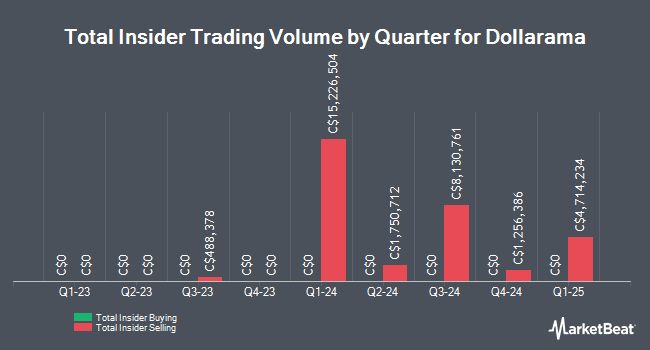

Dollarama Inc. (TSE:DOL - Get Free Report) Director Nicolas Hien sold 9,000 shares of the firm's stock in a transaction on Monday, January 6th. The shares were sold at an average price of C$139.60, for a total transaction of C$1,256,386.50.

Dollarama Trading Down 1.6 %

DOL traded down C$2.26 on Friday, reaching C$137.10. 591,339 shares of the company traded hands, compared to its average volume of 537,181. The company has a quick ratio of 0.08, a current ratio of 1.99 and a debt-to-equity ratio of 391.24. The company has a market cap of C$38.63 billion, a P/E ratio of 35.52, a price-to-earnings-growth ratio of 1.93 and a beta of 0.56. The firm has a fifty day simple moving average of C$143.61 and a two-hundred day simple moving average of C$137.19. Dollarama Inc. has a one year low of C$96.08 and a one year high of C$152.97.

Dollarama Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, February 7th. Investors of record on Friday, February 7th will be paid a $0.092 dividend. The ex-dividend date of this dividend is Friday, January 10th. This represents a $0.37 annualized dividend and a yield of 0.27%. Dollarama's dividend payout ratio (DPR) is currently 9.59%.

Analyst Upgrades and Downgrades

A number of equities analysts have commented on DOL shares. Royal Bank of Canada dropped their price objective on shares of Dollarama from C$160.00 to C$159.00 in a research note on Thursday, December 5th. Wells Fargo & Company downgraded Dollarama from an "overweight" rating to an "equal weight" rating and decreased their price objective for the company from C$136.00 to C$130.00 in a research report on Thursday, September 12th. Stifel Nicolaus raised their price objective on Dollarama from C$136.00 to C$140.00 in a research note on Thursday, December 5th. National Bank Financial downgraded Dollarama from a "strong-buy" rating to a "hold" rating in a research report on Wednesday, December 4th. Finally, Canaccord Genuity Group raised their price target on Dollarama from C$138.00 to C$140.00 and gave the stock a "hold" rating in a research report on Thursday, November 28th. Seven research analysts have rated the stock with a hold rating and five have given a buy rating to the company's stock. Based on data from MarketBeat.com, the company currently has an average rating of "Hold" and an average price target of C$145.17.

View Our Latest Report on Dollarama

About Dollarama

(

Get Free Report)

Dollarama Inc operates a chain of dollar stores in Canada. Its stores offer general merchandise, consumables, and seasonal products. It also sells its products through online store. The company was formerly known as Dollarama Capital Corporation and changed its name to Dollarama Inc in September 2009.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Dollarama, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dollarama wasn't on the list.

While Dollarama currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.