Toronto Dominion Bank lifted its position in shares of DocuSign, Inc. (NASDAQ:DOCU - Free Report) by 30.3% in the third quarter, according to its most recent disclosure with the SEC. The institutional investor owned 26,159 shares of the company's stock after buying an additional 6,081 shares during the quarter. Toronto Dominion Bank's holdings in DocuSign were worth $1,624,000 as of its most recent SEC filing.

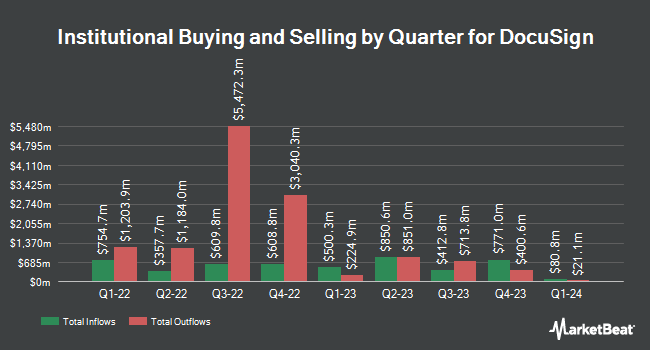

Several other hedge funds and other institutional investors have also bought and sold shares of DOCU. State Street Corp boosted its stake in shares of DocuSign by 2.3% during the third quarter. State Street Corp now owns 5,372,939 shares of the company's stock valued at $333,604,000 after purchasing an additional 120,743 shares in the last quarter. American Century Companies Inc. lifted its position in shares of DocuSign by 1.9% during the 2nd quarter. American Century Companies Inc. now owns 4,099,400 shares of the company's stock worth $219,318,000 after buying an additional 75,026 shares in the last quarter. Renaissance Technologies LLC increased its holdings in DocuSign by 18.3% during the second quarter. Renaissance Technologies LLC now owns 3,729,314 shares of the company's stock worth $199,518,000 after buying an additional 576,414 shares during the last quarter. Pacer Advisors Inc. lifted its stake in DocuSign by 77.9% in the second quarter. Pacer Advisors Inc. now owns 3,519,969 shares of the company's stock valued at $188,318,000 after purchasing an additional 1,541,816 shares during the last quarter. Finally, Geode Capital Management LLC grew its stake in shares of DocuSign by 1.6% during the 3rd quarter. Geode Capital Management LLC now owns 3,483,184 shares of the company's stock worth $215,789,000 after acquiring an additional 53,554 shares during the period. Institutional investors and hedge funds own 77.64% of the company's stock.

Wall Street Analysts Forecast Growth

A number of brokerages have recently issued reports on DOCU. JPMorgan Chase & Co. lifted their price target on DocuSign from $50.00 to $70.00 and gave the company an "underweight" rating in a research report on Tuesday, December 3rd. UBS Group raised their price objective on DocuSign from $60.00 to $100.00 and gave the company a "neutral" rating in a research report on Friday, December 6th. Jefferies Financial Group increased their price target on DocuSign from $80.00 to $95.00 and gave the company a "buy" rating in a report on Tuesday, December 3rd. Royal Bank of Canada reissued a "sector perform" rating and set a $90.00 price target (up from $57.00) on shares of DocuSign in a report on Friday, December 6th. Finally, Piper Sandler lifted their price target on shares of DocuSign from $60.00 to $90.00 and gave the stock a "neutral" rating in a research note on Friday, December 6th. Three research analysts have rated the stock with a sell rating, seven have assigned a hold rating and three have given a buy rating to the company's stock. Based on data from MarketBeat, DocuSign has an average rating of "Hold" and an average target price of $92.45.

Get Our Latest Research Report on DOCU

DocuSign Trading Up 3.5 %

Shares of NASDAQ DOCU traded up $3.35 during midday trading on Monday, reaching $97.83. The company had a trading volume of 4,819,711 shares, compared to its average volume of 2,993,376. DocuSign, Inc. has a 1 year low of $48.70 and a 1 year high of $107.86. The business's 50-day simple moving average is $78.04 and its 200 day simple moving average is $63.41. The stock has a market cap of $19.76 billion, a P/E ratio of 19.88, a P/E/G ratio of 8.72 and a beta of 0.92.

Insiders Place Their Bets

In other news, Director Daniel D. Springer sold 581,588 shares of DocuSign stock in a transaction that occurred on Tuesday, December 10th. The shares were sold at an average price of $97.04, for a total transaction of $56,437,299.52. Following the completion of the transaction, the director now directly owns 906,430 shares of the company's stock, valued at $87,959,967.20. The trade was a 39.08 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, CEO Allan C. Thygesen sold 7,648 shares of the stock in a transaction dated Tuesday, October 1st. The stock was sold at an average price of $62.47, for a total transaction of $477,770.56. Following the sale, the chief executive officer now directly owns 115,589 shares in the company, valued at approximately $7,220,844.83. The trade was a 6.21 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last 90 days, insiders sold 650,650 shares of company stock valued at $60,848,626. 1.66% of the stock is owned by company insiders.

DocuSign Profile

(

Free Report)

DocuSign, Inc provides electronic signature solution in the United States and internationally. The company provides e-signature solution that enables sending and signing of agreements on various devices; Contract Lifecycle Management (CLM), which automates workflows across the entire agreement process; Document Generation streamlines the process of generating new, custom agreements; and Gen for Salesforce, which allows sales representatives to automatically generate agreements with a few clicks from within Salesforce.

Read More

Before you consider DocuSign, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DocuSign wasn't on the list.

While DocuSign currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.