Docebo (NASDAQ:DCBO - Get Free Report) had its price objective upped by equities research analysts at Craig Hallum from $58.00 to $62.00 in a research note issued on Monday,Benzinga reports. The brokerage presently has a "buy" rating on the stock. Craig Hallum's target price would suggest a potential upside of 23.65% from the stock's previous close.

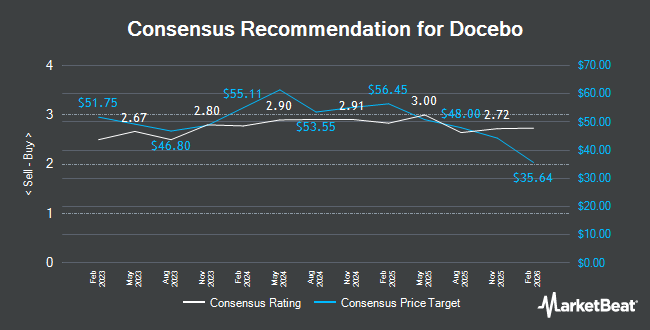

Other research analysts also recently issued research reports about the stock. CIBC lifted their price target on shares of Docebo from $44.00 to $52.00 and gave the stock an "outperform" rating in a research note on Monday, September 16th. Scotiabank upped their target price on shares of Docebo from $50.00 to $55.00 and gave the company a "sector outperform" rating in a report on Thursday, October 24th. Finally, Needham & Company LLC lifted their target price on Docebo from $50.00 to $60.00 and gave the stock a "buy" rating in a research report on Friday. One equities research analyst has rated the stock with a hold rating and ten have given a buy rating to the company's stock. Based on data from MarketBeat, Docebo presently has an average rating of "Moderate Buy" and an average target price of $57.36.

Get Our Latest Report on Docebo

Docebo Trading Down 2.5 %

Shares of DCBO stock traded down $1.31 on Monday, hitting $50.14. The stock had a trading volume of 154,167 shares, compared to its average volume of 89,274. The company has a debt-to-equity ratio of 0.01, a current ratio of 1.11 and a quick ratio of 1.11. The firm has a market capitalization of $1.52 billion, a P/E ratio of 88.71 and a beta of 1.54. The company's 50 day moving average price is $44.81 and its 200-day moving average price is $41.30. Docebo has a 1 year low of $33.81 and a 1 year high of $56.41.

Docebo (NASDAQ:DCBO - Get Free Report) last posted its quarterly earnings data on Thursday, August 8th. The company reported $0.19 earnings per share for the quarter, missing analysts' consensus estimates of $0.20 by ($0.01). Docebo had a return on equity of 29.82% and a net margin of 8.56%. The company had revenue of $53.05 million for the quarter, compared to analysts' expectations of $52.30 million. Analysts anticipate that Docebo will post 0.79 earnings per share for the current year.

Institutional Investors Weigh In On Docebo

Several institutional investors have recently made changes to their positions in DCBO. Stanley Laman Group Ltd. acquired a new position in Docebo during the second quarter worth $843,000. Lord Abbett & CO. LLC boosted its position in shares of Docebo by 54.4% in the 1st quarter. Lord Abbett & CO. LLC now owns 149,590 shares of the company's stock worth $7,327,000 after buying an additional 52,681 shares in the last quarter. Bank of Montreal Can grew its stake in Docebo by 23.1% in the 2nd quarter. Bank of Montreal Can now owns 371,690 shares of the company's stock valued at $14,198,000 after acquiring an additional 69,787 shares during the last quarter. Rice Hall James & Associates LLC purchased a new position in Docebo during the 3rd quarter valued at about $3,907,000. Finally, Acadian Asset Management LLC raised its position in Docebo by 109.0% during the first quarter. Acadian Asset Management LLC now owns 53,497 shares of the company's stock worth $2,611,000 after acquiring an additional 27,897 shares during the last quarter. 53.17% of the stock is currently owned by hedge funds and other institutional investors.

About Docebo

(

Get Free Report)

Docebo Inc operates as a learning management software company that provides artificial intelligence (AI)-powered learning platform in North America and internationally. It offers Learning Management System (LMS) to train internal and external workforces, partners, and customers. The company's cloud platform consists of a learning suite, which includes Docebo Learn LMS, a cloud-based learning platform that allows learning administrators to deliver personalized learning; Docebo Shape, an AI-based learning content creation tool, which enables learning administrators to turn internal and external resources into engaging, multilingual, and microlearning content to share across the business; Docebo Content that allows off-the-shelf learning content by partnering content specialist; Docebo Learning Impact, a learning measurement tool that enables administrators to prove and improve training programs; Docebo Learn Data, which gives a comprehensive view on learning data to business results; Docebo Connect that connects Docebo to custom tech stack and making integrations; and Docebo Flow that allows businesses to directly inject learning into the flow of work.

Read More

Before you consider Docebo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Docebo wasn't on the list.

While Docebo currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.