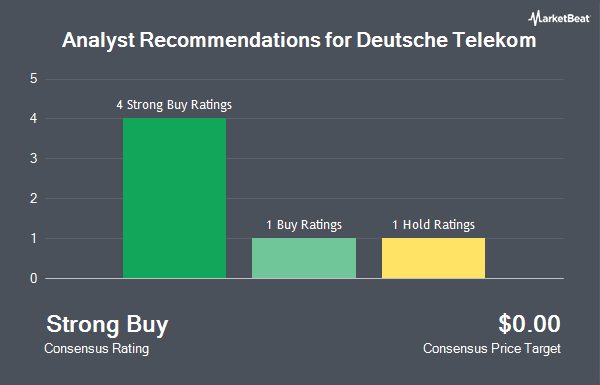

Deutsche Telekom AG (OTCMKTS:DTEGY - Get Free Report) has been given an average recommendation of "Strong Buy" by the five brokerages that are presently covering the stock, Marketbeat.com reports. One research analyst has rated the stock with a hold rating and four have given a strong buy rating to the company.

Several equities research analysts have commented on DTEGY shares. UBS Group upgraded shares of Deutsche Telekom from a "hold" rating to a "strong-buy" rating in a research note on Thursday, January 9th. Barclays upgraded shares of Deutsche Telekom to a "strong-buy" rating in a research report on Monday, November 18th. Finally, Hsbc Global Res lowered shares of Deutsche Telekom from a "strong-buy" rating to a "hold" rating in a research report on Wednesday, March 5th.

Get Our Latest Stock Report on DTEGY

Deutsche Telekom Stock Down 2.2 %

Shares of OTCMKTS:DTEGY traded down $0.82 during mid-day trading on Friday, hitting $36.42. 990,815 shares of the company traded hands, compared to its average volume of 1,310,768. The stock has a 50-day moving average price of $33.44 and a two-hundred day moving average price of $31.24. Deutsche Telekom has a 12-month low of $22.03 and a 12-month high of $37.74. The stock has a market cap of $181.61 billion, a P/E ratio of 14.93, a P/E/G ratio of 1.35 and a beta of 0.77. The company has a current ratio of 1.15, a quick ratio of 1.08 and a debt-to-equity ratio of 1.04.

Deutsche Telekom (OTCMKTS:DTEGY - Get Free Report) last posted its quarterly earnings data on Wednesday, February 26th. The utilities provider reported $0.51 earnings per share (EPS) for the quarter. Deutsche Telekom had a net margin of 5.36% and a return on equity of 7.65%. The firm had revenue of $33 billion for the quarter. On average, equities research analysts forecast that Deutsche Telekom will post 1.86 earnings per share for the current year.

About Deutsche Telekom

(

Get Free ReportDeutsche Telekom AG, together with its subsidiaries, provides integrated telecommunication services. The company operates through Germany, United States, Europe, Systems Solutions, Group Development, and Group Headquarters and Group Services segments. It offers fixed-network services, including voice and data communication services based on fixed-network and broadband technology; and sells terminal equipment and other hardware products, as well as services to resellers.

See Also

Before you consider Deutsche Telekom, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Deutsche Telekom wasn't on the list.

While Deutsche Telekom currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.