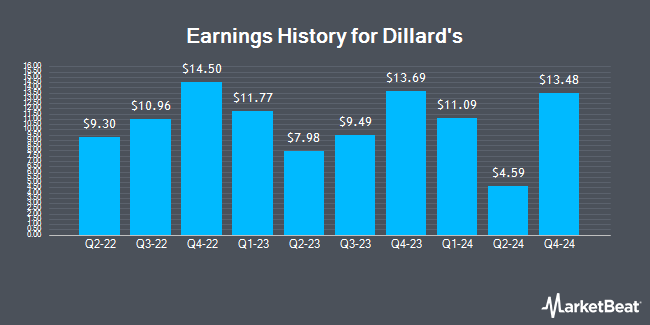

Dillard's (NYSE:DDS - Get Free Report) is anticipated to release its earnings data before the market opens on Monday, February 24th. Analysts expect Dillard's to post earnings of $9.62 per share and revenue of $1.97 billion for the quarter.

Dillard's Stock Down 4.0 %

DDS stock opened at $483.21 on Friday. The company has a 50 day moving average of $462.00 and a two-hundred day moving average of $411.91. The company has a quick ratio of 1.02, a current ratio of 2.38 and a debt-to-equity ratio of 0.27. Dillard's has a 12-month low of $328.00 and a 12-month high of $510.00. The company has a market cap of $7.68 billion, a price-to-earnings ratio of 12.44 and a beta of 0.88.

Dillard's Dividend Announcement

The company also recently disclosed a dividend, which was paid on Monday, January 6th. Investors of record on Monday, December 16th were issued a $25.00 dividend. The ex-dividend date of this dividend was Friday, December 13th. This represents a yield of 5.68%. Dillard's's dividend payout ratio is currently 2.57%.

Wall Street Analyst Weigh In

Several research analysts have recently commented on DDS shares. UBS Group increased their price target on shares of Dillard's from $196.00 to $200.00 and gave the stock a "sell" rating in a research note on Wednesday. Telsey Advisory Group increased their price target on shares of Dillard's from $380.00 to $450.00 and gave the stock a "market perform" rating in a research note on Friday, November 15th. Finally, StockNews.com raised shares of Dillard's from a "hold" rating to a "buy" rating in a report on Tuesday, February 11th.

Read Our Latest Stock Analysis on Dillard's

Insider Buying and Selling at Dillard's

In other news, VP Tom W. Bolin sold 300 shares of the firm's stock in a transaction dated Tuesday, January 14th. The shares were sold at an average price of $433.45, for a total transaction of $130,035.00. Following the completion of the transaction, the vice president now directly owns 1,167 shares of the company's stock, valued at approximately $505,836.15. This trade represents a 20.45 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Insiders own 33.80% of the company's stock.

About Dillard's

(

Get Free Report)

Dillard's, Inc engages in the retail of fashion apparel, cosmetics, and home furnishings, and other consumer goods. It operates through the Retail Operations and Construction segments. The Retail Operations segment comprises sells cosmetics, ladies' apparel, ladies' accessories and lingerie, juniors' and children's apparel, men's apparel and accessories, shoes, and home and furniture products.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Dillard's, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dillard's wasn't on the list.

While Dillard's currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.