Diamond Hill Capital Management Inc. reduced its stake in SBA Communications Co. (NASDAQ:SBAC - Free Report) by 12.9% during the 3rd quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 1,719,037 shares of the technology company's stock after selling 254,830 shares during the quarter. SBA Communications comprises approximately 1.7% of Diamond Hill Capital Management Inc.'s portfolio, making the stock its 22nd biggest holding. Diamond Hill Capital Management Inc. owned approximately 1.60% of SBA Communications worth $413,772,000 as of its most recent filing with the Securities & Exchange Commission.

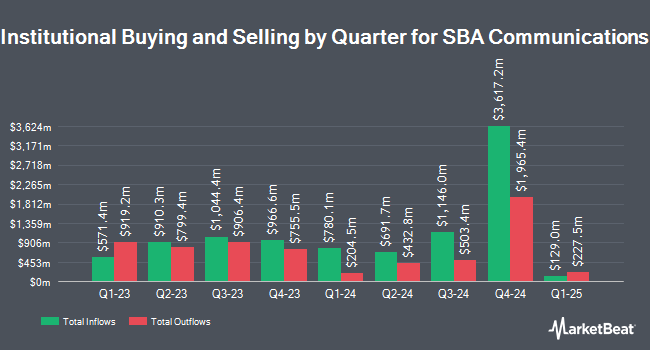

Several other hedge funds and other institutional investors have also recently bought and sold shares of the company. Thurston Springer Miller Herd & Titak Inc. increased its holdings in SBA Communications by 10.7% in the third quarter. Thurston Springer Miller Herd & Titak Inc. now owns 527 shares of the technology company's stock valued at $127,000 after buying an additional 51 shares during the last quarter. Oregon Public Employees Retirement Fund raised its position in SBA Communications by 0.6% in the second quarter. Oregon Public Employees Retirement Fund now owns 9,265 shares of the technology company's stock worth $1,819,000 after acquiring an additional 53 shares in the last quarter. Farther Finance Advisors LLC boosted its holdings in SBA Communications by 32.5% during the third quarter. Farther Finance Advisors LLC now owns 216 shares of the technology company's stock worth $52,000 after buying an additional 53 shares in the last quarter. Checchi Capital Advisers LLC lifted its holdings in shares of SBA Communications by 4.1% during the second quarter. Checchi Capital Advisers LLC now owns 1,457 shares of the technology company's stock valued at $286,000 after purchasing an additional 57 shares during the last quarter. Finally, Industrial Alliance Investment Management Inc. raised its holdings in shares of SBA Communications by 3.9% during the first quarter. Industrial Alliance Investment Management Inc. now owns 1,560 shares of the technology company's stock valued at $338,000 after acquiring an additional 58 shares during the period. 97.35% of the stock is owned by hedge funds and other institutional investors.

Insider Activity at SBA Communications

In other SBA Communications news, EVP Donald Day sold 1,500 shares of the company's stock in a transaction that occurred on Friday, September 13th. The shares were sold at an average price of $242.86, for a total transaction of $364,290.00. Following the completion of the sale, the executive vice president now directly owns 4,998 shares of the company's stock, valued at approximately $1,213,814.28. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. In other news, EVP Donald Day sold 1,500 shares of the firm's stock in a transaction dated Friday, September 13th. The stock was sold at an average price of $242.86, for a total value of $364,290.00. Following the transaction, the executive vice president now owns 4,998 shares of the company's stock, valued at $1,213,814.28. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, Director George R. Krouse, Jr. sold 325 shares of the business's stock in a transaction that occurred on Wednesday, August 21st. The shares were sold at an average price of $219.58, for a total value of $71,363.50. Following the transaction, the director now owns 8,084 shares of the company's stock, valued at approximately $1,775,084.72. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 1.30% of the stock is owned by company insiders.

Analysts Set New Price Targets

Several brokerages recently commented on SBAC. KeyCorp boosted their price target on SBA Communications from $230.00 to $280.00 and gave the company an "overweight" rating in a research note on Monday, October 14th. Morgan Stanley lifted their target price on shares of SBA Communications from $232.00 to $252.00 and gave the company an "overweight" rating in a research note on Wednesday, September 18th. TD Cowen lifted their price target on shares of SBA Communications from $251.00 to $261.00 and gave the stock a "buy" rating in a research report on Tuesday, October 29th. JPMorgan Chase & Co. increased their price target on SBA Communications from $228.00 to $250.00 and gave the stock a "neutral" rating in a report on Monday, September 23rd. Finally, Deutsche Bank Aktiengesellschaft upped their target price on SBA Communications from $230.00 to $240.00 and gave the stock a "buy" rating in a report on Wednesday, August 14th. Three research analysts have rated the stock with a hold rating, ten have given a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat.com, SBA Communications currently has an average rating of "Moderate Buy" and an average target price of $257.23.

View Our Latest Stock Report on SBA Communications

SBA Communications Price Performance

SBA Communications stock traded down $2.48 during trading hours on Monday, reaching $221.44. The stock had a trading volume of 414,822 shares, compared to its average volume of 924,559. The company has a fifty day simple moving average of $237.64 and a 200-day simple moving average of $215.67. The stock has a market cap of $23.81 billion, a PE ratio of 35.32, a PEG ratio of 0.76 and a beta of 0.68. SBA Communications Co. has a 52 week low of $183.64 and a 52 week high of $258.76.

SBA Communications (NASDAQ:SBAC - Get Free Report) last posted its quarterly earnings results on Monday, October 28th. The technology company reported $2.40 earnings per share for the quarter, missing the consensus estimate of $3.17 by ($0.77). The company had revenue of $667.60 million during the quarter, compared to analysts' expectations of $669.29 million. SBA Communications had a negative return on equity of 13.13% and a net margin of 25.76%. The business's quarterly revenue was down 2.2% on a year-over-year basis. During the same quarter in the previous year, the company earned $3.34 EPS. Research analysts predict that SBA Communications Co. will post 12.56 earnings per share for the current fiscal year.

SBA Communications Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Thursday, December 12th. Investors of record on Thursday, November 14th will be issued a $0.98 dividend. This represents a $3.92 annualized dividend and a dividend yield of 1.77%. The ex-dividend date of this dividend is Thursday, November 14th. SBA Communications's payout ratio is currently 61.83%.

SBA Communications Company Profile

(

Free Report)

SBA Communications Corporation is a leading independent owner and operator of wireless communications infrastructure including towers, buildings, rooftops, distributed antenna systems (DAS) and small cells. With a portfolio of more than 39,000 communications sites throughout the Americas, Africa and in Asia, SBA is listed on NASDAQ under the symbol SBAC.

Featured Stories

Before you consider SBA Communications, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SBA Communications wasn't on the list.

While SBA Communications currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.