Charles Schwab Investment Management Inc. lifted its stake in DexCom, Inc. (NASDAQ:DXCM - Free Report) by 11.8% during the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 2,734,155 shares of the medical device company's stock after acquiring an additional 288,381 shares during the period. Charles Schwab Investment Management Inc. owned approximately 0.70% of DexCom worth $183,298,000 at the end of the most recent reporting period.

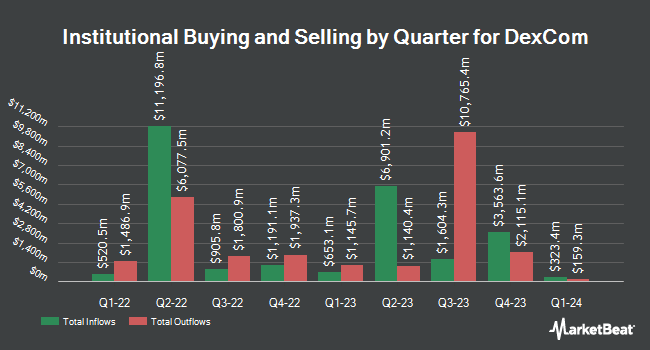

A number of other institutional investors and hedge funds have also bought and sold shares of DXCM. Migdal Insurance & Financial Holdings Ltd. acquired a new position in shares of DexCom during the second quarter valued at about $25,000. Sachetta LLC increased its position in shares of DexCom by 255.2% during the second quarter. Sachetta LLC now owns 238 shares of the medical device company's stock valued at $27,000 after purchasing an additional 171 shares during the period. DT Investment Partners LLC raised its stake in shares of DexCom by 492.2% in the second quarter. DT Investment Partners LLC now owns 379 shares of the medical device company's stock valued at $43,000 after purchasing an additional 315 shares in the last quarter. Riverview Trust Co raised its stake in shares of DexCom by 100.4% in the third quarter. Riverview Trust Co now owns 463 shares of the medical device company's stock valued at $31,000 after purchasing an additional 232 shares in the last quarter. Finally, ORG Partners LLC lifted its position in DexCom by 1,992.0% in the second quarter. ORG Partners LLC now owns 523 shares of the medical device company's stock worth $59,000 after purchasing an additional 498 shares during the period. Institutional investors own 97.75% of the company's stock.

Wall Street Analysts Forecast Growth

Several research analysts recently issued reports on DXCM shares. Oppenheimer dropped their price target on shares of DexCom from $115.00 to $105.00 and set an "outperform" rating for the company in a research report on Friday, October 25th. Barclays cut their target price on DexCom from $138.00 to $113.00 and set an "equal weight" rating for the company in a research report on Monday, July 29th. Raymond James dropped their price objective on DexCom from $115.00 to $99.00 and set a "strong-buy" rating for the company in a research note on Friday, October 25th. Sanford C. Bernstein boosted their target price on shares of DexCom from $82.00 to $86.00 and gave the company an "outperform" rating in a research note on Friday, October 25th. Finally, StockNews.com cut shares of DexCom from a "buy" rating to a "hold" rating in a research report on Saturday, November 2nd. Seven analysts have rated the stock with a hold rating, eleven have issued a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat, the company currently has an average rating of "Moderate Buy" and an average target price of $104.59.

View Our Latest Stock Report on DXCM

Insiders Place Their Bets

In other DexCom news, EVP Sadie Stern sold 4,259 shares of the firm's stock in a transaction that occurred on Wednesday, November 20th. The shares were sold at an average price of $74.73, for a total transaction of $318,275.07. Following the sale, the executive vice president now directly owns 71,192 shares in the company, valued at approximately $5,320,178.16. This trade represents a 5.64 % decrease in their position. The sale was disclosed in a filing with the SEC, which is accessible through this link. Also, COO Jacob Steven Leach sold 746 shares of the company's stock in a transaction that occurred on Monday, September 9th. The shares were sold at an average price of $69.15, for a total transaction of $51,585.90. Following the completion of the transaction, the chief operating officer now owns 264,915 shares of the company's stock, valued at $18,318,872.25. This trade represents a 0.28 % decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders have sold 5,431 shares of company stock worth $399,319. Company insiders own 0.30% of the company's stock.

DexCom Trading Down 2.2 %

Shares of DexCom stock traded down $1.63 during trading on Friday, reaching $72.83. 4,562,893 shares of the company were exchanged, compared to its average volume of 4,662,581. The business has a 50-day moving average price of $70.61 and a 200-day moving average price of $89.55. The firm has a market capitalization of $28.45 billion, a price-to-earnings ratio of 43.61, a P/E/G ratio of 2.28 and a beta of 1.17. The company has a quick ratio of 2.12, a current ratio of 2.46 and a debt-to-equity ratio of 1.23. DexCom, Inc. has a twelve month low of $62.34 and a twelve month high of $142.00.

DexCom Profile

(

Free Report)

DexCom, Inc, a medical device company, focuses on the design, development, and commercialization of continuous glucose monitoring (CGM) systems in the United States and internationally. The company provides its systems for use by people with diabetes, as well as for use by healthcare providers. Its products include Dexcom G6 and Dexcom G7, integrated CGM systems for diabetes management; Dexcom Share, a remote monitoring system; Dexcom Real-Time API, which enables authorized third-party software developers to integrate real-time CGM data into their digital health apps and devices; and Dexcom ONE, that is designed to replace finger stick blood glucose testing for diabetes treatment decisions.

Read More

Before you consider DexCom, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DexCom wasn't on the list.

While DexCom currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.