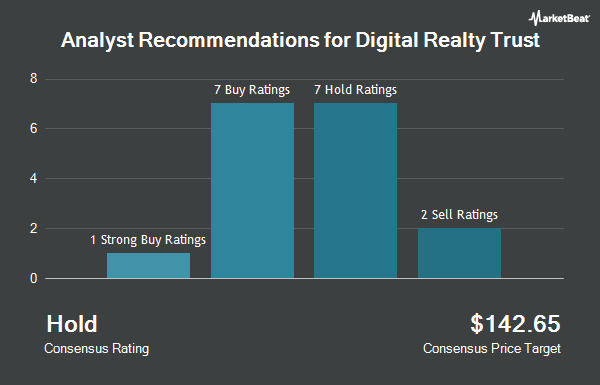

Digital Realty Trust, Inc. (NYSE:DLR - Get Free Report) has received a consensus rating of "Moderate Buy" from the twenty-one ratings firms that are presently covering the stock, MarketBeat Ratings reports. One analyst has rated the stock with a sell recommendation, eight have issued a hold recommendation, eleven have given a buy recommendation and one has given a strong buy recommendation to the company. The average 12-month price target among brokers that have issued a report on the stock in the last year is $170.37.

A number of brokerages have recently weighed in on DLR. Evercore ISI boosted their price target on Digital Realty Trust from $160.00 to $175.00 and gave the stock an "outperform" rating in a research note on Wednesday, October 23rd. HSBC raised shares of Digital Realty Trust from a "reduce" rating to a "hold" rating and boosted their target price for the stock from $124.00 to $160.00 in a research report on Friday, October 4th. Barclays raised their price target on shares of Digital Realty Trust from $135.00 to $142.00 and gave the stock an "underweight" rating in a report on Monday, November 18th. Truist Financial boosted their price objective on shares of Digital Realty Trust from $168.00 to $202.00 and gave the company a "buy" rating in a report on Tuesday, November 12th. Finally, Jefferies Financial Group upped their target price on Digital Realty Trust from $190.00 to $205.00 and gave the company a "buy" rating in a research report on Friday, October 25th.

Read Our Latest Research Report on Digital Realty Trust

Institutional Investors Weigh In On Digital Realty Trust

A number of institutional investors have recently modified their holdings of the business. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC raised its position in Digital Realty Trust by 501.7% during the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 4,326,914 shares of the real estate investment trust's stock worth $700,224,000 after acquiring an additional 3,607,802 shares during the period. Pathway Financial Advisers LLC increased its stake in shares of Digital Realty Trust by 15,301.1% during the third quarter. Pathway Financial Advisers LLC now owns 1,850,292 shares of the real estate investment trust's stock worth $299,433,000 after purchasing an additional 1,838,278 shares in the last quarter. Massachusetts Financial Services Co. MA raised its position in shares of Digital Realty Trust by 543.6% during the 2nd quarter. Massachusetts Financial Services Co. MA now owns 1,447,340 shares of the real estate investment trust's stock worth $220,068,000 after purchasing an additional 1,773,591 shares during the last quarter. Point72 Asset Management L.P. purchased a new position in Digital Realty Trust in the 3rd quarter valued at about $132,980,000. Finally, Wulff Hansen & CO. boosted its holdings in Digital Realty Trust by 15,105.0% in the 2nd quarter. Wulff Hansen & CO. now owns 795,830 shares of the real estate investment trust's stock worth $121,006,000 after buying an additional 790,596 shares during the last quarter. 99.71% of the stock is currently owned by institutional investors and hedge funds.

Digital Realty Trust Stock Up 0.8 %

Shares of NYSE DLR traded up $1.61 during trading hours on Friday, hitting $192.69. 2,073,824 shares of the stock were exchanged, compared to its average volume of 2,090,059. Digital Realty Trust has a 12 month low of $130.00 and a 12 month high of $198.00. The firm has a fifty day moving average price of $176.11 and a 200-day moving average price of $160.04. The company has a quick ratio of 1.61, a current ratio of 1.61 and a debt-to-equity ratio of 0.81. The company has a market cap of $63.92 billion, a PE ratio of 161.92, a PEG ratio of 5.07 and a beta of 0.62.

Digital Realty Trust (NYSE:DLR - Get Free Report) last issued its quarterly earnings results on Thursday, October 24th. The real estate investment trust reported $0.09 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.67 by ($1.58). The business had revenue of $1.43 billion for the quarter, compared to analyst estimates of $1.43 billion. Digital Realty Trust had a return on equity of 2.24% and a net margin of 8.04%. The business's revenue for the quarter was up 2.1% on a year-over-year basis. During the same period in the previous year, the company posted $1.62 earnings per share. On average, sell-side analysts expect that Digital Realty Trust will post 6.71 EPS for the current year.

Digital Realty Trust Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, January 17th. Shareholders of record on Friday, December 13th will be given a $1.22 dividend. The ex-dividend date of this dividend is Friday, December 13th. This represents a $4.88 dividend on an annualized basis and a dividend yield of 2.53%. Digital Realty Trust's dividend payout ratio (DPR) is currently 410.08%.

Digital Realty Trust Company Profile

(

Get Free ReportDigital Realty brings companies and data together by delivering the full spectrum of data center, colocation, and interconnection solutions. PlatformDIGITAL, the company's global data center platform, provides customers with a secure data meeting place and a proven Pervasive Datacenter Architecture (PDx) solution methodology for powering innovation and efficiently managing Data Gravity challenges.

Further Reading

Before you consider Digital Realty Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Digital Realty Trust wasn't on the list.

While Digital Realty Trust currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.