Quantbot Technologies LP boosted its position in Dine Brands Global, Inc. (NYSE:DIN - Free Report) by 308.7% in the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 30,116 shares of the restaurant operator's stock after buying an additional 22,748 shares during the period. Quantbot Technologies LP owned approximately 0.20% of Dine Brands Global worth $941,000 at the end of the most recent quarter.

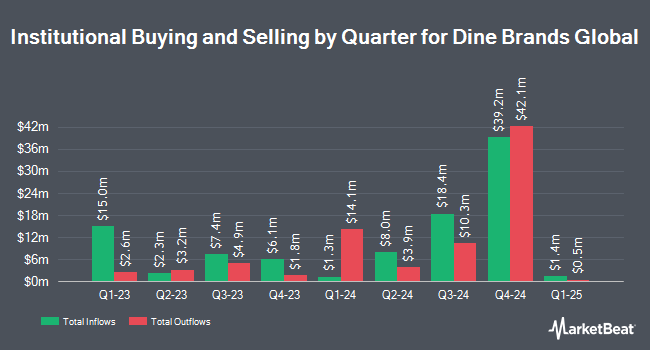

A number of other hedge funds have also recently added to or reduced their stakes in the company. Quarry LP boosted its stake in shares of Dine Brands Global by 32.8% in the 2nd quarter. Quarry LP now owns 2,296 shares of the restaurant operator's stock worth $83,000 after buying an additional 567 shares during the last quarter. Nisa Investment Advisors LLC raised its holdings in shares of Dine Brands Global by 3.6% during the 2nd quarter. Nisa Investment Advisors LLC now owns 20,189 shares of the restaurant operator's stock valued at $742,000 after buying an additional 695 shares in the last quarter. Zurcher Kantonalbank Zurich Cantonalbank boosted its position in Dine Brands Global by 30.1% during the second quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 3,221 shares of the restaurant operator's stock valued at $117,000 after buying an additional 746 shares during the period. Summit Securities Group LLC purchased a new stake in shares of Dine Brands Global during the second quarter valued at approximately $35,000. Finally, Virtu Financial LLC raised its position in Dine Brands Global by 17.5% during the 1st quarter. Virtu Financial LLC now owns 7,515 shares of the restaurant operator's stock valued at $349,000 after purchasing an additional 1,120 shares during the last quarter. Institutional investors and hedge funds own 92.83% of the company's stock.

Wall Street Analyst Weigh In

A number of equities research analysts have recently weighed in on the stock. StockNews.com lowered shares of Dine Brands Global from a "buy" rating to a "hold" rating in a research note on Tuesday, November 5th. Wedbush reiterated an "outperform" rating and issued a $47.00 target price on shares of Dine Brands Global in a research note on Friday, November 15th. Truist Financial reaffirmed a "hold" rating and issued a $37.00 target price (down previously from $66.00) on shares of Dine Brands Global in a research report on Friday, October 4th. KeyCorp dropped their price target on Dine Brands Global from $37.00 to $36.00 and set an "overweight" rating on the stock in a research note on Friday, October 18th. Finally, UBS Group cut their price target on Dine Brands Global from $51.00 to $44.00 and set a "buy" rating for the company in a research note on Thursday, November 7th. Five investment analysts have rated the stock with a hold rating and four have issued a buy rating to the company's stock. Based on data from MarketBeat.com, Dine Brands Global currently has a consensus rating of "Hold" and an average price target of $44.71.

Get Our Latest Analysis on Dine Brands Global

Dine Brands Global Price Performance

NYSE:DIN traded down $0.50 during trading hours on Monday, reaching $35.42. The company had a trading volume of 365,781 shares, compared to its average volume of 436,228. The firm has a market cap of $540.16 million, a PE ratio of 6.00 and a beta of 1.71. Dine Brands Global, Inc. has a 1-year low of $28.25 and a 1-year high of $52.05. The business's 50 day moving average price is $32.33 and its 200-day moving average price is $33.77.

Dine Brands Global (NYSE:DIN - Get Free Report) last posted its quarterly earnings data on Wednesday, November 6th. The restaurant operator reported $1.44 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.34 by $0.10. The company had revenue of $195.00 million for the quarter, compared to analysts' expectations of $198.40 million. Dine Brands Global had a negative return on equity of 37.75% and a net margin of 11.31%. Dine Brands Global's revenue was down 3.8% compared to the same quarter last year. During the same period in the previous year, the firm posted $1.46 EPS. On average, analysts expect that Dine Brands Global, Inc. will post 5.84 earnings per share for the current fiscal year.

Dine Brands Global Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Tuesday, January 7th. Shareholders of record on Friday, December 20th will be issued a dividend of $0.51 per share. The ex-dividend date of this dividend is Friday, December 20th. This represents a $2.04 annualized dividend and a yield of 5.76%. Dine Brands Global's dividend payout ratio (DPR) is 33.94%.

About Dine Brands Global

(

Free Report)

Dine Brands Global, Inc, together with its subsidiaries, owns, franchises, and operates restaurants in the United States and internationally. The company operates through six segments: Applebee's Franchise Operations, International House of Pancakes (IHOP) Franchise Solutions, Fuzzy's franchise operations, Rental Operations, Financing Operations, and Company-Operated Restaurant Operations.

Read More

Before you consider Dine Brands Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dine Brands Global wasn't on the list.

While Dine Brands Global currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.