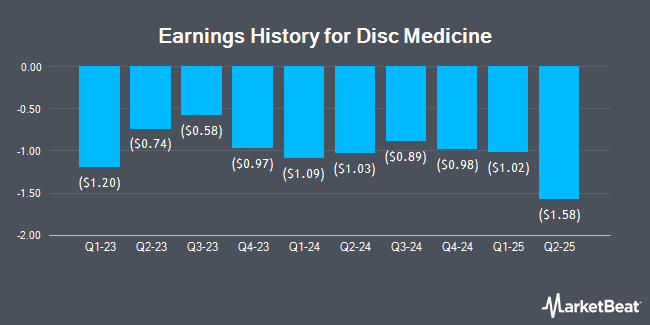

Disc Medicine (NASDAQ:IRON - Get Free Report) is expected to announce its earnings results before the market opens on Thursday, March 20th. Analysts expect the company to announce earnings of ($1.06) per share for the quarter.

Disc Medicine (NASDAQ:IRON - Get Free Report) last announced its earnings results on Thursday, February 27th. The company reported ($0.98) EPS for the quarter, beating the consensus estimate of ($1.06) by $0.08. On average, analysts expect Disc Medicine to post $-4 EPS for the current fiscal year and $-5 EPS for the next fiscal year.

Disc Medicine Stock Up 0.1 %

Shares of NASDAQ IRON opened at $53.93 on Thursday. Disc Medicine has a 12 month low of $25.60 and a 12 month high of $68.86. The company has a market cap of $1.86 billion, a price-to-earnings ratio of -13.55 and a beta of 0.73. The business has a fifty day simple moving average of $56.62 and a 200-day simple moving average of $55.94.

Insider Activity

In other news, CEO John D. Quisel sold 19,820 shares of the stock in a transaction dated Monday, December 23rd. The stock was sold at an average price of $63.14, for a total transaction of $1,251,434.80. Following the transaction, the chief executive officer now owns 72,065 shares of the company's stock, valued at approximately $4,550,184.10. This represents a 21.57 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is accessible through this link. Also, Director Mona Ashiya sold 83,182 shares of the stock in a transaction dated Wednesday, March 12th. The shares were sold at an average price of $54.45, for a total value of $4,529,259.90. Following the transaction, the director now directly owns 194,209 shares in the company, valued at approximately $10,574,680.05. This represents a 29.99 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders have sold 359,408 shares of company stock valued at $20,027,286. Insiders own 4.24% of the company's stock.

Analyst Upgrades and Downgrades

IRON has been the subject of several analyst reports. TD Cowen initiated coverage on Disc Medicine in a report on Thursday, February 27th. They set a "buy" rating for the company. Morgan Stanley reissued an "overweight" rating and set a $85.00 price target on shares of Disc Medicine in a research report on Friday, March 7th. HC Wainwright reissued a "buy" rating and set a $118.00 price target on shares of Disc Medicine in a research report on Tuesday, January 21st. Scotiabank upped their price target on Disc Medicine from $73.00 to $75.00 and gave the company a "sector outperform" rating in a research report on Monday, March 3rd. Finally, Stifel Nicolaus upped their price target on Disc Medicine from $90.00 to $94.00 and gave the company a "buy" rating in a research report on Friday, January 24th. Ten analysts have rated the stock with a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat.com, the stock presently has an average rating of "Buy" and an average target price of $89.10.

Get Our Latest Stock Analysis on IRON

About Disc Medicine

(

Get Free Report)

Disc Medicine, Inc, together with its subsidiaries, a clinical-stage biopharmaceutical company, engages in the discovery, development, and commercialization of novel treatments for patients suffering from serious hematologic diseases in the United States. The company has assembled a portfolio of clinical and preclinical product candidates that aim to modify fundamental biological pathways associated with the formation and function of red blood cells, primarily heme biosynthesis and iron homeostasis.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Disc Medicine, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Disc Medicine wasn't on the list.

While Disc Medicine currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.