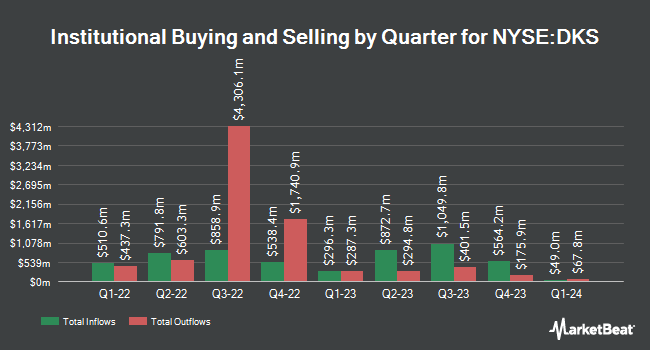

FORA Capital LLC lowered its position in DICK'S Sporting Goods, Inc. (NYSE:DKS - Free Report) by 92.4% during the third quarter, according to its most recent filing with the SEC. The institutional investor owned 1,644 shares of the sporting goods retailer's stock after selling 19,993 shares during the period. FORA Capital LLC's holdings in DICK'S Sporting Goods were worth $343,000 at the end of the most recent quarter.

Several other institutional investors also recently bought and sold shares of the company. Principal Financial Group Inc. grew its stake in DICK'S Sporting Goods by 5.5% during the 2nd quarter. Principal Financial Group Inc. now owns 239,451 shares of the sporting goods retailer's stock valued at $51,446,000 after purchasing an additional 12,396 shares in the last quarter. Swedbank AB acquired a new stake in shares of DICK'S Sporting Goods in the first quarter valued at about $1,670,000. Kerusso Capital Management LLC bought a new stake in shares of DICK'S Sporting Goods during the third quarter worth approximately $1,554,000. &PARTNERS acquired a new position in shares of DICK'S Sporting Goods during the second quarter worth $309,000. Finally, National Pension Service bought a new position in shares of DICK'S Sporting Goods during the 3rd quarter worth about $4,195,000. 89.83% of the stock is owned by institutional investors and hedge funds.

DICK'S Sporting Goods Stock Performance

Shares of NYSE:DKS traded down $6.42 during mid-day trading on Friday, reaching $207.24. 1,206,770 shares of the company traded hands, compared to its average volume of 1,092,371. The company's 50 day moving average price is $205.65 and its 200-day moving average price is $210.77. DICK'S Sporting Goods, Inc. has a 52 week low of $126.24 and a 52 week high of $239.30. The firm has a market cap of $16.87 billion, a PE ratio of 14.81, a PEG ratio of 2.43 and a beta of 1.64. The company has a debt-to-equity ratio of 0.48, a current ratio of 1.72 and a quick ratio of 0.69.

DICK'S Sporting Goods (NYSE:DKS - Get Free Report) last posted its quarterly earnings results on Tuesday, November 26th. The sporting goods retailer reported $2.75 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $2.68 by $0.07. The company had revenue of $3.06 billion for the quarter, compared to analyst estimates of $3.03 billion. DICK'S Sporting Goods had a return on equity of 42.00% and a net margin of 8.65%. DICK'S Sporting Goods's revenue for the quarter was up .5% compared to the same quarter last year. During the same quarter last year, the company earned $2.85 EPS. On average, equities analysts expect that DICK'S Sporting Goods, Inc. will post 13.88 EPS for the current fiscal year.

DICK'S Sporting Goods Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Friday, December 27th. Shareholders of record on Friday, December 13th will be paid a dividend of $1.10 per share. This represents a $4.40 dividend on an annualized basis and a yield of 2.12%. The ex-dividend date of this dividend is Friday, December 13th. DICK'S Sporting Goods's dividend payout ratio is 31.45%.

Wall Street Analyst Weigh In

DKS has been the topic of a number of research reports. Wells Fargo & Company cut their target price on shares of DICK'S Sporting Goods from $230.00 to $227.00 and set an "equal weight" rating on the stock in a research note on Monday, August 12th. Evercore ISI reissued an "outperform" rating and issued a $280.00 price objective on shares of DICK'S Sporting Goods in a report on Thursday, September 5th. Wedbush restated a "neutral" rating and set a $215.00 target price (down from $250.00) on shares of DICK'S Sporting Goods in a research report on Wednesday. JPMorgan Chase & Co. boosted their target price on DICK'S Sporting Goods from $211.00 to $215.00 and gave the stock a "neutral" rating in a report on Monday, September 9th. Finally, Bank of America increased their price target on DICK'S Sporting Goods from $240.00 to $250.00 and gave the stock a "buy" rating in a research note on Thursday, September 5th. Eight analysts have rated the stock with a hold rating and thirteen have assigned a buy rating to the company's stock. According to data from MarketBeat, the company currently has an average rating of "Moderate Buy" and a consensus target price of $244.95.

Get Our Latest Stock Analysis on DKS

DICK'S Sporting Goods Company Profile

(

Free Report)

DICK'S Sporting Goods, Inc, together with its subsidiaries, operates as an omni-channel sporting goods retailer primarily in the United States. The company provides hardlines, includes sporting goods equipment, fitness equipment, golf equipment, and fishing gear products; apparel; and footwear and accessories.

See Also

Before you consider DICK'S Sporting Goods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DICK'S Sporting Goods wasn't on the list.

While DICK'S Sporting Goods currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.