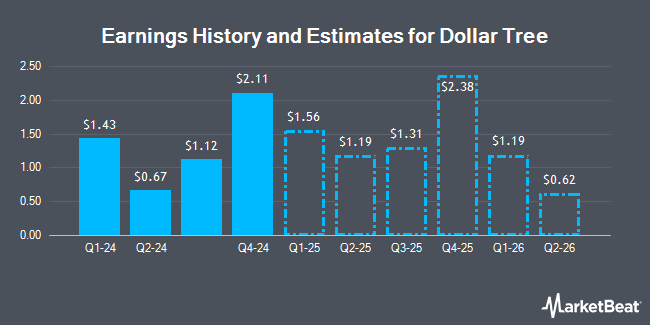

Dollar Tree, Inc. (NASDAQ:DLTR - Free Report) - Analysts at Telsey Advisory Group boosted their FY2025 earnings estimates for Dollar Tree in a research note issued on Wednesday, December 4th. Telsey Advisory Group analyst J. Feldman now forecasts that the company will post earnings of $5.46 per share for the year, up from their previous forecast of $5.41. Telsey Advisory Group has a "Market Perform" rating and a $75.00 price objective on the stock. The consensus estimate for Dollar Tree's current full-year earnings is $5.39 per share. Telsey Advisory Group also issued estimates for Dollar Tree's Q2 2026 earnings at $0.81 EPS, Q3 2026 earnings at $1.23 EPS, FY2026 earnings at $6.12 EPS and FY2027 earnings at $6.91 EPS.

Dollar Tree (NASDAQ:DLTR - Get Free Report) last released its earnings results on Wednesday, December 4th. The company reported $1.12 EPS for the quarter, beating analysts' consensus estimates of $1.07 by $0.05. Dollar Tree had a positive return on equity of 16.89% and a negative net margin of 3.34%. The business had revenue of $7.57 billion for the quarter, compared to analysts' expectations of $7.45 billion. During the same quarter in the prior year, the firm earned $0.97 earnings per share. The firm's revenue was up 3.5% on a year-over-year basis.

Other research analysts also recently issued reports about the stock. Truist Financial lifted their price target on shares of Dollar Tree from $79.00 to $83.00 and gave the stock a "buy" rating in a research note on Thursday. BMO Capital Markets upped their price target on shares of Dollar Tree from $65.00 to $70.00 and gave the company a "market perform" rating in a research report on Thursday. Guggenheim decreased their price objective on Dollar Tree from $120.00 to $100.00 and set a "buy" rating on the stock in a report on Friday. Evercore ISI dropped their target price on Dollar Tree from $94.00 to $92.00 and set an "in-line" rating for the company in a report on Tuesday, December 3rd. Finally, UBS Group reduced their price target on Dollar Tree from $155.00 to $105.00 and set a "buy" rating on the stock in a research report on Thursday, September 5th. Seventeen research analysts have rated the stock with a hold rating and five have assigned a buy rating to the company's stock. Based on data from MarketBeat, the stock currently has an average rating of "Hold" and an average price target of $85.58.

Check Out Our Latest Research Report on DLTR

Dollar Tree Price Performance

Shares of NASDAQ DLTR traded down $0.27 during trading hours on Monday, reaching $71.60. 2,767,439 shares of the stock traded hands, compared to its average volume of 5,012,277. The company's 50-day simple moving average is $67.55 and its two-hundred day simple moving average is $86.79. Dollar Tree has a 52-week low of $60.49 and a 52-week high of $151.21. The company has a debt-to-equity ratio of 0.32, a quick ratio of 0.17 and a current ratio of 1.03.

Hedge Funds Weigh In On Dollar Tree

A number of institutional investors have recently bought and sold shares of DLTR. Cetera Investment Advisers lifted its stake in shares of Dollar Tree by 203.5% in the 1st quarter. Cetera Investment Advisers now owns 12,596 shares of the company's stock valued at $1,677,000 after purchasing an additional 8,446 shares during the period. Cetera Advisors LLC lifted its holdings in shares of Dollar Tree by 119.7% during the first quarter. Cetera Advisors LLC now owns 3,234 shares of the company's stock valued at $431,000 after purchasing an additional 1,762 shares during the last quarter. Mather Group LLC. boosted its position in shares of Dollar Tree by 198.9% in the 2nd quarter. Mather Group LLC. now owns 281 shares of the company's stock worth $30,000 after purchasing an additional 187 shares in the last quarter. Czech National Bank grew its stake in shares of Dollar Tree by 8.4% in the 2nd quarter. Czech National Bank now owns 39,489 shares of the company's stock worth $4,216,000 after buying an additional 3,071 shares during the last quarter. Finally, NorthCrest Asset Manangement LLC increased its position in Dollar Tree by 3.9% during the 2nd quarter. NorthCrest Asset Manangement LLC now owns 5,373 shares of the company's stock valued at $574,000 after buying an additional 200 shares in the last quarter. 97.40% of the stock is owned by institutional investors.

Dollar Tree Company Profile

(

Get Free Report)

Dollar Tree, Inc operates retail discount stores. The company operates in two segments, Dollar Tree and Family Dollar. The Dollar Tree segment offers merchandise at the fixed price of $ 1.25. It provides consumable merchandise, which includes everyday consumables, such as household paper and chemicals, food, candy, health, personal care products, and frozen and refrigerated food; variety merchandise comprising toys, durable housewares, gifts, stationery, party goods, greeting cards, softlines, arts and crafts supplies, and other items; and seasonal goods that include Christmas, Easter, Halloween, and Valentine's Day merchandise.

Further Reading

Before you consider Dollar Tree, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dollar Tree wasn't on the list.

While Dollar Tree currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.