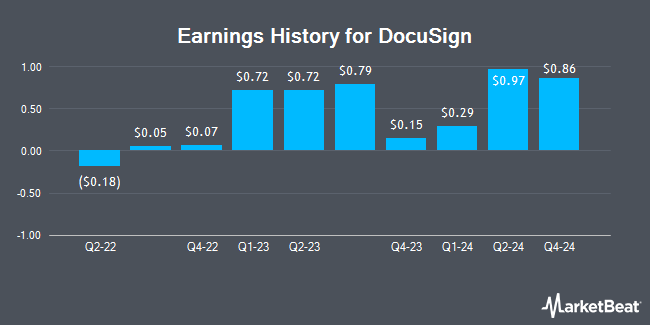

DocuSign (NASDAQ:DOCU - Get Free Report) issued its quarterly earnings data on Thursday. The company reported $0.86 EPS for the quarter, topping the consensus estimate of $0.84 by $0.02, Briefing.com reports. The business had revenue of $776.25 million for the quarter, compared to the consensus estimate of $760.94 million. DocuSign had a return on equity of 14.90% and a net margin of 34.73%. The firm's revenue was up 9.0% compared to the same quarter last year. During the same quarter last year, the business posted $0.76 EPS. DocuSign updated its FY 2026 guidance to EPS and its Q1 2026 guidance to EPS.

DocuSign Stock Performance

DocuSign stock traded up $11.06 during midday trading on Friday, reaching $85.76. 11,927,431 shares of the company's stock were exchanged, compared to its average volume of 2,402,407. DocuSign has a 52 week low of $48.70 and a 52 week high of $107.86. The firm has a market cap of $17.33 billion, a price-to-earnings ratio of 17.68, a P/E/G ratio of 6.94 and a beta of 1.02. The stock's 50-day simple moving average is $87.97 and its 200 day simple moving average is $79.37.

Insider Buying and Selling

In related news, CFO Blake Jeffrey Grayson sold 8,000 shares of DocuSign stock in a transaction dated Friday, February 14th. The stock was sold at an average price of $86.90, for a total transaction of $695,200.00. Following the completion of the transaction, the chief financial officer now owns 77,851 shares in the company, valued at approximately $6,765,251.90. This trade represents a 9.32 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, insider Robert Chatwani sold 14,800 shares of DocuSign stock in a transaction dated Wednesday, December 18th. The stock was sold at an average price of $97.76, for a total value of $1,446,848.00. Following the transaction, the insider now owns 73,414 shares of the company's stock, valued at $7,176,952.64. The trade was a 16.78 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 104,422 shares of company stock worth $9,665,394. Company insiders own 1.66% of the company's stock.

Analysts Set New Price Targets

DOCU has been the subject of a number of research reports. HSBC reiterated a "reduce" rating on shares of DocuSign in a report on Friday, December 6th. Piper Sandler increased their target price on DocuSign from $60.00 to $90.00 and gave the stock a "neutral" rating in a report on Friday, December 6th. Morgan Stanley increased their target price on DocuSign from $62.00 to $97.00 and gave the stock an "equal weight" rating in a report on Friday, December 6th. Robert W. Baird increased their target price on DocuSign from $59.00 to $100.00 and gave the stock a "neutral" rating in a report on Friday, December 6th. Finally, Bank of America lowered their target price on DocuSign from $112.00 to $98.00 and set a "neutral" rating for the company in a report on Friday. Two investment analysts have rated the stock with a sell rating, nine have issued a hold rating and three have given a buy rating to the company. Based on data from MarketBeat, the stock presently has a consensus rating of "Hold" and a consensus price target of $95.58.

Check Out Our Latest Research Report on DocuSign

About DocuSign

(

Get Free Report)

DocuSign, Inc provides electronic signature solution in the United States and internationally. The company provides e-signature solution that enables sending and signing of agreements on various devices; Contract Lifecycle Management (CLM), which automates workflows across the entire agreement process; Document Generation streamlines the process of generating new, custom agreements; and Gen for Salesforce, which allows sales representatives to automatically generate agreements with a few clicks from within Salesforce.

Read More

Before you consider DocuSign, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DocuSign wasn't on the list.

While DocuSign currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.