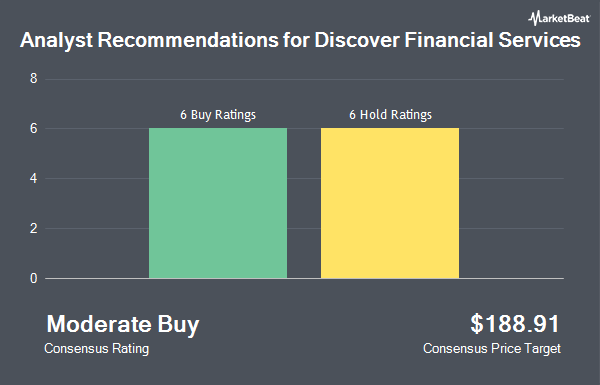

Shares of Discover Financial Services (NYSE:DFS) have been given a consensus recommendation of "Hold" by the eleven ratings firms that are presently covering the company, Marketbeat.com reports. Six equities research analysts have rated the stock with a hold rating and five have issued a buy rating on the company. The average twelve-month price objective among brokers that have updated their coverage on the stock in the last year is $192.40.

Several equities research analysts recently weighed in on DFS shares. UBS Group upgraded Discover Financial Services from a "neutral" rating to a "buy" rating and increased their target price for the company from $150.00 to $239.00 in a report on Monday, January 13th. Truist Financial cut their target price on shares of Discover Financial Services from $262.00 to $219.00 and set a "buy" rating on the stock in a report on Friday. Keefe, Bruyette & Woods lifted their target price on shares of Discover Financial Services from $170.00 to $232.00 and gave the stock an "outperform" rating in a research note on Monday, December 9th. JPMorgan Chase & Co. increased their price target on shares of Discover Financial Services from $146.00 to $169.00 and gave the company a "neutral" rating in a research report on Friday, January 24th. Finally, Wells Fargo & Company boosted their price objective on shares of Discover Financial Services from $185.00 to $214.00 and gave the company an "equal weight" rating in a research report on Friday, January 24th.

View Our Latest Stock Analysis on DFS

Institutional Inflows and Outflows

Hedge funds and other institutional investors have recently made changes to their positions in the stock. Norges Bank purchased a new position in shares of Discover Financial Services during the 4th quarter valued at approximately $724,720,000. C2P Capital Advisory Group LLC d.b.a. Prosperity Capital Advisors acquired a new position in shares of Discover Financial Services during the fourth quarter valued at approximately $351,766,000. Invesco Ltd. increased its position in shares of Discover Financial Services by 38.5% during the fourth quarter. Invesco Ltd. now owns 2,974,471 shares of the financial services provider's stock worth $515,268,000 after purchasing an additional 826,287 shares in the last quarter. Third Point LLC acquired a new position in Discover Financial Services in the 4th quarter valued at $110,867,000. Finally, Empyrean Capital Partners LP purchased a new stake in shares of Discover Financial Services during the fourth quarter worth $100,993,000. Hedge funds and other institutional investors own 86.94% of the company's stock.

Discover Financial Services Stock Performance

Shares of Discover Financial Services stock traded up $0.43 during trading hours on Tuesday, reaching $164.90. The company had a trading volume of 1,055,142 shares, compared to its average volume of 1,406,593. The company has a debt-to-equity ratio of 1.09, a current ratio of 1.09 and a quick ratio of 1.03. Discover Financial Services has a one year low of $119.31 and a one year high of $205.76. The firm has a market cap of $41.49 billion, a PE ratio of 10.31, a price-to-earnings-growth ratio of 1.51 and a beta of 1.45. The business has a fifty day simple moving average of $186.28 and a 200 day simple moving average of $168.46.

Discover Financial Services (NYSE:DFS - Get Free Report) last issued its quarterly earnings data on Wednesday, January 22nd. The financial services provider reported $5.11 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $3.13 by $1.98. Discover Financial Services had a return on equity of 26.18% and a net margin of 17.29%. On average, analysts anticipate that Discover Financial Services will post 13.88 earnings per share for the current fiscal year.

Discover Financial Services Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Friday, June 6th. Investors of record on Friday, May 23rd will be given a dividend of $0.70 per share. This represents a $2.80 annualized dividend and a yield of 1.70%. The ex-dividend date is Friday, May 23rd. Discover Financial Services's dividend payout ratio is currently 17.54%.

About Discover Financial Services

(

Get Free ReportDiscover Financial Services, through its subsidiaries, provides digital banking products and services, and payment services in the United States. It operates in two segments, Digital Banking and Payment Services. The Digital Banking segment offers Discover-branded credit cards to individuals; personal loans, home loans, and other consumer lending; and direct-to-consumer deposit products comprising savings accounts, certificates of deposit, money market accounts, IRA certificates of deposit, IRA savings accounts and checking accounts, and sweep accounts.

Featured Stories

Before you consider Discover Financial Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Discover Financial Services wasn't on the list.

While Discover Financial Services currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.