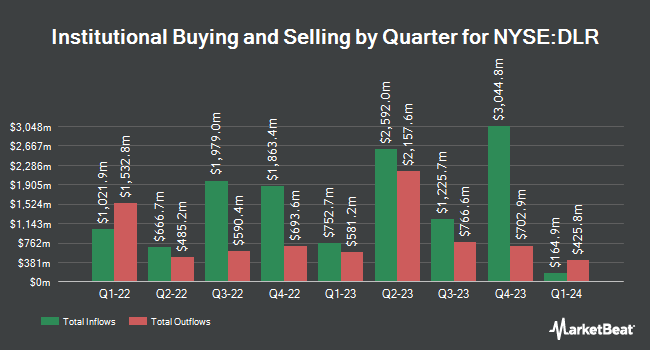

Natixis Advisors LLC cut its holdings in Digital Realty Trust, Inc. (NYSE:DLR - Free Report) by 2.8% during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 182,465 shares of the real estate investment trust's stock after selling 5,176 shares during the quarter. Natixis Advisors LLC owned approximately 0.06% of Digital Realty Trust worth $29,528,000 as of its most recent SEC filing.

Other institutional investors also recently modified their holdings of the company. Blair William & Co. IL boosted its position in shares of Digital Realty Trust by 7.7% in the 1st quarter. Blair William & Co. IL now owns 21,221 shares of the real estate investment trust's stock worth $3,057,000 after purchasing an additional 1,520 shares in the last quarter. O Shaughnessy Asset Management LLC raised its position in shares of Digital Realty Trust by 10.0% in the 1st quarter. O Shaughnessy Asset Management LLC now owns 17,778 shares of the real estate investment trust's stock worth $2,561,000 after purchasing an additional 1,622 shares during the last quarter. Bessemer Group Inc. boosted its stake in Digital Realty Trust by 102.1% in the 1st quarter. Bessemer Group Inc. now owns 19,528 shares of the real estate investment trust's stock worth $2,813,000 after purchasing an additional 9,865 shares in the last quarter. Lake Street Advisors Group LLC grew its position in Digital Realty Trust by 148.8% during the 1st quarter. Lake Street Advisors Group LLC now owns 3,934 shares of the real estate investment trust's stock valued at $567,000 after purchasing an additional 2,353 shares during the last quarter. Finally, RB Capital Management LLC increased its stake in Digital Realty Trust by 2.4% during the 1st quarter. RB Capital Management LLC now owns 4,252 shares of the real estate investment trust's stock valued at $612,000 after purchasing an additional 100 shares in the last quarter. 99.71% of the stock is currently owned by institutional investors.

Digital Realty Trust Price Performance

Shares of NYSE:DLR traded up $3.59 during mid-day trading on Monday, reaching $183.26. The stock had a trading volume of 2,316,409 shares, compared to its average volume of 1,866,850. The business's 50 day moving average price is $166.56 and its 200 day moving average price is $155.01. Digital Realty Trust, Inc. has a 1 year low of $130.00 and a 1 year high of $193.88. The company has a market cap of $60.79 billion, a P/E ratio of 150.98, a price-to-earnings-growth ratio of 4.77 and a beta of 0.59. The company has a current ratio of 1.61, a quick ratio of 1.61 and a debt-to-equity ratio of 0.81.

Digital Realty Trust (NYSE:DLR - Get Free Report) last announced its quarterly earnings results on Thursday, October 24th. The real estate investment trust reported $0.09 earnings per share for the quarter, missing the consensus estimate of $1.67 by ($1.58). Digital Realty Trust had a return on equity of 2.24% and a net margin of 8.04%. The business had revenue of $1.43 billion during the quarter, compared to the consensus estimate of $1.43 billion. During the same quarter in the prior year, the firm posted $1.62 EPS. The company's revenue for the quarter was up 2.1% on a year-over-year basis. Research analysts expect that Digital Realty Trust, Inc. will post 6.71 EPS for the current fiscal year.

Digital Realty Trust Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Friday, January 17th. Stockholders of record on Friday, December 13th will be given a dividend of $1.22 per share. This represents a $4.88 annualized dividend and a dividend yield of 2.66%. The ex-dividend date is Friday, December 13th. Digital Realty Trust's dividend payout ratio is currently 410.08%.

Wall Street Analyst Weigh In

DLR has been the topic of a number of recent analyst reports. JPMorgan Chase & Co. increased their price target on shares of Digital Realty Trust from $180.00 to $185.00 and gave the company an "overweight" rating in a report on Friday, October 25th. Stifel Nicolaus restated a "buy" rating and issued a $195.00 target price (up previously from $185.00) on shares of Digital Realty Trust in a report on Friday, October 25th. Hsbc Global Res upgraded shares of Digital Realty Trust from a "moderate sell" rating to a "hold" rating in a research note on Friday, October 4th. Argus downgraded Digital Realty Trust from a "buy" rating to a "hold" rating in a research note on Thursday, August 1st. Finally, TD Cowen upped their price objective on Digital Realty Trust from $120.00 to $128.00 and gave the company a "hold" rating in a research report on Friday, October 25th. Two analysts have rated the stock with a sell rating, nine have issued a hold rating, eleven have assigned a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and an average target price of $169.84.

View Our Latest Stock Analysis on DLR

Digital Realty Trust Profile

(

Free Report)

Digital Realty brings companies and data together by delivering the full spectrum of data center, colocation, and interconnection solutions. PlatformDIGITAL, the company's global data center platform, provides customers with a secure data meeting place and a proven Pervasive Datacenter Architecture (PDx) solution methodology for powering innovation and efficiently managing Data Gravity challenges.

Featured Articles

Before you consider Digital Realty Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Digital Realty Trust wasn't on the list.

While Digital Realty Trust currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.