Digi International (NASDAQ:DGII - Get Free Report) is scheduled to release its earnings data after the market closes on Wednesday, November 13th. Analysts expect Digi International to post earnings of $0.42 per share for the quarter. Persons interested in registering for the company's earnings conference call can do so using this link.

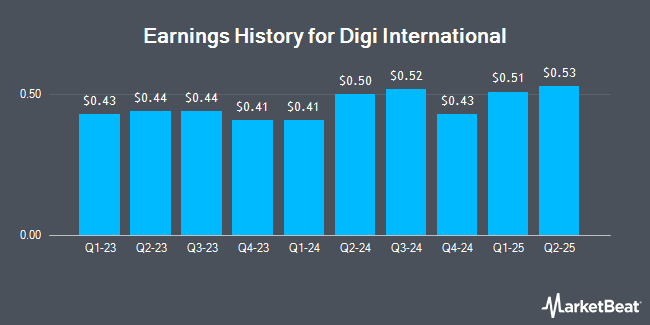

Digi International (NASDAQ:DGII - Get Free Report) last released its quarterly earnings results on Wednesday, August 7th. The technology company reported $0.50 EPS for the quarter, topping analysts' consensus estimates of $0.49 by $0.01. Digi International had a return on equity of 11.32% and a net margin of 3.94%. The company had revenue of $105.20 million for the quarter, compared to analysts' expectations of $105.60 million. During the same period in the prior year, the firm earned $0.44 earnings per share. The firm's revenue was down 6.3% compared to the same quarter last year. On average, analysts expect Digi International to post $2 EPS for the current fiscal year and $2 EPS for the next fiscal year.

Digi International Stock Performance

Shares of DGII traded up $2.84 during mid-day trading on Wednesday, hitting $32.21. 289,559 shares of the company's stock were exchanged, compared to its average volume of 191,510. The business's 50 day moving average is $28.55 and its two-hundred day moving average is $26.64. The firm has a market capitalization of $1.17 billion, a P/E ratio of 63.85, a P/E/G ratio of 0.97 and a beta of 1.06. The company has a current ratio of 2.00, a quick ratio of 1.31 and a debt-to-equity ratio of 0.27. Digi International has a fifty-two week low of $20.17 and a fifty-two week high of $32.90.

Analyst Ratings Changes

DGII has been the topic of a number of recent analyst reports. Craig Hallum cut their target price on shares of Digi International from $32.00 to $28.00 and set a "buy" rating on the stock in a research note on Thursday, August 8th. Piper Sandler cut their price target on shares of Digi International from $27.00 to $26.00 and set a "neutral" rating on the stock in a report on Thursday, August 8th. One investment analyst has rated the stock with a hold rating and five have assigned a buy rating to the stock. According to data from MarketBeat, the company currently has an average rating of "Moderate Buy" and a consensus target price of $34.20.

View Our Latest Report on DGII

About Digi International

(

Get Free Report)

Digi International Inc provides business and mission-critical Internet of Things (IoT) products, services, and solutions in the United States, Europe, the Middle East, Africa, and internationally. The company operates in two segments, IoT Products & Services, and IoT Solutions. It offers cellular routers for mission-critical wireless connectivity; cellular modules to embed cellular communications abilities into the products to deploy and manage intelligent and secure cellular connected products; console servers to provide secure and remote access to network equipment in data centers and at edge locations; and radio frequency products, including embedded wireless modules, off-the-shelf gateways, modems, and adapters under the Digi XBee brand.

See Also

Before you consider Digi International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Digi International wasn't on the list.

While Digi International currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.