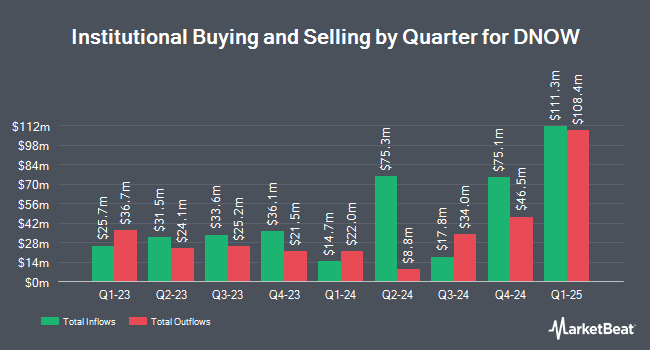

JPMorgan Chase & Co. raised its holdings in DNOW Inc. (NYSE:DNOW - Free Report) by 6.5% during the fourth quarter, according to its most recent filing with the Securities & Exchange Commission. The fund owned 1,843,620 shares of the oil and gas company's stock after buying an additional 112,135 shares during the quarter. JPMorgan Chase & Co. owned 1.74% of DNOW worth $23,985,000 at the end of the most recent quarter.

Several other institutional investors also recently added to or reduced their stakes in DNOW. Smartleaf Asset Management LLC boosted its position in shares of DNOW by 78.7% in the fourth quarter. Smartleaf Asset Management LLC now owns 2,010 shares of the oil and gas company's stock valued at $26,000 after acquiring an additional 885 shares during the period. KBC Group NV raised its stake in DNOW by 72.4% during the 4th quarter. KBC Group NV now owns 6,560 shares of the oil and gas company's stock valued at $85,000 after purchasing an additional 2,754 shares during the last quarter. Coldstream Capital Management Inc. boosted its holdings in DNOW by 10.1% in the 3rd quarter. Coldstream Capital Management Inc. now owns 14,106 shares of the oil and gas company's stock valued at $182,000 after purchasing an additional 1,291 shares during the period. HighTower Advisors LLC grew its position in DNOW by 9.7% in the 3rd quarter. HighTower Advisors LLC now owns 16,541 shares of the oil and gas company's stock worth $211,000 after purchasing an additional 1,458 shares during the last quarter. Finally, WINTON GROUP Ltd bought a new position in shares of DNOW during the 4th quarter worth about $221,000. 97.63% of the stock is owned by institutional investors.

Wall Street Analyst Weigh In

Several equities research analysts recently weighed in on DNOW shares. StockNews.com upgraded shares of DNOW from a "hold" rating to a "buy" rating in a research note on Thursday, February 27th. Stifel Nicolaus raised their price objective on DNOW from $17.00 to $20.00 and gave the stock a "buy" rating in a research report on Friday, February 14th. Finally, Susquehanna decreased their price objective on DNOW from $19.00 to $18.00 and set a "neutral" rating on the stock in a report on Monday.

Check Out Our Latest Stock Analysis on DNOW

DNOW Stock Performance

Shares of DNOW stock traded up $0.21 during mid-day trading on Tuesday, reaching $15.44. The company's stock had a trading volume of 98,166 shares, compared to its average volume of 1,122,837. The firm's 50-day moving average is $15.78 and its two-hundred day moving average is $14.36. DNOW Inc. has a 1-year low of $11.42 and a 1-year high of $18.45. The company has a market cap of $1.63 billion, a P/E ratio of 21.15 and a beta of 1.21.

DNOW (NYSE:DNOW - Get Free Report) last posted its quarterly earnings results on Thursday, February 13th. The oil and gas company reported $0.25 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.11 by $0.14. DNOW had a net margin of 3.41% and a return on equity of 9.04%. Sell-side analysts anticipate that DNOW Inc. will post 0.86 EPS for the current year.

DNOW announced that its Board of Directors has approved a stock buyback plan on Friday, January 24th that authorizes the company to repurchase $160.00 million in outstanding shares. This repurchase authorization authorizes the oil and gas company to reacquire up to 10% of its shares through open market purchases. Shares repurchase plans are often an indication that the company's board of directors believes its shares are undervalued.

About DNOW

(

Free Report)

DNOW Inc distributes downstream energy and industrial products for petroleum refining, chemical processing, LNG terminals, power generation utilities, and customer on-site locations in the United States, Canada, and internationally. The company provides consumable maintenance, repair, and operating supplies; pipes, manual and automated valves, fittings, flanges, gaskets, fasteners, electrical instrumentations, artificial lift, pumping solutions, valve actuation and modular process, and measurement and control equipment; and mill supplies, tools, safety supplies, and personal protective equipment, as well as artificial lift systems, coatings, and miscellaneous expendable items.

Recommended Stories

Before you consider DNOW, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DNOW wasn't on the list.

While DNOW currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.