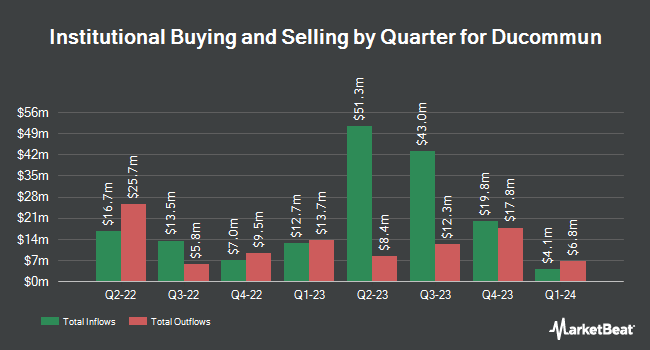

Diamond Hill Capital Management Inc. lifted its position in shares of Ducommun Incorporated (NYSE:DCO - Free Report) by 24.2% during the fourth quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 161,985 shares of the aerospace company's stock after purchasing an additional 31,601 shares during the quarter. Diamond Hill Capital Management Inc. owned 1.10% of Ducommun worth $10,312,000 at the end of the most recent reporting period.

A number of other hedge funds and other institutional investors also recently made changes to their positions in the company. Victory Capital Management Inc. raised its holdings in shares of Ducommun by 1.6% during the third quarter. Victory Capital Management Inc. now owns 18,900 shares of the aerospace company's stock worth $1,244,000 after acquiring an additional 300 shares during the period. Pathstone Holdings LLC raised its holdings in shares of Ducommun by 1.1% during the third quarter. Pathstone Holdings LLC now owns 28,375 shares of the aerospace company's stock worth $1,868,000 after acquiring an additional 319 shares during the period. Connor Clark & Lunn Investment Management Ltd. increased its stake in Ducommun by 24.2% in the 3rd quarter. Connor Clark & Lunn Investment Management Ltd. now owns 46,908 shares of the aerospace company's stock valued at $3,088,000 after buying an additional 9,142 shares during the last quarter. Advisors Asset Management Inc. increased its stake in Ducommun by 57.0% in the 3rd quarter. Advisors Asset Management Inc. now owns 12,972 shares of the aerospace company's stock valued at $854,000 after buying an additional 4,710 shares during the last quarter. Finally, Algert Global LLC increased its stake in Ducommun by 6.0% in the 3rd quarter. Algert Global LLC now owns 22,642 shares of the aerospace company's stock valued at $1,491,000 after buying an additional 1,287 shares during the last quarter. 92.15% of the stock is owned by institutional investors.

Analyst Upgrades and Downgrades

DCO has been the topic of several recent research reports. StockNews.com lowered shares of Ducommun from a "strong-buy" rating to a "buy" rating in a research note on Friday, February 28th. Truist Financial lifted their price target on shares of Ducommun from $80.00 to $82.00 and gave the company a "buy" rating in a research note on Tuesday, January 14th. Finally, Royal Bank of Canada started coverage on shares of Ducommun in a research note on Tuesday, December 31st. They issued an "outperform" rating and a $72.00 price target on the stock.

Get Our Latest Stock Report on DCO

Ducommun Stock Performance

Shares of Ducommun stock traded up $0.23 during trading on Wednesday, hitting $59.77. 82,411 shares of the stock were exchanged, compared to its average volume of 78,502. The stock has a market capitalization of $885.37 million, a price-to-earnings ratio of 30.04 and a beta of 1.56. The company has a fifty day moving average price of $63.88 and a 200-day moving average price of $64.07. Ducommun Incorporated has a 1-year low of $48.21 and a 1-year high of $70.50. The company has a current ratio of 3.21, a quick ratio of 2.16 and a debt-to-equity ratio of 0.37.

About Ducommun

(

Free Report)

Ducommun Incorporated provides engineering and manufacturing services for products and applications used primarily in the aerospace and defense, industrial, medical, and other industries in the United States. The company operates through two segments, Electronic Systems and Structural Systems. The Electronic Systems segment provides cable assemblies and interconnect systems; printed circuit board assemblies; electronic, electromechanical, and mechanical components and assemblies, as well as lightning diversion systems; and radar enclosures, aircraft avionics racks, shipboard communications and control enclosures, printed circuit board assemblies, cable assemblies, wire harnesses, interconnect systems, lightning diversion strips, surge suppressors, conformal shields, and other assemblies.

Read More

Before you consider Ducommun, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ducommun wasn't on the list.

While Ducommun currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.