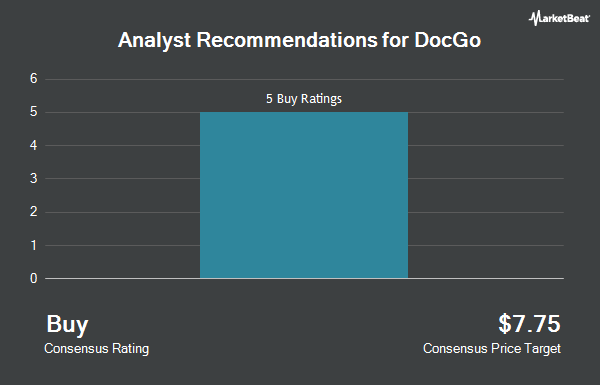

DocGo Inc. (NASDAQ:DCGO - Get Free Report) has earned a consensus rating of "Moderate Buy" from the six analysts that are covering the company, Marketbeat Ratings reports. One equities research analyst has rated the stock with a hold recommendation and five have issued a buy recommendation on the company. The average 1 year price target among analysts that have issued ratings on the stock in the last year is $4.89.

Several equities analysts recently weighed in on the stock. Needham & Company LLC decreased their target price on shares of DocGo from $7.00 to $4.00 and set a "buy" rating for the company in a research note on Friday, February 28th. Stifel Nicolaus lowered their target price on DocGo from $6.50 to $5.50 and set a "buy" rating on the stock in a research note on Friday, February 28th. Finally, Deutsche Bank Aktiengesellschaft downgraded shares of DocGo from a "buy" rating to a "hold" rating and decreased their price target for the company from $5.00 to $2.85 in a research note on Friday, February 28th.

Check Out Our Latest Analysis on DocGo

DocGo Trading Down 3.3 %

Shares of DocGo stock traded down $0.09 during trading hours on Tuesday, reaching $2.64. 489,115 shares of the company's stock were exchanged, compared to its average volume of 753,251. DocGo has a fifty-two week low of $2.63 and a fifty-two week high of $5.68. The stock has a market cap of $269.24 million, a P/E ratio of 9.43, a P/E/G ratio of 14.16 and a beta of 1.08. The company has a 50 day moving average of $4.03 and a two-hundred day moving average of $3.91.

Institutional Trading of DocGo

Several hedge funds and other institutional investors have recently made changes to their positions in the company. Centiva Capital LP bought a new position in shares of DocGo during the third quarter valued at $43,000. Summit Investment Advisors Inc. raised its holdings in shares of DocGo by 38.7% during the fourth quarter. Summit Investment Advisors Inc. now owns 10,639 shares of the company's stock valued at $45,000 after purchasing an additional 2,968 shares during the period. Prudential Financial Inc. bought a new stake in DocGo in the 4th quarter valued at about $55,000. Intech Investment Management LLC acquired a new position in DocGo during the 3rd quarter worth approximately $62,000. Finally, Royce & Associates LP acquired a new position in shares of DocGo during the fourth quarter worth approximately $64,000. 56.44% of the stock is currently owned by institutional investors.

DocGo Company Profile

(

Get Free ReportDocGo Inc provides mobile health and medical transportation services for various health care providers in the United States and the United Kingdom. The company's transportation services include emergency response services; and non-emergency transport services comprise ambulance and wheelchair transportation services.

Recommended Stories

Before you consider DocGo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DocGo wasn't on the list.

While DocGo currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 best stocks to own in Spring 2025, carefully selected for their growth potential amid market volatility. This exclusive report highlights top companies poised to thrive in uncertain economic conditions—download now to gain an investing edge.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.