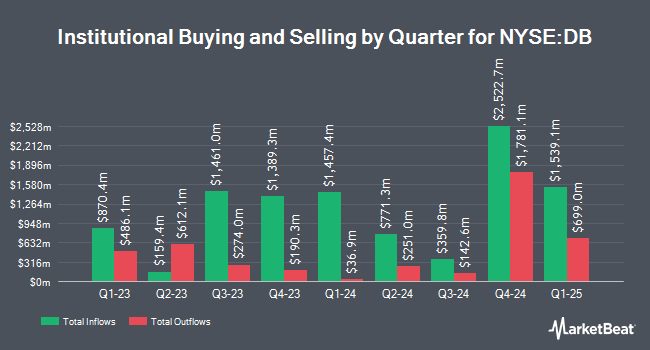

Several other institutional investors have also recently bought and sold shares of the company. Wilmington Savings Fund Society FSB bought a new position in Deutsche Bank Aktiengesellschaft in the 3rd quarter worth approximately $43,000. M&T Bank Corp increased its position in Deutsche Bank Aktiengesellschaft by 18.6% during the third quarter. M&T Bank Corp now owns 14,321 shares of the bank's stock worth $248,000 after acquiring an additional 2,241 shares during the period. Public Employees Retirement System of Ohio acquired a new position in Deutsche Bank Aktiengesellschaft during the 3rd quarter valued at $28,515,000. National Bank of Canada FI boosted its holdings in Deutsche Bank Aktiengesellschaft by 98.0% in the 3rd quarter. National Bank of Canada FI now owns 21,187 shares of the bank's stock valued at $366,000 after purchasing an additional 10,489 shares during the period. Finally, Wellington Management Group LLP grew its position in Deutsche Bank Aktiengesellschaft by 332.0% in the 3rd quarter. Wellington Management Group LLP now owns 2,194,855 shares of the bank's stock worth $37,964,000 after purchasing an additional 1,686,776 shares during the last quarter. Institutional investors own 27.90% of the company's stock.

Analysts Set New Price Targets

A number of brokerages have recently commented on DB. Barclays raised shares of Deutsche Bank Aktiengesellschaft from an "equal weight" rating to an "overweight" rating in a research report on Tuesday, September 3rd. StockNews.com cut Deutsche Bank Aktiengesellschaft from a "buy" rating to a "hold" rating in a report on Tuesday, December 10th. Three equities research analysts have rated the stock with a hold rating and two have issued a buy rating to the stock. According to data from MarketBeat, the company has an average rating of "Hold".

Check Out Our Latest Stock Analysis on DB

Deutsche Bank Aktiengesellschaft Price Performance

Shares of DB stock traded down $0.36 during mid-day trading on Tuesday, reaching $17.61. The company's stock had a trading volume of 1,089,780 shares, compared to its average volume of 2,279,704. The firm's 50-day moving average is $17.19 and its two-hundred day moving average is $16.50. The company has a market cap of $36.40 billion, a P/E ratio of 9.06 and a beta of 1.21. Deutsche Bank Aktiengesellschaft has a 1-year low of $12.43 and a 1-year high of $18.07. The company has a debt-to-equity ratio of 1.47, a quick ratio of 0.78 and a current ratio of 0.78.

Deutsche Bank Aktiengesellschaft Company Profile

(

Free Report)

Deutsche Bank Aktiengesellschaft, a stock corporation, provides corporate and investment banking, and asset management products and services to private individuals, corporate entities, and institutional clients in Germany, the United Kingdom, rest of Europe, the Middle East, Africa, the Americas, and the Asia-Pacific.

Featured Articles

Before you consider Deutsche Bank Aktiengesellschaft, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Deutsche Bank Aktiengesellschaft wasn't on the list.

While Deutsche Bank Aktiengesellschaft currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.