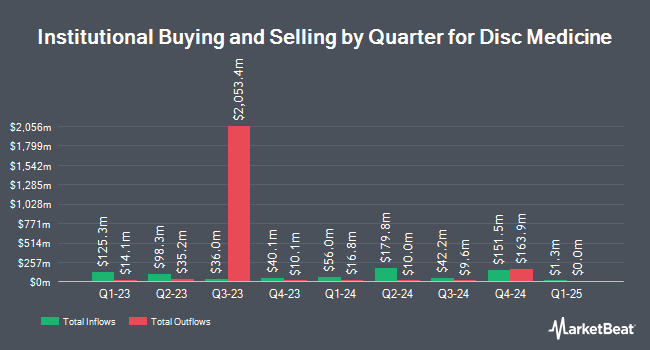

Walleye Capital LLC grew its stake in shares of Disc Medicine, Inc. (NASDAQ:IRON - Free Report) by 53.7% during the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 209,236 shares of the company's stock after buying an additional 73,140 shares during the period. Walleye Capital LLC owned 0.70% of Disc Medicine worth $10,282,000 at the end of the most recent reporting period.

Other institutional investors and hedge funds have also recently modified their holdings of the company. Frazier Life Sciences Management L.P. increased its holdings in Disc Medicine by 123.5% during the 2nd quarter. Frazier Life Sciences Management L.P. now owns 1,754,834 shares of the company's stock worth $79,090,000 after acquiring an additional 969,834 shares during the period. Logos Global Management LP bought a new position in shares of Disc Medicine in the second quarter worth $41,690,000. Point72 Asset Management L.P. purchased a new stake in shares of Disc Medicine in the second quarter worth $34,318,000. Deerfield Management Company L.P. Series C boosted its stake in Disc Medicine by 53.8% during the second quarter. Deerfield Management Company L.P. Series C now owns 1,023,265 shares of the company's stock valued at $46,119,000 after buying an additional 357,730 shares during the period. Finally, Atlas Venture Life Science Advisors LLC grew its position in Disc Medicine by 9.7% during the second quarter. Atlas Venture Life Science Advisors LLC now owns 2,509,456 shares of the company's stock worth $113,101,000 after buying an additional 222,223 shares in the last quarter. 83.70% of the stock is owned by hedge funds and other institutional investors.

Disc Medicine Stock Performance

IRON stock traded down $1.10 during trading on Friday, hitting $63.45. 101,209 shares of the company traded hands, compared to its average volume of 352,327. The firm has a market capitalization of $1.89 billion, a PE ratio of -15.94 and a beta of 0.60. Disc Medicine, Inc. has a 1 year low of $25.60 and a 1 year high of $77.60. The company has a 50-day moving average of $54.05 and a 200-day moving average of $47.26.

Disc Medicine (NASDAQ:IRON - Get Free Report) last announced its earnings results on Tuesday, November 12th. The company reported ($0.89) earnings per share (EPS) for the quarter, beating the consensus estimate of ($1.04) by $0.15. Sell-side analysts expect that Disc Medicine, Inc. will post -4.05 EPS for the current year.

Wall Street Analyst Weigh In

IRON has been the subject of a number of research analyst reports. Morgan Stanley upgraded Disc Medicine from an "equal weight" rating to an "overweight" rating and set a $85.00 price target for the company in a research report on Tuesday, November 5th. Wells Fargo & Company initiated coverage on shares of Disc Medicine in a research note on Thursday, August 22nd. They issued an "overweight" rating and a $75.00 price target for the company. HC Wainwright increased their price target on shares of Disc Medicine from $70.00 to $118.00 and gave the stock a "buy" rating in a report on Wednesday, November 13th. Wedbush reaffirmed an "outperform" rating and set a $83.00 price objective (up from $75.00) on shares of Disc Medicine in a report on Tuesday, November 12th. Finally, Raymond James raised Disc Medicine from an "outperform" rating to a "strong-buy" rating and increased their target price for the company from $66.00 to $110.00 in a research note on Monday, November 4th. Nine equities research analysts have rated the stock with a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat.com, the stock presently has a consensus rating of "Buy" and an average price target of $85.80.

View Our Latest Stock Report on Disc Medicine

Insider Buying and Selling at Disc Medicine

In other news, Director William Richard White sold 7,136 shares of the stock in a transaction on Monday, November 4th. The stock was sold at an average price of $58.61, for a total transaction of $418,240.96. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, insider William Jacob Savage sold 14,183 shares of the business's stock in a transaction on Monday, November 25th. The stock was sold at an average price of $65.45, for a total value of $928,277.35. Following the transaction, the insider now owns 40,405 shares in the company, valued at approximately $2,644,507.25. This trade represents a 25.98 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 30,879 shares of company stock worth $1,912,335 over the last quarter. Insiders own 4.24% of the company's stock.

Disc Medicine Profile

(

Free Report)

Disc Medicine, Inc, together with its subsidiaries, a clinical-stage biopharmaceutical company, engages in the discovery, development, and commercialization of novel treatments for patients suffering from serious hematologic diseases in the United States. The company has assembled a portfolio of clinical and preclinical product candidates that aim to modify fundamental biological pathways associated with the formation and function of red blood cells, primarily heme biosynthesis and iron homeostasis.

Further Reading

Before you consider Disc Medicine, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Disc Medicine wasn't on the list.

While Disc Medicine currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.