KeyCorp downgraded shares of Dollar Tree (NASDAQ:DLTR - Free Report) from an overweight rating to a sector weight rating in a report released on Thursday morning, Marketbeat reports.

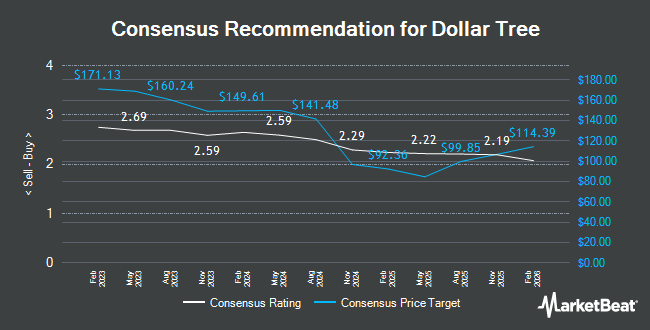

A number of other equities research analysts have also commented on the company. Telsey Advisory Group lowered Dollar Tree from an "outperform" rating to a "market perform" rating and decreased their price target for the stock from $95.00 to $75.00 in a research report on Tuesday. UBS Group lowered their target price on Dollar Tree from $155.00 to $105.00 and set a "buy" rating for the company in a research note on Thursday, September 5th. Wells Fargo & Company reduced their price target on shares of Dollar Tree from $130.00 to $100.00 and set an "overweight" rating on the stock in a research report on Thursday, September 5th. Melius Research began coverage on shares of Dollar Tree in a research report on Monday, September 23rd. They issued a "hold" rating and a $70.00 price objective for the company. Finally, BMO Capital Markets lowered shares of Dollar Tree from an "outperform" rating to a "market perform" rating and reduced their target price for the stock from $130.00 to $68.00 in a research report on Thursday, September 5th. One investment analyst has rated the stock with a sell rating, fifteen have assigned a hold rating and five have given a buy rating to the company. According to MarketBeat.com, Dollar Tree currently has an average rating of "Hold" and a consensus target price of $88.11.

View Our Latest Analysis on Dollar Tree

Dollar Tree Price Performance

Shares of Dollar Tree stock traded up $1.13 during midday trading on Thursday, hitting $63.54. 5,790,244 shares of the company were exchanged, compared to its average volume of 3,294,638. The firm has a 50 day simple moving average of $69.76 and a 200-day simple moving average of $95.00. Dollar Tree has a 52 week low of $60.52 and a 52 week high of $151.21. The firm has a market cap of $13.66 billion, a P/E ratio of -13.13, a PEG ratio of 2.83 and a beta of 0.87. The company has a debt-to-equity ratio of 0.33, a current ratio of 1.02 and a quick ratio of 0.17.

Dollar Tree (NASDAQ:DLTR - Get Free Report) last issued its earnings results on Wednesday, September 4th. The company reported $0.67 EPS for the quarter, missing the consensus estimate of $1.04 by ($0.37). The firm had revenue of $7.37 billion during the quarter, compared to analyst estimates of $7.49 billion. Dollar Tree had a negative net margin of 3.44% and a positive return on equity of 15.77%. The firm's revenue for the quarter was up .7% on a year-over-year basis. During the same quarter in the prior year, the firm posted $0.91 EPS. Research analysts forecast that Dollar Tree will post 5.33 earnings per share for the current year.

Insiders Place Their Bets

In other news, Director Daniel J. Heinrich purchased 2,200 shares of the firm's stock in a transaction dated Friday, September 6th. The stock was bought at an average price of $68.27 per share, with a total value of $150,194.00. Following the acquisition, the director now directly owns 9,823 shares of the company's stock, valued at approximately $670,616.21. This represents a 0.00 % increase in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Company insiders own 6.80% of the company's stock.

Hedge Funds Weigh In On Dollar Tree

Several institutional investors have recently modified their holdings of the business. National Bank of Canada FI boosted its stake in Dollar Tree by 223.4% in the 1st quarter. National Bank of Canada FI now owns 1,414,788 shares of the company's stock worth $188,379,000 after purchasing an additional 977,313 shares during the period. Primecap Management Co. CA grew its holdings in shares of Dollar Tree by 50.0% during the second quarter. Primecap Management Co. CA now owns 2,872,460 shares of the company's stock worth $306,693,000 after buying an additional 957,275 shares in the last quarter. Renaissance Technologies LLC raised its position in Dollar Tree by 488.4% in the 2nd quarter. Renaissance Technologies LLC now owns 1,044,595 shares of the company's stock valued at $111,531,000 after buying an additional 867,054 shares during the last quarter. Mizuho Markets Americas LLC bought a new stake in Dollar Tree in the 1st quarter valued at approximately $99,862,000. Finally, Equity Investment Corp boosted its position in Dollar Tree by 95.9% during the 3rd quarter. Equity Investment Corp now owns 1,525,374 shares of the company's stock worth $107,264,000 after acquiring an additional 746,913 shares during the last quarter. Institutional investors own 97.40% of the company's stock.

About Dollar Tree

(

Get Free Report)

Dollar Tree, Inc operates retail discount stores. The company operates in two segments, Dollar Tree and Family Dollar. The Dollar Tree segment offers merchandise at the fixed price of $ 1.25. It provides consumable merchandise, which includes everyday consumables, such as household paper and chemicals, food, candy, health, personal care products, and frozen and refrigerated food; variety merchandise comprising toys, durable housewares, gifts, stationery, party goods, greeting cards, softlines, arts and crafts supplies, and other items; and seasonal goods that include Christmas, Easter, Halloween, and Valentine's Day merchandise.

Read More

Before you consider Dollar Tree, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dollar Tree wasn't on the list.

While Dollar Tree currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.