Dillon & Associates Inc. raised its holdings in shares of Amazon.com, Inc. (NASDAQ:AMZN) by 4.9% during the fourth quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 90,381 shares of the e-commerce giant's stock after acquiring an additional 4,196 shares during the quarter. Amazon.com comprises approximately 2.7% of Dillon & Associates Inc.'s portfolio, making the stock its 9th biggest holding. Dillon & Associates Inc.'s holdings in Amazon.com were worth $19,793,000 as of its most recent SEC filing.

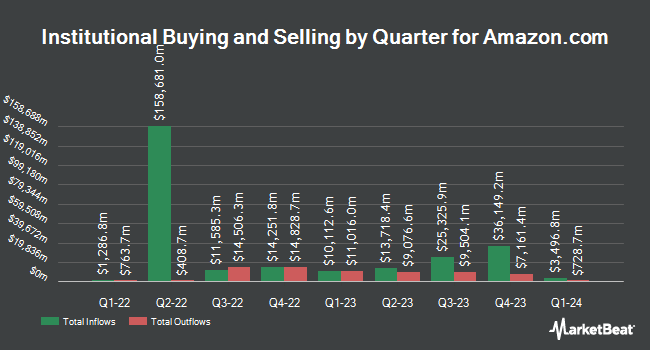

Other institutional investors have also recently made changes to their positions in the company. Vanguard Group Inc. increased its position in shares of Amazon.com by 2.2% during the fourth quarter. Vanguard Group Inc. now owns 823,360,597 shares of the e-commerce giant's stock valued at $180,637,081,000 after buying an additional 17,635,391 shares during the period. State Street Corp grew its stake in Amazon.com by 3.3% during the third quarter. State Street Corp now owns 359,179,990 shares of the e-commerce giant's stock valued at $66,926,008,000 after acquiring an additional 11,370,309 shares in the last quarter. Geode Capital Management LLC increased its holdings in Amazon.com by 3.4% during the 3rd quarter. Geode Capital Management LLC now owns 199,915,046 shares of the e-commerce giant's stock worth $37,116,341,000 after acquiring an additional 6,545,944 shares during the period. Bank of New York Mellon Corp lifted its stake in Amazon.com by 0.8% in the 4th quarter. Bank of New York Mellon Corp now owns 67,092,427 shares of the e-commerce giant's stock worth $14,719,407,000 after purchasing an additional 545,292 shares in the last quarter. Finally, Charles Schwab Investment Management Inc. boosted its holdings in Amazon.com by 4.1% in the 4th quarter. Charles Schwab Investment Management Inc. now owns 59,638,207 shares of the e-commerce giant's stock valued at $13,084,026,000 after purchasing an additional 2,330,113 shares during the period. Hedge funds and other institutional investors own 72.20% of the company's stock.

Amazon.com Stock Up 3.3 %

Shares of NASDAQ:AMZN opened at $186.54 on Friday. Amazon.com, Inc. has a 12-month low of $151.61 and a 12-month high of $242.52. The stock has a market capitalization of $1.98 trillion, a price-to-earnings ratio of 33.73, a PEG ratio of 1.50 and a beta of 1.39. The stock has a fifty day simple moving average of $194.27 and a two-hundred day simple moving average of $207.70. The company has a current ratio of 1.06, a quick ratio of 0.87 and a debt-to-equity ratio of 0.18.

Amazon.com (NASDAQ:AMZN - Get Free Report) last announced its quarterly earnings results on Thursday, February 6th. The e-commerce giant reported $1.86 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.52 by $0.34. Amazon.com had a net margin of 9.29% and a return on equity of 24.25%. On average, research analysts anticipate that Amazon.com, Inc. will post 6.31 earnings per share for the current fiscal year.

Wall Street Analyst Weigh In

A number of brokerages recently issued reports on AMZN. Bank of America lowered their price objective on Amazon.com from $257.00 to $225.00 and set a "buy" rating on the stock in a research report on Wednesday, April 9th. Rosenblatt Securities lifted their price target on Amazon.com from $236.00 to $287.00 and gave the company a "buy" rating in a research report on Friday, February 7th. Canaccord Genuity Group restated a "buy" rating on shares of Amazon.com in a research report on Thursday, February 13th. Westpark Capital started coverage on shares of Amazon.com in a research report on Tuesday, April 1st. They set a "buy" rating and a $280.00 target price for the company. Finally, Benchmark increased their price target on shares of Amazon.com from $215.00 to $265.00 and gave the stock a "buy" rating in a report on Tuesday, February 4th. Two equities research analysts have rated the stock with a hold rating and forty-five have issued a buy rating to the company. According to data from MarketBeat, the stock has an average rating of "Moderate Buy" and an average target price of $247.56.

Get Our Latest Analysis on Amazon.com

Insider Activity

In other news, CEO Douglas J. Herrington sold 2,500 shares of the business's stock in a transaction on Tuesday, April 1st. The stock was sold at an average price of $187.99, for a total value of $469,975.00. Following the completion of the transaction, the chief executive officer now owns 509,474 shares in the company, valued at $95,776,017.26. The trade was a 0.49 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, VP Shelley Reynolds sold 8,833 shares of the stock in a transaction on Friday, February 21st. The shares were sold at an average price of $222.47, for a total value of $1,965,077.51. Following the sale, the vice president now directly owns 119,780 shares in the company, valued at $26,647,456.60. This trade represents a 6.87 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 104,798 shares of company stock worth $23,341,803 over the last 90 days. 10.80% of the stock is currently owned by insiders.

Amazon.com Profile

(

Free Report)

Amazon.com, Inc engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally. The company operates through three segments: North America, International, and Amazon Web Services (AWS). It also manufactures and sells electronic devices, including Kindle, Fire tablets, Fire TVs, Echo, Ring, Blink, and eero; and develops and produces media content.

Read More

Want to see what other hedge funds are holding AMZN? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Amazon.com, Inc. (NASDAQ:AMZN - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Amazon.com, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amazon.com wasn't on the list.

While Amazon.com currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report