DJE Kapital AG bought a new stake in Zoetis Inc. (NYSE:ZTS - Free Report) during the 4th quarter, according to its most recent filing with the Securities and Exchange Commission. The fund bought 133,423 shares of the company's stock, valued at approximately $21,670,000.

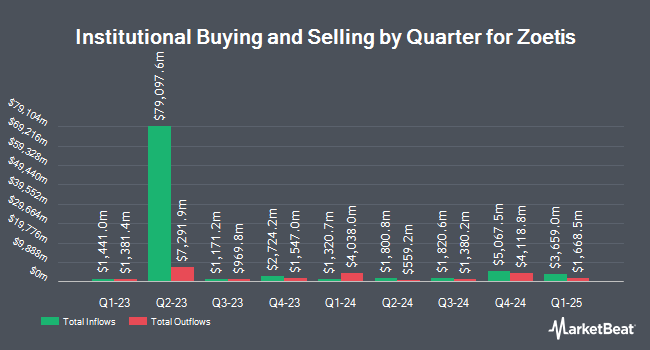

Several other hedge funds have also made changes to their positions in the company. Hancock Whitney Corp grew its position in Zoetis by 0.3% in the third quarter. Hancock Whitney Corp now owns 18,569 shares of the company's stock worth $3,628,000 after acquiring an additional 61 shares during the period. Strategy Asset Managers LLC grew its holdings in shares of Zoetis by 3.5% during the 3rd quarter. Strategy Asset Managers LLC now owns 1,822 shares of the company's stock worth $356,000 after purchasing an additional 62 shares during the period. VeraBank N.A. increased its position in shares of Zoetis by 4.1% during the 4th quarter. VeraBank N.A. now owns 1,562 shares of the company's stock worth $254,000 after purchasing an additional 62 shares during the last quarter. Procyon Advisors LLC raised its holdings in Zoetis by 1.4% in the 4th quarter. Procyon Advisors LLC now owns 4,712 shares of the company's stock valued at $768,000 after buying an additional 63 shares during the period. Finally, Deseret Mutual Benefit Administrators lifted its position in Zoetis by 6.6% in the fourth quarter. Deseret Mutual Benefit Administrators now owns 1,045 shares of the company's stock valued at $170,000 after buying an additional 65 shares during the last quarter. Hedge funds and other institutional investors own 92.80% of the company's stock.

Insider Buying and Selling at Zoetis

In other news, EVP Roxanne Lagano sold 326 shares of the business's stock in a transaction that occurred on Tuesday, February 11th. The shares were sold at an average price of $171.18, for a total transaction of $55,804.68. Following the completion of the sale, the executive vice president now owns 16,107 shares in the company, valued at approximately $2,757,196.26. The trade was a 1.98 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. 0.16% of the stock is currently owned by insiders.

Zoetis Stock Up 0.2 %

ZTS stock traded up $0.26 during mid-day trading on Thursday, reaching $167.26. The company had a trading volume of 3,010,514 shares, compared to its average volume of 3,273,812. Zoetis Inc. has a fifty-two week low of $144.80 and a fifty-two week high of $200.33. The company has a market capitalization of $74.90 billion, a price-to-earnings ratio of 30.58, a price-to-earnings-growth ratio of 2.78 and a beta of 0.94. The company has a debt-to-equity ratio of 1.09, a quick ratio of 1.08 and a current ratio of 1.75. The firm has a fifty day simple moving average of $166.57 and a 200 day simple moving average of $176.99.

Zoetis (NYSE:ZTS - Get Free Report) last announced its quarterly earnings data on Thursday, February 13th. The company reported $1.40 EPS for the quarter, beating analysts' consensus estimates of $1.37 by $0.03. Zoetis had a net margin of 26.86% and a return on equity of 53.82%. The company had revenue of $2.32 billion for the quarter, compared to the consensus estimate of $2.30 billion. Analysts forecast that Zoetis Inc. will post 6.07 earnings per share for the current fiscal year.

Zoetis Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Tuesday, June 3rd. Investors of record on Monday, April 21st will be issued a $0.50 dividend. This represents a $2.00 dividend on an annualized basis and a yield of 1.20%. The ex-dividend date is Monday, April 21st. Zoetis's dividend payout ratio (DPR) is 36.56%.

Analyst Ratings Changes

A number of research firms have recently issued reports on ZTS. Piper Sandler boosted their price target on shares of Zoetis from $200.00 to $205.00 and gave the company an "overweight" rating in a research note on Thursday, February 27th. Stifel Nicolaus cut their target price on Zoetis from $210.00 to $180.00 and set a "buy" rating on the stock in a research report on Tuesday, January 7th. Barclays raised their price target on Zoetis from $242.00 to $244.00 and gave the stock an "overweight" rating in a research report on Friday, February 14th. StockNews.com downgraded Zoetis from a "buy" rating to a "hold" rating in a report on Tuesday, February 25th. Finally, Leerink Partners started coverage on Zoetis in a report on Monday, December 2nd. They set an "outperform" rating and a $215.00 target price for the company. Two research analysts have rated the stock with a hold rating, nine have given a buy rating and two have issued a strong buy rating to the company. Based on data from MarketBeat, Zoetis currently has an average rating of "Buy" and a consensus price target of $215.90.

View Our Latest Stock Analysis on Zoetis

Zoetis Profile

(

Free Report)

Zoetis Inc engages in the discovery, development, manufacture, and commercialization of animal health medicines, vaccines, and diagnostic products and services in the United States and internationally. The company commercializes products primarily across species, including livestock, such as cattle, swine, poultry, fish, and sheep and others; and companion animals comprising dogs, cats, and horses.

Further Reading

Before you consider Zoetis, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zoetis wasn't on the list.

While Zoetis currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.