Research analysts at TD Cowen assumed coverage on shares of Dianthus Therapeutics (NASDAQ:DNTH - Get Free Report) in a note issued to investors on Friday, Marketbeat Ratings reports. The brokerage set a "buy" rating on the stock.

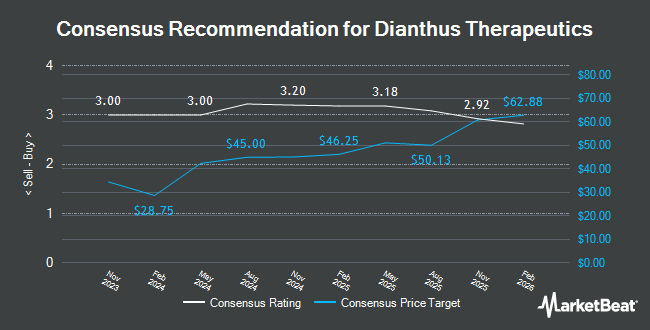

DNTH has been the subject of several other research reports. Raymond James raised shares of Dianthus Therapeutics to a "moderate buy" rating in a report on Thursday, December 12th. HC Wainwright reaffirmed a "buy" rating and set a $40.00 price target on shares of Dianthus Therapeutics in a research report on Monday, November 11th. Finally, Oppenheimer lifted their price objective on Dianthus Therapeutics from $48.00 to $52.00 and gave the company an "outperform" rating in a report on Monday, November 11th. Eight equities research analysts have rated the stock with a buy rating and two have issued a strong buy rating to the company's stock. According to MarketBeat, Dianthus Therapeutics has an average rating of "Buy" and an average target price of $46.43.

Get Our Latest Stock Analysis on DNTH

Dianthus Therapeutics Stock Performance

NASDAQ:DNTH traded up $0.76 during mid-day trading on Friday, hitting $23.80. The company had a trading volume of 389,926 shares, compared to its average volume of 205,798. Dianthus Therapeutics has a fifty-two week low of $7.75 and a fifty-two week high of $33.77. The firm has a market cap of $704.41 million, a P/E ratio of -9.52 and a beta of 1.74. The business's fifty day moving average is $25.77 and its two-hundred day moving average is $26.60.

Dianthus Therapeutics (NASDAQ:DNTH - Get Free Report) last released its quarterly earnings data on Thursday, November 7th. The company reported ($0.74) earnings per share for the quarter, missing the consensus estimate of ($0.59) by ($0.15). Dianthus Therapeutics had a negative return on equity of 21.68% and a negative net margin of 1,250.32%. The firm had revenue of $2.17 million for the quarter, compared to the consensus estimate of $1.07 million. Equities analysts forecast that Dianthus Therapeutics will post -2.61 earnings per share for the current year.

Institutional Investors Weigh In On Dianthus Therapeutics

Institutional investors have recently bought and sold shares of the company. SG Americas Securities LLC bought a new stake in shares of Dianthus Therapeutics in the second quarter worth $112,000. Bank of New York Mellon Corp raised its holdings in Dianthus Therapeutics by 860.5% during the second quarter. Bank of New York Mellon Corp now owns 80,935 shares of the company's stock worth $2,095,000 after acquiring an additional 72,509 shares in the last quarter. Rhumbline Advisers acquired a new position in Dianthus Therapeutics during the second quarter valued at approximately $832,000. American Century Companies Inc. increased its position in shares of Dianthus Therapeutics by 38.6% during the 2nd quarter. American Century Companies Inc. now owns 30,432 shares of the company's stock worth $788,000 after purchasing an additional 8,473 shares during the last quarter. Finally, WINTON GROUP Ltd bought a new stake in shares of Dianthus Therapeutics during the 2nd quarter worth approximately $265,000. Institutional investors own 47.53% of the company's stock.

About Dianthus Therapeutics

(

Get Free Report)

Dianthus Therapeutics, Inc, a clinical-stage biotechnology company, develops complement therapeutics for patients with severe autoimmune and inflammatory diseases. It is developing DNTH103, a monoclonal antibody, which is in Phase 2 clinical trial, for the treatment of generalized myasthenia gravis, multifocal motor neuropathy, and chronic inflammatory demyelinating polyneuropathy.

See Also

Before you consider Dianthus Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dianthus Therapeutics wasn't on the list.

While Dianthus Therapeutics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.