WCM Investment Management LLC increased its stake in shares of Devon Energy Co. (NYSE:DVN - Free Report) by 130.9% in the fourth quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 44,999 shares of the energy company's stock after buying an additional 25,511 shares during the quarter. WCM Investment Management LLC's holdings in Devon Energy were worth $1,439,000 at the end of the most recent quarter.

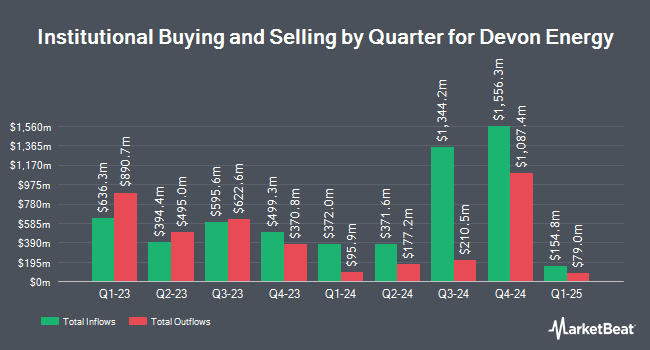

Other institutional investors have also recently added to or reduced their stakes in the company. Thompson Investment Management Inc. grew its stake in shares of Devon Energy by 60.0% in the fourth quarter. Thompson Investment Management Inc. now owns 1,600 shares of the energy company's stock worth $52,000 after purchasing an additional 600 shares in the last quarter. Empirical Finance LLC grew its stake in shares of Devon Energy by 61.5% in the fourth quarter. Empirical Finance LLC now owns 33,267 shares of the energy company's stock worth $1,089,000 after purchasing an additional 12,665 shares in the last quarter. Cidel Asset Management Inc. grew its stake in shares of Devon Energy by 24.4% in the fourth quarter. Cidel Asset Management Inc. now owns 7,184 shares of the energy company's stock worth $235,000 after purchasing an additional 1,410 shares in the last quarter. Sumitomo Mitsui DS Asset Management Company Ltd grew its stake in shares of Devon Energy by 51.4% in the fourth quarter. Sumitomo Mitsui DS Asset Management Company Ltd now owns 120,741 shares of the energy company's stock worth $3,952,000 after purchasing an additional 40,988 shares in the last quarter. Finally, Tandem Financial LLC bought a new position in shares of Devon Energy in the fourth quarter worth $117,000. 69.72% of the stock is currently owned by institutional investors.

Analyst Ratings Changes

Several research analysts have recently issued reports on the company. StockNews.com raised Devon Energy from a "sell" rating to a "hold" rating in a research note on Friday, January 3rd. Sanford C. Bernstein raised Devon Energy from a "market perform" rating to an "outperform" rating and set a $45.00 price target for the company in a research note on Wednesday, January 15th. Wolfe Research raised Devon Energy from a "peer perform" rating to an "outperform" rating and set a $45.00 target price for the company in a research note on Friday, January 3rd. Susquehanna decreased their target price on Devon Energy from $63.00 to $62.00 and set a "positive" rating for the company in a research note on Friday, October 18th. Finally, Benchmark raised Devon Energy from a "hold" rating to a "buy" rating and set a $44.00 target price for the company in a research note on Tuesday, January 14th. Nine analysts have rated the stock with a hold rating and fourteen have given a buy rating to the company. According to MarketBeat.com, Devon Energy has an average rating of "Moderate Buy" and an average price target of $49.45.

View Our Latest Stock Analysis on Devon Energy

Devon Energy Stock Up 1.3 %

Devon Energy stock traded up $0.46 during mid-day trading on Friday, hitting $34.68. The company's stock had a trading volume of 9,066,227 shares, compared to its average volume of 9,265,842. The firm's 50 day moving average is $34.27 and its 200 day moving average is $38.65. The company has a market cap of $22.78 billion, a PE ratio of 6.43, a price-to-earnings-growth ratio of 1.04 and a beta of 1.98. The company has a debt-to-equity ratio of 0.61, a current ratio of 1.11 and a quick ratio of 1.01. Devon Energy Co. has a 52-week low of $30.39 and a 52-week high of $55.09.

About Devon Energy

(

Free Report)

Devon Energy Corporation, an independent energy company, engages in the exploration, development, and production of oil, natural gas, and natural gas liquids in the United States. It operates in Delaware, Eagle Ford, Anadarko, Williston, and Powder River Basins. The company was founded in 1971 and is headquartered in Oklahoma City, Oklahoma.

See Also

Before you consider Devon Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Devon Energy wasn't on the list.

While Devon Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.