Huntington National Bank lowered its position in Diageo plc (NYSE:DEO - Free Report) by 34.1% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The firm owned 9,811 shares of the company's stock after selling 5,085 shares during the quarter. Huntington National Bank's holdings in Diageo were worth $1,377,000 as of its most recent SEC filing.

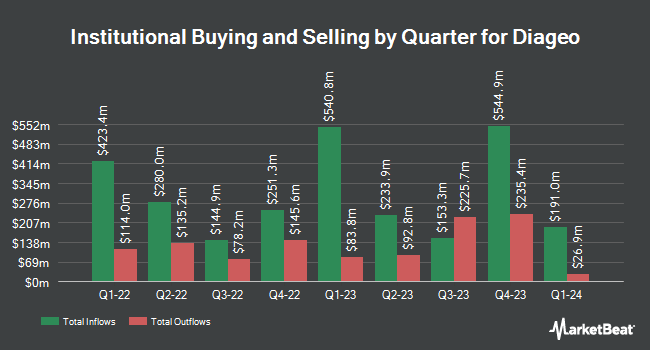

Several other institutional investors also recently modified their holdings of the company. Cable Hill Partners LLC boosted its position in shares of Diageo by 17.7% during the 3rd quarter. Cable Hill Partners LLC now owns 3,111 shares of the company's stock valued at $444,000 after acquiring an additional 467 shares in the last quarter. Schrum Private Wealth Management LLC boosted its holdings in Diageo by 79.4% during the third quarter. Schrum Private Wealth Management LLC now owns 3,492 shares of the company's stock valued at $490,000 after purchasing an additional 1,546 shares in the last quarter. Addison Advisors LLC grew its stake in shares of Diageo by 108.2% in the 3rd quarter. Addison Advisors LLC now owns 406 shares of the company's stock valued at $57,000 after purchasing an additional 211 shares during the period. Catalytic Wealth RIA LLC grew its stake in shares of Diageo by 25.2% in the 3rd quarter. Catalytic Wealth RIA LLC now owns 5,793 shares of the company's stock valued at $813,000 after purchasing an additional 1,166 shares during the period. Finally, Chartwell Investment Partners LLC lifted its position in shares of Diageo by 4.8% during the 3rd quarter. Chartwell Investment Partners LLC now owns 32,138 shares of the company's stock worth $4,510,000 after buying an additional 1,481 shares during the period. Institutional investors and hedge funds own 8.97% of the company's stock.

Diageo Stock Performance

DEO stock traded down $1.69 during midday trading on Friday, reaching $118.16. 725,045 shares of the company's stock traded hands, compared to its average volume of 757,479. The company has a current ratio of 1.53, a quick ratio of 0.55 and a debt-to-equity ratio of 1.62. The company has a 50-day simple moving average of $131.57 and a two-hundred day simple moving average of $131.80. Diageo plc has a 1-year low of $117.84 and a 1-year high of $154.71.

Wall Street Analysts Forecast Growth

A number of brokerages have weighed in on DEO. Bank of America upgraded Diageo from a "neutral" rating to a "buy" rating in a research report on Thursday, September 12th. Royal Bank of Canada upgraded shares of Diageo from an "underperform" rating to a "sector perform" rating in a research report on Monday, August 12th. Three research analysts have rated the stock with a sell rating, three have given a hold rating and two have issued a buy rating to the company. Based on data from MarketBeat, Diageo presently has a consensus rating of "Hold".

View Our Latest Research Report on Diageo

Diageo Profile

(

Free Report)

Diageo plc, together with its subsidiaries, engages in the production, marketing, and sale of alcoholic beverages. The company offers scotch, gin, vodka, rum, raki, liqueur, wine, tequila, Chinese white spirits, cachaça, and brandy, as well as beer, including cider and flavored malt beverages. It also provides Chinese, Canadian, Irish, American, and Indian-Made Foreign Liquor whiskies, as well as flavored malt beverages, ready to drink, and non-alcoholic products.

See Also

Before you consider Diageo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Diageo wasn't on the list.

While Diageo currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.