Dollar General (NYSE:DG - Get Free Report) had its price target hoisted by equities researchers at Truist Financial from $76.00 to $93.00 in a research report issued to clients and investors on Tuesday,Benzinga reports. The brokerage presently has a "hold" rating on the stock. Truist Financial's price target suggests a potential upside of 4.37% from the stock's previous close.

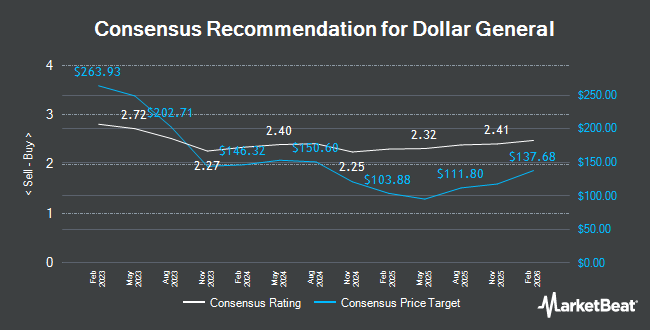

DG has been the topic of several other research reports. Morgan Stanley dropped their price target on Dollar General from $100.00 to $80.00 and set an "equal weight" rating on the stock in a research report on Tuesday, January 21st. Bank of America cut their price target on Dollar General from $95.00 to $90.00 and set a "buy" rating for the company in a research note on Friday, March 14th. Gordon Haskett cut shares of Dollar General from a "strong-buy" rating to a "hold" rating in a research note on Tuesday, January 28th. The Goldman Sachs Group reduced their target price on shares of Dollar General from $104.00 to $93.00 and set a "buy" rating for the company in a research note on Thursday, January 23rd. Finally, Telsey Advisory Group reiterated a "market perform" rating and set a $85.00 price target on shares of Dollar General in a research note on Thursday, March 13th. One analyst has rated the stock with a sell rating, fourteen have assigned a hold rating, nine have issued a buy rating and one has given a strong buy rating to the stock. According to MarketBeat.com, Dollar General has an average rating of "Hold" and an average price target of $94.75.

Read Our Latest Report on DG

Dollar General Stock Performance

NYSE:DG traded up $1.98 during mid-day trading on Tuesday, reaching $89.11. 4,210,641 shares of the stock were exchanged, compared to its average volume of 3,843,195. The company has a quick ratio of 0.15, a current ratio of 1.15 and a debt-to-equity ratio of 0.78. Dollar General has a 1 year low of $66.43 and a 1 year high of $153.82. The company has a 50 day simple moving average of $80.35 and a 200-day simple moving average of $78.25. The stock has a market capitalization of $19.60 billion, a P/E ratio of 14.68, a P/E/G ratio of 2.18 and a beta of 0.40.

Dollar General (NYSE:DG - Get Free Report) last released its quarterly earnings results on Thursday, March 13th. The company reported $1.68 EPS for the quarter, beating the consensus estimate of $1.51 by $0.17. The firm had revenue of $10.30 billion during the quarter, compared to the consensus estimate of $10.26 billion. Dollar General had a net margin of 3.33% and a return on equity of 18.85%. Dollar General's revenue for the quarter was up 4.5% on a year-over-year basis. During the same quarter in the prior year, the firm earned $1.83 EPS. Analysts anticipate that Dollar General will post 5.75 earnings per share for the current fiscal year.

Insider Buying and Selling at Dollar General

In other news, EVP Emily C. Taylor sold 809 shares of the firm's stock in a transaction on Friday, April 4th. The stock was sold at an average price of $94.72, for a total transaction of $76,628.48. Following the sale, the executive vice president now owns 48,532 shares in the company, valued at $4,596,951.04. This trade represents a 1.64 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. 0.49% of the stock is owned by insiders.

Hedge Funds Weigh In On Dollar General

Large investors have recently added to or reduced their stakes in the business. IMG Wealth Management Inc. purchased a new position in shares of Dollar General during the 4th quarter worth about $25,000. Altshuler Shaham Ltd purchased a new stake in shares of Dollar General during the 4th quarter valued at $25,000. Ameriflex Group Inc. acquired a new stake in shares of Dollar General during the 4th quarter worth $31,000. Wilmington Savings Fund Society FSB purchased a new position in shares of Dollar General in the 3rd quarter worth $33,000. Finally, Providence First Trust Co acquired a new position in Dollar General in the fourth quarter valued at $33,000. 91.77% of the stock is currently owned by hedge funds and other institutional investors.

About Dollar General

(

Get Free Report)

Dollar General Corporation, a discount retailer, provides various merchandise products in the southern, southwestern, midwestern, and eastern United States. It offers consumable products, including paper and cleaning products, such as paper towels, bath tissues, paper dinnerware, trash and storage bags, disinfectants, and laundry products; packaged food comprising cereals, pasta, canned soups, fruits and vegetables, condiments, spices, sugar, and flour; and perishables that include milk, eggs, bread, refrigerated and frozen food, beer, and wine.

Recommended Stories

Before you consider Dollar General, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dollar General wasn't on the list.

While Dollar General currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.