Digi International (NASDAQ:DGII - Free Report) had its target price lifted by Piper Sandler from $26.00 to $32.00 in a research note published on Thursday,Benzinga reports. Piper Sandler currently has a neutral rating on the technology company's stock.

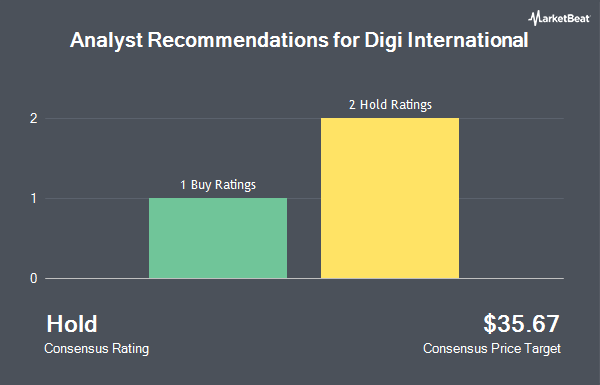

Separately, Craig Hallum reissued a "hold" rating and set a $32.00 price target (up from $28.00) on shares of Digi International in a research report on Thursday. Two research analysts have rated the stock with a hold rating and four have issued a buy rating to the company's stock. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus price target of $36.20.

View Our Latest Research Report on DGII

Digi International Stock Performance

DGII traded down $0.29 during trading on Thursday, reaching $31.68. 391,883 shares of the company's stock were exchanged, compared to its average volume of 193,325. Digi International has a 1 year low of $20.17 and a 1 year high of $34.08. The company has a debt-to-equity ratio of 0.27, a current ratio of 2.00 and a quick ratio of 1.31. The stock has a market capitalization of $1.15 billion, a P/E ratio of 67.11, a price-to-earnings-growth ratio of 1.09 and a beta of 1.06. The company's fifty day simple moving average is $28.98 and its 200-day simple moving average is $26.75.

Institutional Investors Weigh In On Digi International

A number of hedge funds and other institutional investors have recently made changes to their positions in the company. Captrust Financial Advisors grew its stake in shares of Digi International by 13.5% during the 3rd quarter. Captrust Financial Advisors now owns 20,338 shares of the technology company's stock worth $560,000 after purchasing an additional 2,418 shares during the period. SG Americas Securities LLC grew its stake in shares of Digi International by 92.5% during the 2nd quarter. SG Americas Securities LLC now owns 8,140 shares of the technology company's stock worth $187,000 after purchasing an additional 3,911 shares during the period. Bank of New York Mellon Corp grew its stake in shares of Digi International by 2.1% during the 2nd quarter. Bank of New York Mellon Corp now owns 312,765 shares of the technology company's stock worth $7,172,000 after purchasing an additional 6,534 shares during the period. Rhumbline Advisers grew its stake in shares of Digi International by 6.7% during the 2nd quarter. Rhumbline Advisers now owns 114,584 shares of the technology company's stock worth $2,627,000 after purchasing an additional 7,208 shares during the period. Finally, BNP Paribas Financial Markets grew its stake in shares of Digi International by 51.8% during the 3rd quarter. BNP Paribas Financial Markets now owns 24,129 shares of the technology company's stock worth $664,000 after purchasing an additional 8,235 shares during the period. Institutional investors and hedge funds own 95.90% of the company's stock.

About Digi International

(

Get Free Report)

Digi International Inc provides business and mission-critical Internet of Things (IoT) products, services, and solutions in the United States, Europe, the Middle East, Africa, and internationally. The company operates in two segments, IoT Products & Services, and IoT Solutions. It offers cellular routers for mission-critical wireless connectivity; cellular modules to embed cellular communications abilities into the products to deploy and manage intelligent and secure cellular connected products; console servers to provide secure and remote access to network equipment in data centers and at edge locations; and radio frequency products, including embedded wireless modules, off-the-shelf gateways, modems, and adapters under the Digi XBee brand.

Featured Stories

Before you consider Digi International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Digi International wasn't on the list.

While Digi International currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.