Diamond Hill Capital Management Inc. trimmed its stake in Enstar Group Limited (NASDAQ:ESGR - Free Report) by 3.4% in the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 107,457 shares of the insurance provider's stock after selling 3,730 shares during the quarter. Diamond Hill Capital Management Inc. owned 0.71% of Enstar Group worth $34,557,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

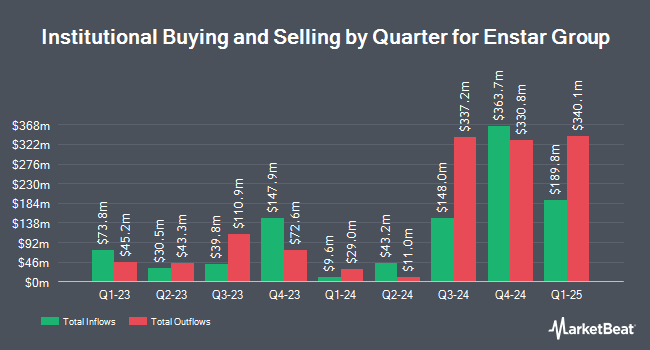

Several other hedge funds and other institutional investors have also recently added to or reduced their stakes in the business. Daiwa Securities Group Inc. raised its position in Enstar Group by 0.5% during the second quarter. Daiwa Securities Group Inc. now owns 6,958 shares of the insurance provider's stock valued at $2,127,000 after acquiring an additional 38 shares in the last quarter. CWM LLC raised its position in shares of Enstar Group by 22.0% in the third quarter. CWM LLC now owns 227 shares of the insurance provider's stock valued at $73,000 after purchasing an additional 41 shares during the period. US Bancorp DE lifted its stake in shares of Enstar Group by 40.7% in the third quarter. US Bancorp DE now owns 211 shares of the insurance provider's stock worth $68,000 after buying an additional 61 shares during the last quarter. Arizona State Retirement System lifted its stake in shares of Enstar Group by 1.9% in the second quarter. Arizona State Retirement System now owns 3,404 shares of the insurance provider's stock worth $1,041,000 after buying an additional 63 shares during the last quarter. Finally, Wealth Enhancement Advisory Services LLC lifted its stake in shares of Enstar Group by 3.9% in the second quarter. Wealth Enhancement Advisory Services LLC now owns 1,721 shares of the insurance provider's stock worth $526,000 after buying an additional 65 shares during the last quarter. Institutional investors own 81.01% of the company's stock.

Analysts Set New Price Targets

Separately, StockNews.com initiated coverage on shares of Enstar Group in a research note on Monday, November 4th. They issued a "hold" rating for the company.

Read Our Latest Report on ESGR

Enstar Group Stock Performance

Shares of Enstar Group stock traded down $0.16 on Monday, reaching $324.84. The stock had a trading volume of 14,376 shares, compared to its average volume of 74,643. The business's 50-day moving average price is $322.05 and its two-hundred day moving average price is $317.34. The company has a debt-to-equity ratio of 0.34, a quick ratio of 0.31 and a current ratio of 0.31. Enstar Group Limited has a fifty-two week low of $249.24 and a fifty-two week high of $348.48. The stock has a market cap of $4.95 billion, a P/E ratio of 5.54 and a beta of 0.65.

Enstar Group Company Profile

(

Free Report)

Enstar Group Limited acquires and manages insurance and reinsurance companies and portfolios in run-off in Bermuda and internationally. It engages in the run-off property and casualty; other reinsurance; life and catastrophe; and legacy underwriting businesses; as well as investment activities. The company also provides consulting services, including claims inspection, claims validation, reinsurance asset collection, syndicate management, and IT consulting services to the insurance and reinsurance industry.

See Also

Before you consider Enstar Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enstar Group wasn't on the list.

While Enstar Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.