Dollar General (NYSE:DG - Free Report) had its target price trimmed by HSBC from $100.00 to $88.00 in a research report sent to investors on Friday. The brokerage currently has a hold rating on the stock.

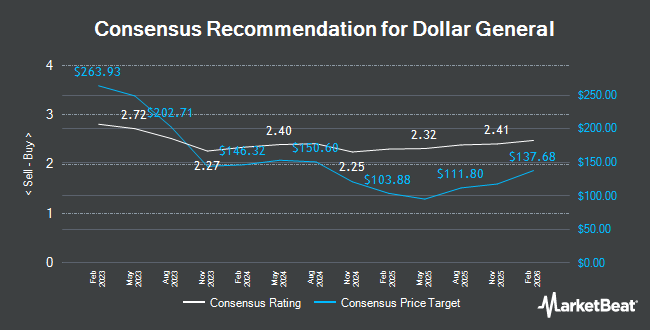

Other equities analysts have also issued research reports about the company. Jefferies Financial Group reduced their price objective on Dollar General from $110.00 to $90.00 and set a "buy" rating for the company in a research note on Friday. The Goldman Sachs Group decreased their price target on Dollar General from $169.00 to $122.00 and set a "buy" rating for the company in a report on Friday, August 30th. JPMorgan Chase & Co. dropped their price objective on shares of Dollar General from $97.00 to $82.00 and set a "neutral" rating on the stock in a research note on Tuesday, November 5th. Daiwa America cut shares of Dollar General from a "moderate buy" rating to a "hold" rating in a research note on Wednesday, September 4th. Finally, Wells Fargo & Company cut their price objective on shares of Dollar General from $145.00 to $130.00 and set an "equal weight" rating for the company in a report on Tuesday, August 27th. Two investment analysts have rated the stock with a sell rating, fourteen have assigned a hold rating, seven have given a buy rating and one has given a strong buy rating to the company. According to MarketBeat.com, the stock has a consensus rating of "Hold" and an average price target of $104.45.

Check Out Our Latest Research Report on DG

Dollar General Stock Performance

Dollar General stock traded down $1.17 during trading hours on Friday, hitting $75.88. 3,704,309 shares of the stock traded hands, compared to its average volume of 3,199,770. Dollar General has a 1 year low of $73.51 and a 1 year high of $168.07. The stock has a market capitalization of $16.69 billion, a price-to-earnings ratio of 11.78, a P/E/G ratio of 2.24 and a beta of 0.45. The company has a debt-to-equity ratio of 0.86, a current ratio of 1.22 and a quick ratio of 0.24. The firm's 50 day moving average price is $81.85 and its 200-day moving average price is $110.38.

Dollar General (NYSE:DG - Get Free Report) last issued its quarterly earnings results on Thursday, August 29th. The company reported $1.70 earnings per share for the quarter, missing the consensus estimate of $1.79 by ($0.09). The business had revenue of $10.21 billion during the quarter, compared to analyst estimates of $10.37 billion. Dollar General had a return on equity of 20.62% and a net margin of 3.57%. Dollar General's quarterly revenue was up 4.2% compared to the same quarter last year. During the same quarter last year, the company posted $2.13 EPS. As a group, equities analysts expect that Dollar General will post 5.86 EPS for the current fiscal year.

Dollar General Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Tuesday, October 22nd. Investors of record on Tuesday, October 8th were given a dividend of $0.59 per share. This represents a $2.36 annualized dividend and a dividend yield of 3.11%. The ex-dividend date of this dividend was Tuesday, October 8th. Dollar General's payout ratio is 36.65%.

Insider Buying and Selling at Dollar General

In related news, Director Warren F. Bryant bought 1,000 shares of the stock in a transaction dated Tuesday, September 10th. The shares were acquired at an average cost of $80.83 per share, for a total transaction of $80,830.00. Following the acquisition, the director now directly owns 42,030 shares in the company, valued at approximately $3,397,284.90. This trade represents a 2.44 % increase in their position. The acquisition was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, EVP Steven R. Deckard sold 2,010 shares of the stock in a transaction that occurred on Wednesday, September 18th. The shares were sold at an average price of $86.66, for a total value of $174,186.60. Following the completion of the sale, the executive vice president now directly owns 2,887 shares of the company's stock, valued at approximately $250,187.42. This represents a 41.05 % decrease in their position. The disclosure for this sale can be found here. 0.49% of the stock is currently owned by insiders.

Institutional Inflows and Outflows

Institutional investors and hedge funds have recently modified their holdings of the company. Industrial Alliance Investment Management Inc. lifted its holdings in Dollar General by 3.5% in the first quarter. Industrial Alliance Investment Management Inc. now owns 2,390 shares of the company's stock valued at $373,000 after acquiring an additional 80 shares during the last quarter. Pullen Investment Management LLC boosted its position in Dollar General by 4.3% in the 2nd quarter. Pullen Investment Management LLC now owns 2,105 shares of the company's stock valued at $278,000 after buying an additional 87 shares during the period. Pathway Financial Advisers LLC grew its stake in Dollar General by 30.6% during the 2nd quarter. Pathway Financial Advisers LLC now owns 376 shares of the company's stock worth $50,000 after purchasing an additional 88 shares in the last quarter. Mitchell Mcleod Pugh & Williams Inc. grew its position in shares of Dollar General by 3.8% during the second quarter. Mitchell Mcleod Pugh & Williams Inc. now owns 2,835 shares of the company's stock worth $375,000 after buying an additional 103 shares in the last quarter. Finally, Wedbush Securities Inc. increased its position in shares of Dollar General by 7.3% in the 2nd quarter. Wedbush Securities Inc. now owns 1,661 shares of the company's stock valued at $220,000 after purchasing an additional 113 shares during the last quarter. Institutional investors and hedge funds own 91.77% of the company's stock.

Dollar General Company Profile

(

Get Free Report)

Dollar General Corporation, a discount retailer, provides various merchandise products in the southern, southwestern, midwestern, and eastern United States. It offers consumable products, including paper and cleaning products, such as paper towels, bath tissues, paper dinnerware, trash and storage bags, disinfectants, and laundry products; packaged food comprising cereals, pasta, canned soups, fruits and vegetables, condiments, spices, sugar, and flour; and perishables that include milk, eggs, bread, refrigerated and frozen food, beer, and wine.

Recommended Stories

Before you consider Dollar General, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dollar General wasn't on the list.

While Dollar General currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.