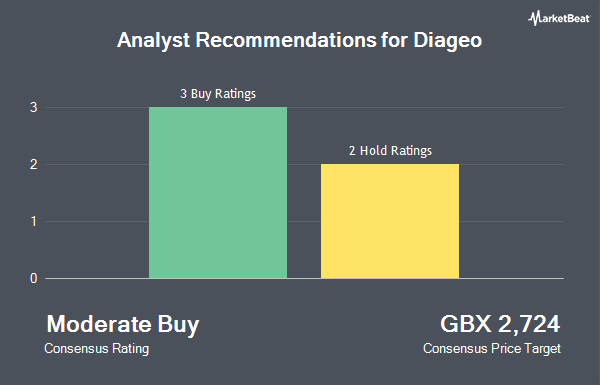

Diageo plc (LON:DGE - Get Free Report) has been assigned a consensus rating of "Hold" from the six brokerages that are covering the firm, Marketbeat.com reports. One equities research analyst has rated the stock with a sell recommendation, three have given a hold recommendation and two have issued a buy recommendation on the company. The average 1 year price objective among analysts that have covered the stock in the last year is GBX 3,008 ($37.91).

DGE has been the topic of several recent analyst reports. JPMorgan Chase & Co. reaffirmed a "neutral" rating and issued a GBX 3,200 ($40.33) price target on shares of Diageo in a research note on Thursday, August 22nd. Citigroup reiterated a "buy" rating and set a GBX 3,000 ($37.81) price target on shares of Diageo in a research report on Monday, July 29th. Finally, Royal Bank of Canada upgraded shares of Diageo to a "sector perform" rating and upped their price objective for the stock from GBX 2,100 ($26.47) to GBX 2,400 ($30.25) in a report on Monday, August 12th.

View Our Latest Stock Report on Diageo

Diageo Trading Down 0.9 %

Shares of DGE stock traded down GBX 21 ($0.26) on Friday, hitting GBX 2,344.50 ($29.55). 2,814,392 shares of the stock traded hands, compared to its average volume of 7,899,513. The company has a debt-to-equity ratio of 186.26, a quick ratio of 0.62 and a current ratio of 1.53. Diageo has a twelve month low of GBX 2,165.60 ($27.29) and a twelve month high of GBX 3,056 ($38.51). The firm's 50-day moving average price is GBX 2,505.82 and its two-hundred day moving average price is GBX 2,556.04. The stock has a market capitalization of £52.05 billion, a PE ratio of 1,776.14, a PEG ratio of 1.75 and a beta of 0.36.

Insider Activity

In other news, insider Javier Ferrán purchased 352 shares of the business's stock in a transaction on Monday, November 11th. The shares were bought at an average price of GBX 2,350 ($29.62) per share, with a total value of £8,272 ($10,424.70). In the last quarter, insiders purchased 1,015 shares of company stock worth $2,475,760. Corporate insiders own 0.11% of the company's stock.

Diageo Company Profile

(

Get Free ReportDiageo plc, together with its subsidiaries, engages in the production, marketing, and sale of alcoholic beverages. It offers scotch, gin, vodka, rum, raki, liqueur, wine, tequila, Chinese white spirits, cachaça, and brandy, as well as beer, including cider and flavoured malt beverages. The company also provides Canadian, Irish, American, and Indian-Made Foreign Liquor whiskies, as well as ready to drink and non-alcoholic products.

Recommended Stories

Before you consider Diageo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Diageo wasn't on the list.

While Diageo currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.