DLocal (NASDAQ:DLO - Free Report) had its price target lifted by Barclays from $8.00 to $9.00 in a research report sent to investors on Monday morning,Benzinga reports. They currently have an equal weight rating on the stock.

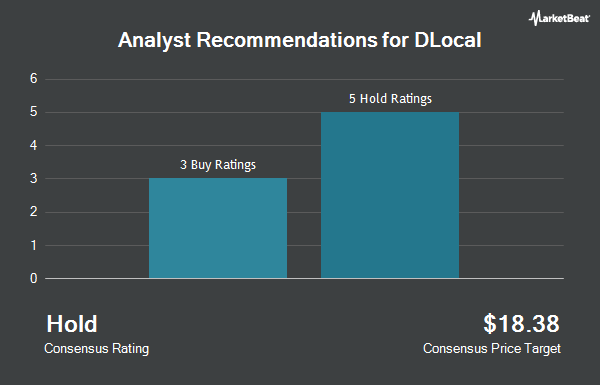

Several other brokerages have also issued reports on DLO. Susquehanna cut their target price on shares of DLocal from $21.00 to $14.00 and set a "positive" rating on the stock in a research note on Thursday, August 15th. Bank of America upped their price objective on shares of DLocal from $7.50 to $8.00 and gave the stock a "neutral" rating in a report on Thursday, August 15th. Seven equities research analysts have rated the stock with a hold rating and two have given a buy rating to the company. Based on data from MarketBeat.com, DLocal currently has an average rating of "Hold" and an average price target of $12.61.

Read Our Latest Analysis on DLocal

DLocal Price Performance

DLO stock traded up $0.68 during trading on Monday, reaching $10.57. 2,053,702 shares of the company were exchanged, compared to its average volume of 1,608,802. The company has a debt-to-equity ratio of 0.01, a current ratio of 1.54 and a quick ratio of 1.50. DLocal has a twelve month low of $6.57 and a twelve month high of $19.45. The company has a 50-day moving average of $8.70 and a two-hundred day moving average of $8.75. The company has a market capitalization of $3.13 billion, a price-to-earnings ratio of 24.30, a P/E/G ratio of 4.58 and a beta of 0.74.

DLocal (NASDAQ:DLO - Get Free Report) last posted its quarterly earnings data on Wednesday, November 13th. The company reported $0.09 EPS for the quarter, meeting analysts' consensus estimates of $0.09. DLocal had a net margin of 16.35% and a return on equity of 32.59%. The company had revenue of $185.80 million for the quarter, compared to analyst estimates of $181.47 million. During the same period in the prior year, the firm posted $0.16 EPS. The company's quarterly revenue was up 13.4% on a year-over-year basis. As a group, equities analysts predict that DLocal will post 0.47 earnings per share for the current fiscal year.

Institutional Trading of DLocal

A number of large investors have recently added to or reduced their stakes in DLO. Quarry LP increased its holdings in DLocal by 1,124.7% during the second quarter. Quarry LP now owns 3,919 shares of the company's stock worth $32,000 after buying an additional 3,599 shares during the last quarter. International Assets Investment Management LLC purchased a new stake in DLocal during the third quarter worth about $109,000. Ridgewood Investments LLC increased its holdings in DLocal by 31.8% during the second quarter. Ridgewood Investments LLC now owns 13,654 shares of the company's stock worth $110,000 after buying an additional 3,293 shares during the last quarter. Krane Funds Advisors LLC purchased a new stake in DLocal during the second quarter worth about $122,000. Finally, IQ EQ FUND MANAGEMENT IRELAND Ltd increased its holdings in DLocal by 24.7% during the second quarter. IQ EQ FUND MANAGEMENT IRELAND Ltd now owns 15,639 shares of the company's stock worth $127,000 after buying an additional 3,101 shares during the last quarter. Hedge funds and other institutional investors own 90.13% of the company's stock.

About DLocal

(

Get Free Report)

DLocal Limited operates a payment processing platform worldwide. The company offers pay-in solution which the business and get paid for their products and services through various payment methods, including international and local cards, online bank transfers and direct debit, cash, and alternative payment methods.

Featured Articles

Before you consider DLocal, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DLocal wasn't on the list.

While DLocal currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.